Highlights:

- Surefire shared the updated beneficiation Scoping Study for its Victory Bore Vanadium Project in WA.

- Currently, Surefire focuses on the larger, higher-grade Victory Bore deposit.

- The project holds mineral resources containing 2.263 billion lbs. of vanadium pentoxide.

Taking forward its legacy to unlock new opportunities across its portfolio projects, Surefire Resources NL (ASX:SRN) shared the updated beneficiation Scoping Study for its wholly-owned Victory Bore Vanadium Project in WA.

The updated Scoping Study has confirmed the economic viability of the vanadium project at current market prices. Previously in 2012, Quest Minerals had undertaken the original Scoping Study on the vanadium project. Excited by the enhanced potential economic opportunity following a significant rise in the vanadium prices, SRN had involved MinRizon, the global mining consulting firm, to review and update the study and identify opportunities for process improvements.

Read Here: Surefire Resources (ASX:SRN) comes closer to diamond drilling on Victory Bore Vanadium Deposit

Existing JORC Resources at Victory Bore Vanadium Project Source: Surefire Resources Announcement 04 May 2022

The Scoping Study is based on the JORC mineral resource estimates that were announced in 2017. Currently, the project holds mineral resources containing 2.263 billion lbs. of vanadium pentoxide. The resource is hosted in magnetite-hosted ore.

Also Read: Surefire Resources (ASX:SRN) enhances gold footprint at Yidby

Currently, Surefire focuses on the larger, higher-grade Victory Bore deposit, with further work pending at the Unaly Hill deposit.

Vanadium market and Opportunity at Victory Bore

In recent times, vanadium price has increased substantially. The vanadium market is a fast-evolving market with strong demand anticipations from high-capacity battery solutions for utility-scale applications. The energy storage applications, specially the vanadium redox flow batteries (VFRBs) as well as the high-velocity transport applications, are together driving the demand.

The ongoing war in Eastern Europe has triggered countries across the globe to boost their defense systems, enhancing the demand for vanadium steel alloys for military equipment. On the supply side, China has now turned into a net importer of vanadium products.

Must Here: Surefire Resources NL (ASX:SRN) ticks all the right boxes at WA projects

The beneficiation test work at the Victory Bore vanadium project has demonstrated that the following three products can be produced –

- Vanadium pentoxide flake (V2O5) – Currently trades at US$11.10 an lb or AU$15.41/lb (1AUD=US$0.72)

- Ferrovanadium - Currently trades at US$45.25 a kg or AU$62.84/kg

- Magnetite concentrate – Currently trades at US$660.35/t or AU$917.15/t (1AUD=US$0.72)

The company would assess the optimal production route to maximise the profit potential and shareholder returns.

Currently, Surefire hasn't set any timeframe for the project's development. The company would undertake the definition of additional resources and holds enough finances to conduct the work.

Scoping Study

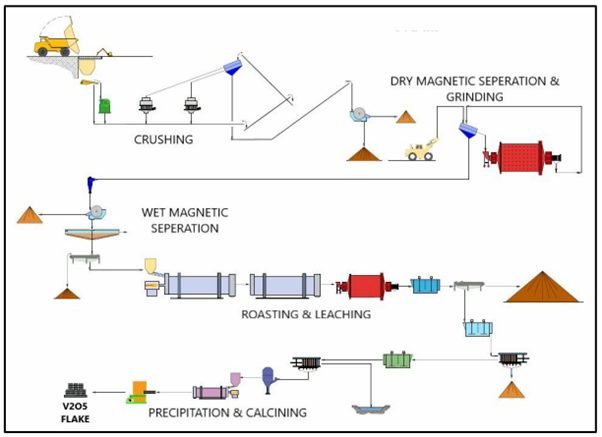

The Scoping Study was based on metallurgical test works by Promet Engineers, Mineral Engineering Technical Services Pty Ltd (Mets), and the CSIRO. The metallurgical work demonstrates the application of an industry-standard beneficiation flowsheet to recover vanadium via magnetic separation, sodium salt roasting and water leaching. Other producers in the region are using the beneficiation process. Further test work would be conducted during the Prefeasibility Study to validate their conclusions.

The study was concluded considering conventional mining, beneficiation, and transportation processes. The pit optimisation for open pit mining has been planned.

CAPEX and OPEX - A Net Present Value (NPV) model is yet to be developed. The study update was undertaken to provide an OPEX estimate to gain SRN’s Board confidence to advance to a Prefeasibility Study stage on the project.

The results of the Scoping Study have bolstered the Board’s confidence that the mineral project can deliver strong economic returns on investment.

Read Here: Surefire Resources NL (ASX:SRN) on the right path at Vanadium project amid high energy storage demand

Proposed beneficiation flowsheet at the Victory Bore Vanadium Project Source: Surefire Resources Announcement 04 May 2022

Process Flow Sheet – Ores will be processed using crushing, two pass grinding and magnetic separation using dry and wet magnetic separators. The weight recovery is estimated to be 94% (Pre-final leach) for vanadium and 89.2% for the vanadium pentoxide product. The economic benefit of producing ferrovanadium will be evaluated at the PFS stage.