Highlights

- Virgin Money is a financial services provider and is dual listed on LSE and ASX

- In FY23, the company reported an 8% YoY surge in the underlying net interest income to GBP 1,716 million

- Ubique Asset Management Pty Ltd is the top shareholder of VUK with a shareholding of around 5.28%

Virgin Money UK Plc (ASX:VUK) is a dual listed firm with listing on the London Stock Exchange (LSE) and Australian Securities Exchange (ASX). The financial services firm is engaged in offering banking products and services.

The AUD 3.90billion-market cap-firm reported an 8% YoY increase in its underlying net interest income to GBP 1,716 million in the financial year 2023 (FY23). Meanwhile, the underlying operating income increased by 8% YoY to GBP 1,873 million and statutory profit before tax decreased by 42% YoY to GBP 345 million in FY23.

The period saw an increase in income because of NIM expansion and positive fair value movements.

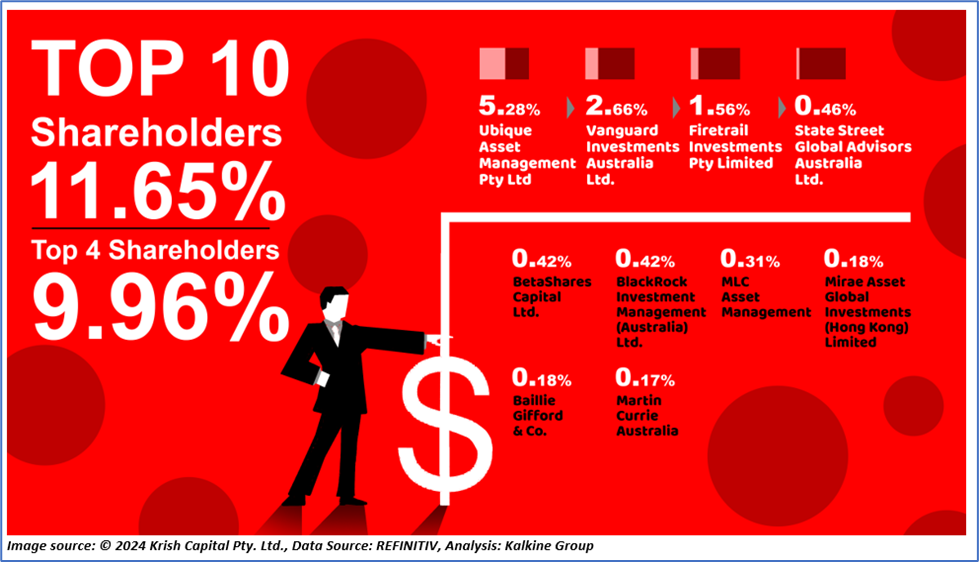

Top 10 shareholders of VUK

The top 10 shareholders of VUK have nearly 11.65% stake in the company, while the top four have around 9.96% shareholding. The top two shareholders of VUK are Ubique Asset Management Pty Ltd and Vanguard Investments Australia Ltd. With a shareholding of ~5.28% and ~2.66%, respectively.

Recent business update

Today (15 January 2024), through an ASX-filing, the company informed that BlackRock, Inc has less than 5% voting rights.

On 21 December 2023, the company shared that Lucinda Charles-Jones would join the company as a remuneration committee chair elect and non-executive director. Lucinda would take up the role from 22 January 2024.

Outlook

In FY24, the company expects NIM of 190-195bps, CET1 of 13-13.5% and continuous loan growth in BAU and unsecured business. Moreover, the company expects that its underlying cost to income ratio would be more stable in FY24, compared to FY23.

By the end of the three-year period ending in 2024, the company anticipates delivering nearly GBP 800 million in distribution.

The focus is on investing in technological capabilities, undertaking further buybacks and driving growth in target lending segments and relationship deposits.

Share performance of VUK

VUK shares closed 0.67% down at AUD 2.95 apiece on 15 January 2024. With this, VUK’s share price has increased by 5.36% in the last nine months and has dropped by 8.39% in the last six months.

The 52-week high of VUK is AUD 3.52, recorded on 16 January 2023 and the 52-week low is AUD 2.52, recorded on 29 March 2023.

VUK Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 15 January 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.