Highlights

- Lithium Australia has developed an outstanding portfolio of technologies to improve the supply chain of energy metals for the battery industry.

- The company is well-positioned to play a key role in meeting the demand for and disposal of lithium-ion batteries.

- Through its 100%-owned subsidiaries, Envirostream and VSPC, LIT expects to disrupt the Li-ion battery industry.

The world is moving from the costly lithium-nickel-cobalt-manganese (NCM) batteries to lithium ferro phosphate (LFP) batteries, which are more stable and have an improved cycle life. China dominates the LFP battery market segment, posing supply chain risks.

Lithium Australia Limited (ASX:LIT) is working towards establishing a new order in the LFP battery space. The company, through its 100%-owned subsidiary VSPC, is advancing next-generation cathode powders, including LFP, to substitute the Chinese batteries. The company has highlighted its efforts in this regard in the recently released investors’ presentation.

Additionally, Envirostream is leading the lithium-ion battery recycling industry in Australia. Currently, more than 90% of lithium-ion batteries (LIBs) end up in landfill, presenting an opportunity for increased volumes. The company plans to develop a nationwide network of battery collection and processing facilities to cater for the expected increase in spent batteries.

Opportunities in Li-ion battery recycling

As per the data shared by the company, LIB waste is growing at a rate of 20% per annum, and the volume could exceed 100,000 tonnes by 2036. LIBs pose risks as they could release toxic chemicals and metals into the environment if not disposed of properly. Estimates show that only ~9% of LIBs are recycled in Australia currently.

Lithium Australia has taken up the cause and working towards creating a circular battery economy, and at the same time, the company is eyeing to aid in meeting the surging demand for batteries for the EV industry. Envirostream, launched in 2017, is accredited by B-cycle to operate in this space.

B-cycle is a federal government-accredited organisation working on a product stewardship scheme for end-of-life batteries. The scheme facilitates rebates to promote recycling. Recently, Envirostream secured its first rebate from the scheme.

Envirostream, which owns and operates battery facilities in Melbourne, plans to expand its operations nationwide to meet the surging demand.

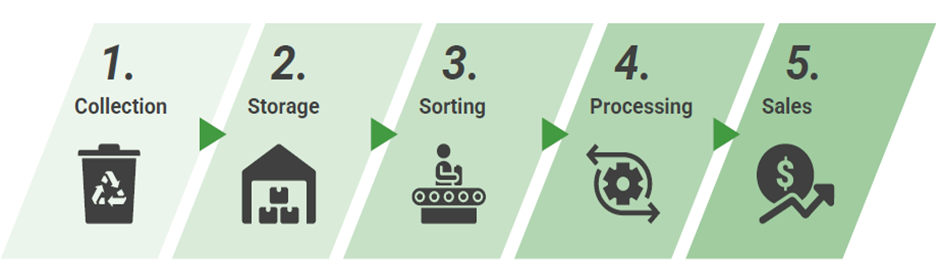

Five key battery recycling steps (Image source: Company update, 6 July 2022)

Data source: Company update, 6 July 2022

LIT to aid industry to move away from Chinese dominance

Lithium Australia acquired a 100% interest in VSPC in 2017 to gain exposure in the exciting lithium-ion battery industry. VSPC, established in 1999, is engaged in the research & development of high-purity, nano-scale materials, including advanced cathode materials.

VSPC currently owns an R&D facility (pilot plant) in Brisbane with a capacity of 1-2tpa LFP. The company has patented its processes that include three families of patents.

To reduce the strain on the supply-chain of LFP batteries and move away from the Chinese dominance, VSPC is initially planning to establish a 10,000tpa LFP cathode manufacturing plant.

The LFP cathode material market is expected to reach approximately 3.3Mt annually by FY30 from the FY21 level of approximately 400,000tpa. Over 99% of current LFP production comes from China.

Image source: Company update, 6 July 2022

VSPC is targeting commercial production from 2026. Currently, a Definitive Feasibility Study (DFS) is in progress for the manufacturing plant, and the company is evaluating Australia and North America for the plant. The Prefeasibility Study has already been completed and churned out some encouraging financial metrics, including revenue generation of US$140 million and free cash flow of US$56 million annually with an IRR of 33%.

VSPC has already commenced LFP product testing through cell manufacturers and continues further investigations for producing key raw materials to increase cost competitiveness.

LIT shares were trading at AU$0.065 in the early hours of 7 July 2022, up 6.5% from the last close.