Summary

- J Cap again targeted WiseTech after its CEO and Founder, Richard White sold 2,445,653 shares, representing ~0.76% of the total issued capital of WTC. He now has control of ~151 million WTC shares.

- A day prior, on 29 June, there was an announcement regarding Richard While selling 206k shares.

- J Cap blamed WTC for its failed acquisition strategy and highlighted its most significant acquisition to date, Containerchain.

- The US-based Company highlighted that Containerchain is bleeding accounts, and six customers in Singapore have migrated to CargoMove.

- WiseTech’s shares took a hit with declines in the last three days.

WiseTech Global Limited (ASX:WTC), a provider of software solutions to the logistics industry worldwide, was once again targeted by J Capital Research USA, LLC (J Cap) after the Company announced the sale of nearly 2.4 million shares by CEO and Founder, Richard White.

J Cap has blamed WiseTech, stating that WTC has been hiding its failed acquisitions strategy by writing down earn-outs without writing off the equivalent item.

In this backdrop, let us first look at the market announcement of WiseTech concerning the sale of the shares and then see the what points J Cap raised.

Sale of 2.4 million shares:

On 30 June 2020, WiseTech Global Limited announced that RealWise Holdings Pty Ltd, a Company which is controlled by WTC’s CEO and Founder, Richard White, sold 2,445,653 shares. The shares represent ~0.76% of the total issued capital of WiseTech Global.

Once the transaction gets completed, Richard White would have voting control over ~151 million WiseTech Global shares, which represents 46.9% of the issued capital of WTC.

Mr White, on 29 June 2020, had disposed 206,439 ordinary shares at A$22.02 per share.

J Cap and WiseTech History:

During October 2019, J Cap had attacked WiseTech and said that the Company had overstated its profit and organic growth. J Cap also questioned its European revenue growth, and on the way they do business. It also pointed out that WiseTech has poorly integrated and underperforming acquisitions. Click on the following links for further details:

Tech Stock That Is Being Hammered: WiseTech Global Limited

A look at WiseTech Global Limited’s response to J Capital Research’s Allegations

J Cap Accused WiseTech For Inflated Profit And Poor Acquisitions

J Cap Again Attacks on WiseTech:

J Capital Research is a US-based Company that publishes research reports on listed companies based on thorough primary research.

After WTC’s market release on the sale of ~2.4 million shares, J Cap also published its report where it directly aimed at the Company stating that WTC was trying to sweep its failed acquisition strategy by writing down earn-outs without writing off the equivalent item—goodwill. J Cap expects that the investor would have an unpleasant surprise when WTC reports its annual results for FY2020 in August and projects the goodwill write-downs of ~A$200 million to A$300 million.

J Cap blamed WiseTech for getting rid of 40% of the earn-outs from 17 poor-performing acquisitions in May 2020 in a fantastic way. It also pointed out one of WTC’s biggest acquisition Containerchain is bleeding accounts, and the majority of A$87 million in related goodwill would be written off.

J Cap highlighted that Containerchain is a loss-making business and could possibly collapse. Containerchain is a top provider of container optimisation solutions to the container shipping & landside container logistics communities in APAC, Europe & the United States.

Containerchain is headquartered in Singapore and provides real-time tracking, automation, connectivity, operational planning and container visibility across the supply chain.

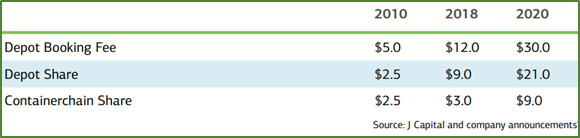

Targeting WTC’s business Containerchain, J Cap said that in the early days in Australia and New Zealand, Containerchain shared the booking fee 50-50 with the depot operator and gave incentive to the operator. It had fixed the fee that was 50% of the revenue. Later on, the depot operator saw an opportunity to improve their revenue and increase the fee and did not contribute to the increase with Containerchain. As a result, Containerchain got small increments, and the majority was taken by the depots. Also, Containerchain had to wait for clients to roll-off long term contracts the previous year to get a bigger portion of the booking fee.

Since WTC acquired Containerchain, the booking fee increased to A$30, rising from 1% to more than 6% of the ocean freight charges for a container. It was a matter of concern for the freight forwarders who were frustrated with the rise in fees (up by 300% over the past 12 months). They are even planning to act with the ACCC. Further, Industry associations also believe that the charges are unfair and do not reflect the service rendered.

In Singapore, Containerchain works with Container Depot Association of Singapore, that keeps 50% of the fee and does not give anything to the depot operator. Many depot operators are leaving Containerchain, which was confirmed by another player in the same business CargoMove when interviewed by J Cap. CargoMove stated that six Containerchain’s customers have now migrated to their system.

Stock Performance:

WTC stock took a hit in the last couple of days following the announcements of the CEO selling his stake in the Company. The share price fell by 8.549%, 2.223% and 4.134% on 29 June, 30 June, and 1 July, respectively. However, the stock was trading at A$19.310 on 2 July 2020 (at 01:24 PM AEST), up 4.097% compared to the previous close.

The Company has a market cap of A$6 billion with ~323.28 million outstanding shares. WTC has delivered a decent return of 16.67% in the last three months.