Highlights

- Cyprium Metals (ASX:CYM) has received firm commitments to raise AU$16 million under a placement.

- CYM has also announced a non-renounceable entitlement offer to raise up to AU$10 million, for which a prospectus will be issued shortly.

- The capital raised supports recently announced AU$50M Offtake Prepayment Facility with Glencore

Cyprium Metals Limited (ASX:CYM) announces a capital raising of around AU$26 million before costs. The capital will be raised via a placement and a pro-rata non‐renounceable rights issue.

CYM has received strong support from the existing shareholders for the placement. The fund raising will support the Company in financing the restart of the Nifty Copper Project.

CYM receives firm commitments to raise AU$16 million

CYM has received firm commitments to raise AU$16 million through the issue of around 139.1 million new shares at 11.5 cents per share under the Company’s present placement capacity pursuant to ASX Listing Rule 7.1.

Source: © Andreyyalansky19 | Megapixl.com

Further, the non-renounceable pro-rata entitlement offer will help the Company raise up to AU$10 million at the Offer Price of one new share for every eight shares presently held by eligible shareholders. These shares will be issued at a price same as that of the placement shares.

Utilisation of funds

CYM plans to use the funds raised from the capital raising towards the funding strategy to finance the recommencement of the Nifty Copper Project. The company aims to offer a secure, stable, and sustainable supply of copper metal at 25ktpa.

On 27 June, CYM entered an exclusive LOI (letter of Intent) with Glencore International AG for AU$50 million. The deal was related to a copper cathode offtake secured prepayment facility as part of the targeted AUD240-260 million debt financing package to fund the recommencement of the Nifty Copper Project.

Source: © Kikkerdirk | Megapixl.com

CYM continues to progressively engage with senior debt providers who are conducting due diligence activities and assessing financing documentation.

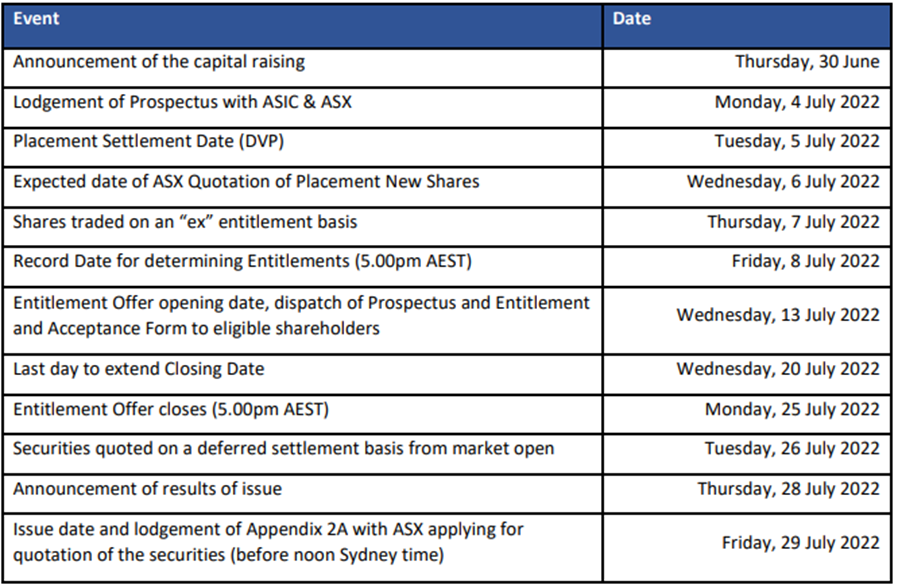

Tentative schedule for capital raising

The Company plans to release a prospectus detailing the terms of the entitlement offer, which includes a top-up facility. Under this facility, the eligible shareholders who get their complete entitlement will have the opportunity to apply for additional shares from those not accepted by other eligible shareholders.

The tentative schedule shared by the Company for the capital raising is as follows:

Source: CYM Announcement 30/06/2022

CYM stock was noted at AU$0.112 on 30 June 2022.

_07_15_2022_09_55_52_923961.png)