Highlights

- Demand for coking coal seems to remain high as steel production is slated to rise in India and China.

- Coking coal prices touched an all-time high amid the Russia-Ukraine war due to supply concerns.

- Aspire Mining operates a metallurgical coal project in Mongolia, close to the world’s largest importer and consumer of the commodity.

- The Company, which is currently progressing with a DFS, plans an investment decision in 2022.

Metallurgical coal or coking coal prices rose to unprecedented heights during the conflict between Russia and Ukraine. For the first time, the prices crossed the US$400/tonne mark before cooling down to the current level of US$300/tonne.

The long-term outlook for the commodity remains positive, owing to its primary use in the manufacturing of steel, rather than thermal coal, which is one of the main contributors to carbon emissions. Metallurgical coal is used to prepare coke, which is then used as a raw material for steel production.

As the majority of metallurgical coal is consumed by the steel industry, steel consumption or demand trends could be analysed to get an idea of trends for metallurgical coal.

Related read: Aspire Mining (ASX:AKM) delivers robust first half amid strong coal prices

Can coking coal prices go further north?

China accounts for more than half of the global steel production and is the largest consumer of coke. Europe, China, South Korea, and Japan relied heavily on Russian coal. However, due to a ban on Russian trade or government stance, several countries have stopped importing from Russia and looking for a suitable supply substitute.

China and India are the two largest importers of metallurgical coal. During the second half of 2021, the Chinese government put restrictions on steel production to curb the carbon emission issue, while India’s steel production showed robust growth during the same period. According to data from the Australian government’s Resources and Energy Quarterly December 2021 edition, the Indian steel industry is struggling with the supply of coal, with demand expected to grow in 2022.

In the absence of Russian supply and robust demand from India and China, the year 2022 could see a further increase in the commodity price.

Related read: Aspire Mining’s (ASX:AKM) Ovoot Project gathers steam with recent developments in Mongolia

In this upbeat scenario, let us explore how Aspire Mining Limited is advancing its flagship Ovoot Coking Coal Project (OCCP).

Ovoot Project Overview (Data source: company update, 30 November 2021)

AKM fast-tracks OCCP amid buoyant coal market

Aspire Mining Limited (ASX:AKM) is committed to the development of its coal project located in close vicinity of two of the largest markets- China and India. The company operates the Ovoot Coking Coal Project (OCCP) in north-western Mongolia. The project is spread over an area of 130km2, including one mining licence and two exploration licences.

By the end of the December 2021 quarter, Aspire reported a coal reserve of 255Mt of high-grade (fat) coking coal. After completing a Pre-Feasibility Study on the project, the company is currently progressing with a Definitive Feasibility Study (DFS).

For DFS, the company is advancing on the Front End Engineering Design (FEED) studies for the coal wash plant and infrastructure.

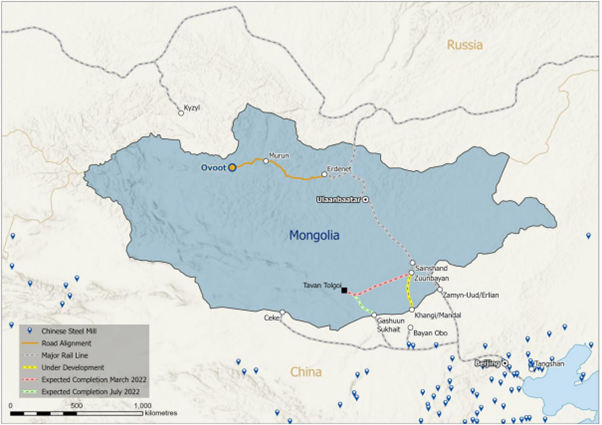

The PFS and the DFS are being done keeping Erdenet Rail Terminal infrastructure, including truck unloading, coal storage and train load-out infrastructure in focus.

Related read: Aspire Mining reports significant progress at Ovoot Project in December quarter

Mongolian Rail development map (Image source: 15 February 2022)

2022 game plan

The project’s Detailed Environmental Impact Assessment (DEIA) report is complete, and it is now under review with the Ministry of Nature, Environment and Tourism.

Aspire is also targeting the completion of Road Detailed Engineering works by the second quarter of 2022. Under this, the company has wrapped up the Route Geotech survey and road design matched to optimal truck/trailer configurations.

To know more: Inside Aspire Mining’s (ASX:AKM) March quarter plans for Ovoot project

AKM shares were trading at AU$0.086 in the early hours of 1 April 2022.