Highlights

- Housing credit continued to showcase a moderate pace of growth over the year to March 2023

- In the March quarter of the current year, the household wealth increased by AUD 299.1 billion or 2.1% QoQ and stood at AUD 14,807.8 billion

- For 1HFY23 ending 31 March 2023, NAB reported a 19.3% jump in its revenue, largely because of the acquisition of the Citi consumer business

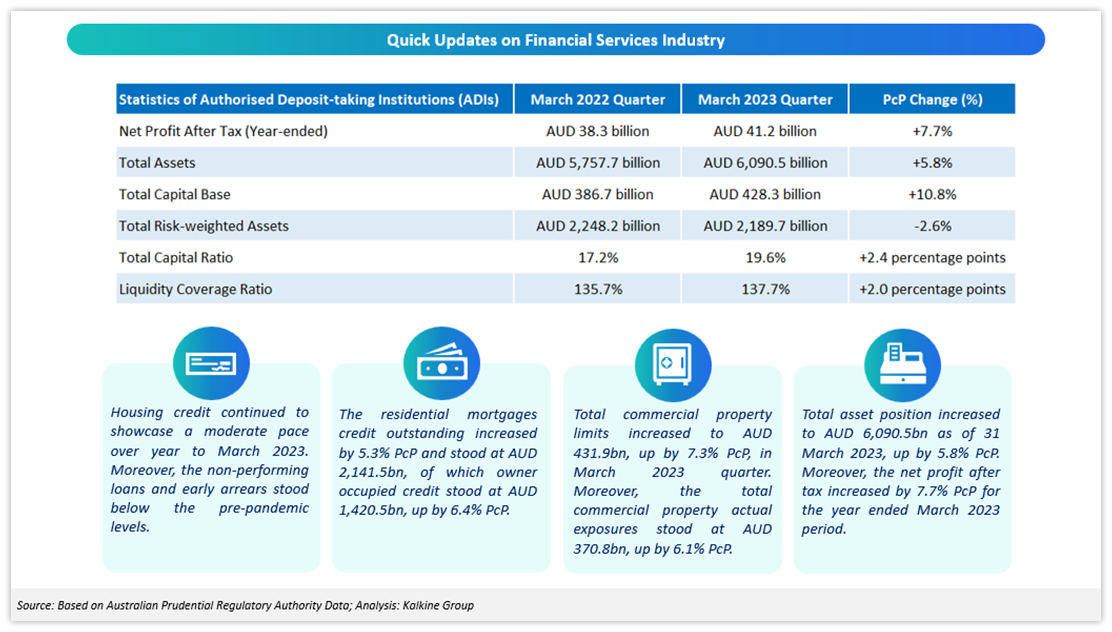

Australia’s financial services sector may showcase considerable resilience amid macroeconomic disruptions. The total managed funds industry advanced by 3.1% sequentially to AUD 4,544.9 billion funds under management. In April 2023, the value of new loan commitments for business purchase of property increased by 9.8% on a seasonally adjusted basis. Housing credit continued to show moderate growth over the year to March 2023.

In the March quarter of the current year, the household wealth increased by AUD 299.1 billion or 2.1% QoQ and stood at AUD 14,807.8 billion. Demand for credit increased by AUD 27.7 billion QoQ and stood at AUD 89.4 billion in March 2023 quarter. Household net lending position stood at AUD 23.9 billion in March 2023 quarter, largely owing to AUD 44.5 billion acquisition of financial assets and partially offset by AUD 20.6 billion incurrences of liabilities.

As per Australian National Accounts, the gross value added in the financial and insurance services industry was largely driven by superannuation services in December 2022 quarter, culminating in a contribution of 0.6% QoQ uptick in other financial and insurance services.

Given this background, let’s understand the prospects of the National Australia Bank and how it is placed for FY23.

National Australia Bank Limited (ASX:NAB)

NAB operates in the financial services industry via two segments, namely, Business and Private Banking.

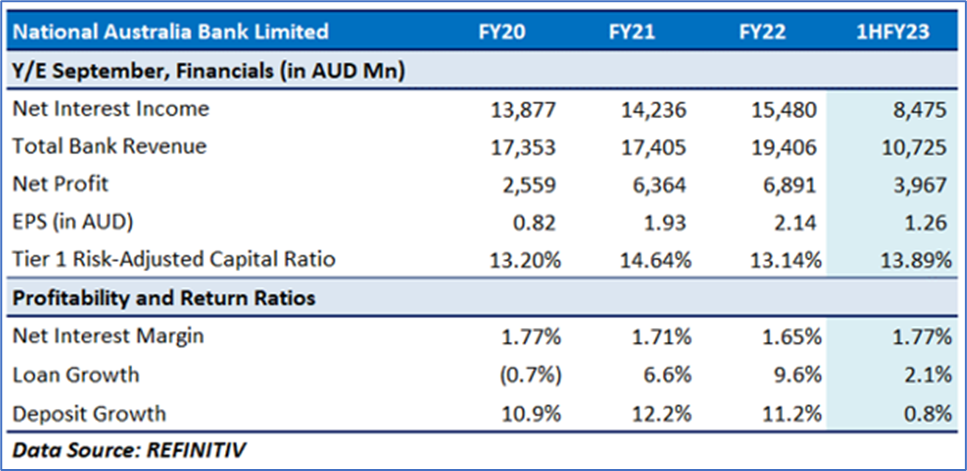

For 1HFY23 ending 31 March 2023, NAB reported a 19.3% jump in its revenue, largely because of the acquisition of the Citi consumer business. It also witnessed margin increase along with favourable volumes; its net interest margin surged by 14 basis points to 1.77%, illustrating higher earnings on deposits and capital.

For FY23, NAB expects to deliver productivity benefits of nearly AUD 400 million to combat inflationary pressures. Meanwhile, its FY23 funding task is well advanced due to AUD 23 billion raised in 1HFY23.

However, the lender could face some challenges as the overall growth and consumption in Australia have softened amid monetary policy tightening.

NAB Share Price Performance

NAB shares closed 0.380% higher at AUD 26.35 on Thursday (29 June 2023). The stock has witnessed a decline of around 4.77% in the last three months, and over the last six months, it has declined by nearly 11.93%. The stock has a 52-week low and 52-week high of AUD 25.100 and AUD 32.830, respectively and is currently trading below the 52-week high-low average.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 29 June 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.