Highlights

- West African resources is a gold mining company with operations in West Africa

- In FY23, the company marked third consecutive year of achieving gold production and cost guidance

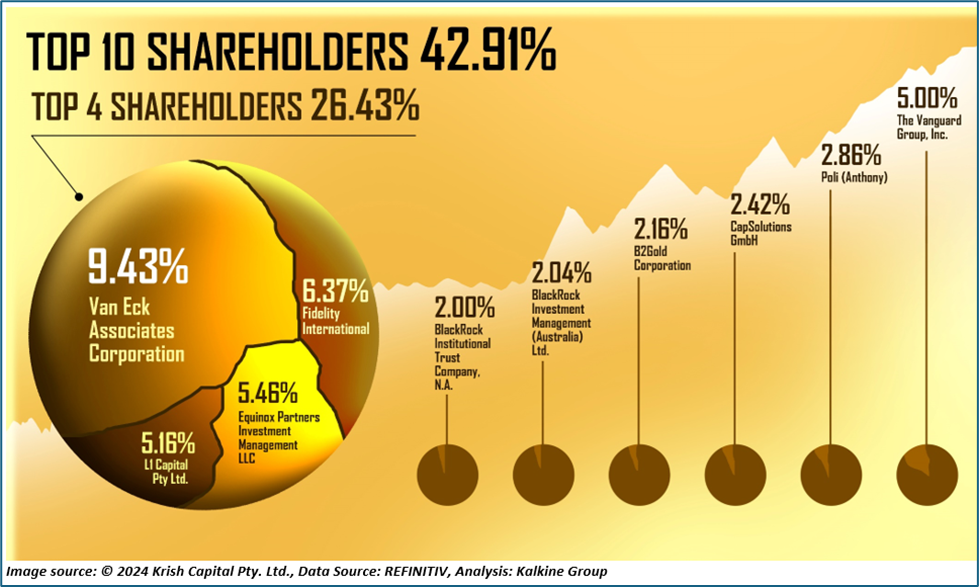

- Van Eck Associates Corporation has the maximum stale in the firm with a shareholding of around 9.43%

Australia-based gold mining firm, West African Resources Limited (ASX:WAF) is engaged in the exploration, acquisition and development of gold projects in West Africa. Its Mining Operations segment comprises of the Sanbrado Gold Project operations in Burkina Faso.

The AUD 954.49 million-market cap firm achieved its annual production and cost guidance for the third consecutive year in the financial year 2023 (FY23) with a gold production of 226,823 ounces at an AISC of USD 1,126/oz.

During the first half of FY23, the company reported 4% YoY drop in revenue to AUD 309.7 million, 2% YoY decline in total income to AUD 98.8 million and 11% YoY rise in operating cash flow to AUD 109.8 million. In the first half, gold production was 113,009oz at an AISC of USD 1,169/oz.

The top 10 shareholders of WAF

The top 10 shareholders of WAF have around 42.91% shareholding in the company, while the top four have nearly 26.43% shareholding. The top two shareholders of WAF are Van Eck Associates Corporation and Fidelity International with a shareholding of ~9.43% and ~6.37%, respectively.

Recent business update

On 29 January 2024, the company shared that an employee of a contractor was injured while working at the Kiaka Golf Project. Investigations on the accident are ongoing.

The company released its quarterly update for the period ended 31 December 2023. During the quarter, the gold production was 58,047oz at an AISC of USD 1,030/oz and gold sales stood at 66,059oz at an average price of USD 1,978/oz. the company ended the quarter with a cash balance of AUD 135 million and unsold gold bullion balance of AUD 10 million.

Outlook

The focus of WAF is to maintain construction at Kiaka Gold Project within budget and on schedule. By the second half of 2025, the company plans to pour the first gold at Kiaka.

The annual gold production target for 2024 is over 200,000oz and for 2025-2032, it is 400,000oz.

Share performance of WAF

WAF shares closed 2.68% up at AUD 0.955 apiece on 30 January 2024. With this, in the past one year, WAF’s share price has dropped by 14.73% and increased by 6.11% in the last six months.

The 52-week high of WAF is AUD 1.16, recorded on 30 January 2023 and the 52-week low is AUD 0.66, recorded on 5 October 2023.

WAF Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 30 January 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.