Highlights

- Boab Metals Limited has received strong demand for its 75% share of the high quality Sorby Hills Lead-Silver concentrate from leading domestic and international offtakers.

- The attractive terms for the offtake proposals received by the Company confirmed the high quality of the Sorby Hills Lead-Silver concentrate.

- Boab to complete the offtake tender process in Q1 2022.

In a significant update about its offtake tender process, Boab Metals Limited (ASX:BML) has highlighted strong demand for its high quality Sorby Hills Lead-Silver concentrate by Leading Domestic and International Offtakers.

Boab Metals holds 75% share of the high quality Sorby Hills Lead-Silver concentrate, and the balance 25% concentrate production belongs to the Company’s joint venture partner and one of China’s largest lead smelting and silver producers, Henan Yuguang Gold & Lead Co. Ltd.

Both lead and silver are witnessing good interest with end users seeking to secure supplies amidst growth in lead and silver market.

RELATED ARTICLE: Boab Metals (ASX:BML) poised to grow amid silver supply concerns

Offtake Proposals received to date by Boab Metals have offered attractive terms and confirmed the high quality of the Sorby Hills Lead-Silver concentrate.

Commenting on the solid demand during offtake tender process, Boab Managing Director and CEO, Mr Simon Noon indicated that the Company is highly encouraged on receiving offtake proposals from a host of international and domestic lead concentrate smelters and traders. He added, “The strength of responses demonstrates the depth of market demand for our Sorby Hills Lead-Silver concentrate and gives us every confidence that we will conclude binding offtake on highly competitive terms.

We look forward to completing this process with our shortlisted offtake proponents in calendar Q1 2022.”

ALSO READ: Boab Metals (ASX:BML) hosts NAIF and commercial banks on a site visit of Sorby Hills Project

Preliminary soundings had demonstrated encouraging outcomes

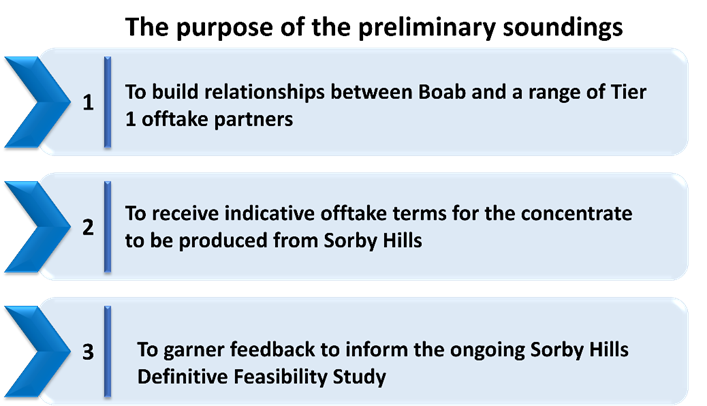

Boab undertook a series of Preliminary Offtake Soundings earlier this year with several leading base metals smelters and traders.

Image Source: Copyright © 2021 Kalkine Media®

The extremely positive preliminary soundings demonstrate significant demand for the Sorby Hills Lead-Silver concentrate. Notably, the quality of the concentrate does not attract penalty element charges based on the detailed Pre-Feasibility Study (PFS) concentrate assay specification. Moreover, Feedback from the preliminary soundings also provided useful insights for the ongoing DFS metallurgical program and Lead market dynamics considering the larger picture.

ALSO READ: Boab Metals makes significant DFS headway with encouraging metallurgical testwork results

Formal competitive tender process slated for completion in the early next quarter

On the back of positive preliminary soundings, Boab commenced a formal competitive tender process for its share of the Sorby Hills concentrate. The Company is encouraged by the attractive terms of the offtake proposals, which have confirmed strong demand for the high-quality Sorby Hills Lead-Silver concentrate.

ALSO READ: A recap into Boab Metals’ impressive 2021 performance

Boab has shortlisted the proponents providing the strongest proposals. The tender process to award binding offtake of the Sorby Hills concentrate is on track for completion in Q1 2022.