Highlights

- Winsome Resources Limited (ASX:WR1) shares have gained over 200% in the last six months.

- However, the stock has been on a downtrend after hitting an all-time high of AUD 2.520 on 31 January 2023.

- Of late, the stock is witnessing some buying.

Lithium-focused exploration company Winsome Resources Limited's (ASX:WR1) shares ended nearly 4.5% higher at AUD 1.390 on Thursday. WR1, which is up over 200% in the last one year, has been on a downward trend after hitting an all-time high of AUD 2.520 on 31 January 2023. However, the stock witnessed some recovery after publishing its quarterly activities report on 26 April 2023.

During the January-March quarter of 2023, its step-out drilling program at Adina extended the strike length of the mineralised pegmatite body to a potential 1,600m.

Further, the drilling of hole AD-22-043 validated the extension of the mineralised pegmatite body. This drilling intersected 17.1m of spodumene-bearing pegmatite about 1km east of previously reported drilling at Adina, the company said, adding that drilling at Adina continued to intersect broad widths of spodumene-bearing pegmatite.

Earlier last month, Winsome Resources said it would acquire the Tilly project in Canada, located 20 kilometres from its Adina project in the world-class James Bay lithium region. The acquisition increases its landholding within James Bay to more than 850 square kilometres. As per the company, the Tilly project is a welcome addition to the company's lithium portfolio.

Given these developments, will WR1 shares be able to retest their 52-week high? Let’s study the price chart of WR1 for some clues.

WR1’s Technical Analysis:

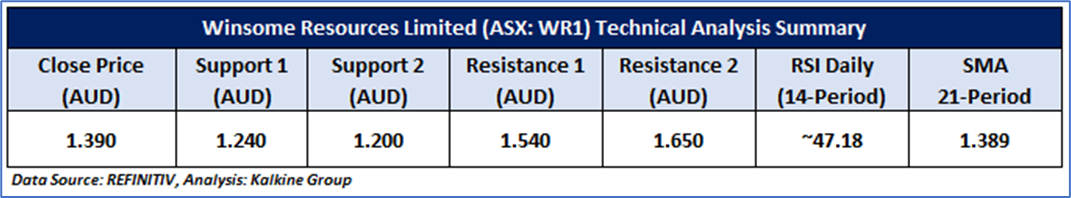

The stock price of WR1 is forming a falling wedge with a positive bias, despite being in a mid-term correction. In addition, between March and April 2023, WR1 established a bottom divergence relative to the RSI (14-period) indicator, which resulted in the stock rebounding to the upper boundary of the pattern. The price of the stock is currently confronted by two potential resistance levels: the trend-following indicator 21-day SMA and the short-term downward trendline. Nevertheless, if the stock surpasses these resistance levels, it may gain additional upward momentum to rally further. Important support for the stock is located at AUD 1.240, while important resistance is positioned at AUD 1.540.

Daily Technical Chart – WR1

The technical levels for the stock were evaluated as per the closing price of AUD 1.390 per share as on 04 May 2023, up by ~4.5%.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Technical Indicators Defined:

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

The Green colour line reflects the 21-period moving average. SMA helps to identify existing price trends. If the prices are trading above the 21-period, prices are currently in a bullish trend (Vice – Versa).

The Blue colour line reflects the 50-period moving average. SMA helps to identify existing price trends. If the prices are trading above the 50-period, prices are currently in a bullish trend (Vice – Versa).

The Orange/ Yellow colour line represents the Trendline.

The Purple colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period), which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status, while a reading of 30 or below suggests an oversold status.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.