Highlights

- Calima Energy has increased its landholding in the Brooks area to more than 69,000 net acres.

- The company has secured an option to acquire any unleased shallow gas rights that lie within the expanded acreage.

- CE1 has identified more than 20 drill locations on the newly leased acreage.

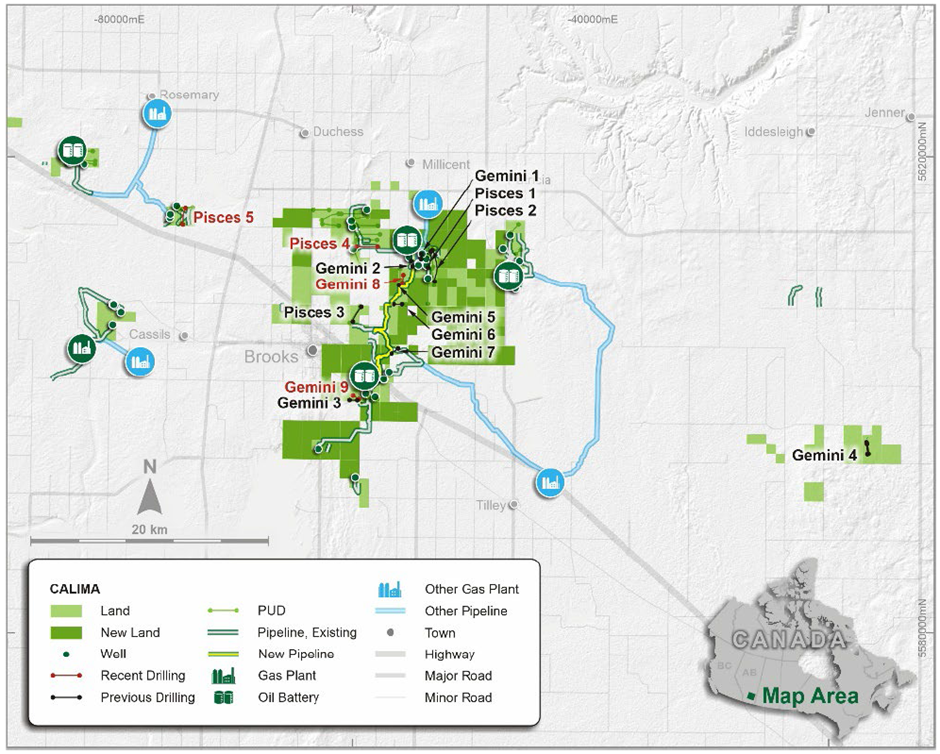

Canada-based oil & gas company Calima Energy Limited (ASX:CE1) has widened its footprint at Brooks, one of its producing assets in the Alberta region of Canada. The company has expanded its land acreage by 33,116 acres to over 69,000 net acres.

The strategic mineral leasing deal gave Calima shareholders’ a reason to smile as CE1 shares jumped nearly 7.7% to close the day’s trade at AU$0.14 apiece on the ASX on 3 August 2022.

The Brooks area has been a significant contributor to the company’s overall production portfolio. The area is responsible for 2,700 boe/d of hydrocarbon production, which is approximately 63% of the total production of 4,300boe/d.

The company has drilled more than 70 wells in the area since 2013 and intends to drill 21 more horizontal wells over the next three years. The area also houses two highly prolific oil & gas formations, Sunburst and Glauconitic, which are the drilling targets for Calima.

To know more about Calima, click here

Overview of the lease agreement

Calima has chosen the acreage for lease because of its close proximity to the Sunburst and Glauconitic targets as well as existing infrastructure in the area, which includes oil batteries for wells 2-29, 15-23 and 6-19. The agreement has expanded the land cover to 69,000 net acres or ~108 net sections.

The agreement will also provide access to an extensive 3D seismic database of the newly acquired lease. This will aid in the geophysical evaluation of the newly acquired land.

As part of the deal, Calima also has an option to acquire any unleased shallow gas rights on the acquired land.

Acreage in the Brooks area (Image source: CE1 update, 3 August 2022)

Under the terms of the agreement, Calima has committed a capital expenditure of C$1.75 million every year. The lease has an initial term of three years.

Way forward

Calima plans to drill five additional horizontal wells this year in the Brooks area. And thereafter, it plans to drill seven wells each year for the next two years. Two committed wells have already been drilled, taking Calima’s total well count to 21 in the next three years.

The company has already identified more than 20 drill locations on the newly acquired lease.

Calima revealed that a typical Sunburst well costs around C$1.3 million, while a Glauconitic well costs around C$2.6 million. Both of these targets have resulted in an attractive rate of return with an average payout of 8 to 13 months if WTI crude oil prices are around US$85/bbl.