Highlights

- Bounty has announced a further oil appraisal program in the Naccowlah Block.

- Cooroo NW 7 will be a vertical development well to test numerous zones in the Westbourne Formation.

- The rig is currently being rigged to the location with spud anticipated today.

In a cheery market update, Bounty Oil & Gas NL (ASX:BUY) announced that the independent Australian oil and gas explorer and producer was participating in a further oil appraisal program in the Naccowlah Block of SW Queensland.

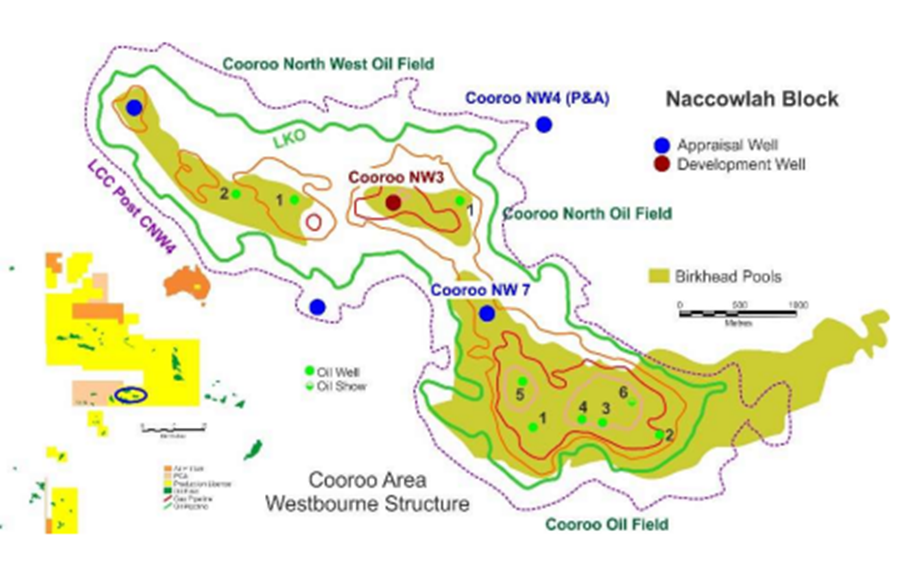

The appraisal program will continue the 5-well program undertaken in 2019-2020 at the operational Cooroo Northwest Oilfield. Cooroo NW Field is a 6km long structure within the PL 36 Naccowlah Block, just 18km southwest of the Jackson Oil Facility.

Read Here: Pavo-1 discovery upgrades prospectivity of Bounty’s (ASX:BUY) Cerberus Project

Cooroo oil field Source: Bounty Oil & Gas announcement 29 June 2022

Details of Cooroo NW 7

Cooroo NW 7 will be a vertical development well and is planned to extend to a depth of 1,843 metres MDRT (measured depth below rig rotary table) to test numerous zones in the Westbourne Formation. Secondary targets are interpreted as the Birkhead/Poolowanna Formations.

Location:

- Latitude - 27 degrees 41 minutes 45.31” South

- Longitude - 142 degrees 15 minutes 14.20” East

The well will be drilled using Ensign 967 Rig. The rig is currently being rigged to the location with spud anticipated today. Results of the appraisal program will be reported after the completion of the well. Bounty has oil producing facilities at Naccowlah in SW Queensland along with two undeveloped proved oil and gas discoveries in the Carnarvon and Surat Basin. Bounty holds a 2% stake in the operating Naccowlah Block and facilities.

Also Read: Where does Bounty Oil & Gas stand amid strong oil prices

Source: Bounty Oil & Gas

BUY traded at AU$0.006 a share on 29 June 2022 with a market capitalisation of AU$9.59 million.

Must Read: Dorado Field-Lookalike Drill Targets at Bounty Oil & Gas’ (ASX:BUY) Cerberus set for drilling