Highlights

- Silver Lake is a gold producing firm with operations in Western Australia and Northern Ontario, Canada.

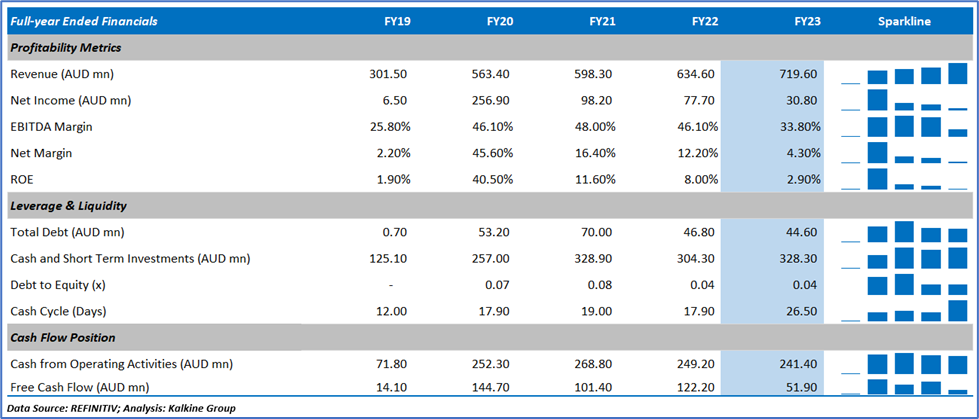

- In FY23, the company’s revenue increased by 13% over the previous year to AUD 719.6 million.

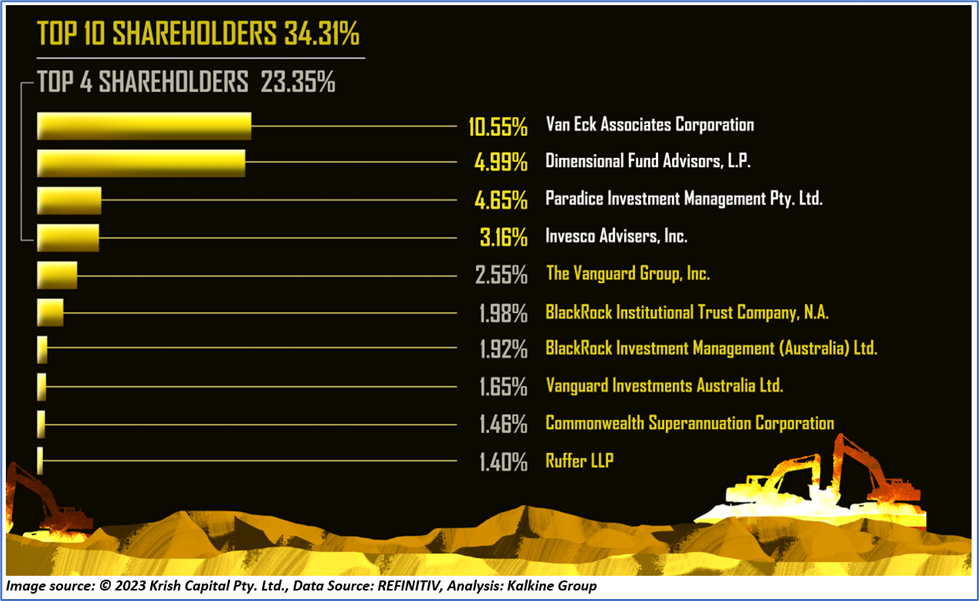

- Van Eck Associates Corporation has the highest stake in the firm with a shareholding of around 10.55%.

Silver Lake Resources Limited (ASX:SLR) is an Australia-based gold producer with operations in Western Australia and Northern Ontario, Canada. The company engaged in mine development, mine operations, exploration and sale of gold and gold/copper concentrate.

The gold explorer has delivered its annual guidance for the ninth consecutive year in the financial year 2023 (FY23).

In FY23, the company’s revenue increased by 13% YoY to AUD 719.6 million, whereas EBITDA fell by 7% YoY to AUD 248.4 million.

Gold sales during FY23 were 260,372 ounces, while the gold production was 261,604 ounces. Copper production during the stated period was 1,483 tonnes.

The period saw the development of a new underground mine at Mount Monger, record production at the Deflector mine and inclusion and investment in the Canadian mine, Sugan Zone.

Here is the historical financial trend of SLR.

Top 10 shareholders of SLR

The top 10 shareholders of SLR have around 34.31% shareholding in the company, while the top four shareholders have approximately 23.35% shareholding. The maximum stake is held by Van Eck Associates Corporation and Dimensional Fund Advisors, L.P. with a shareholding of ~10.55% and ~4.99%, respectively.

Recent business update

Through an ASX filing dated 5 September 2023, the company informed that the Perth office of its share registry is shifting to Level 17, 221 Georges Terrace, Perth WA 6000, effective from 18 September 2023.

Outlook

In FY24, the company expects to deliver gold sales of 210,000-230,000 ounces at an AISC of AUD 1,850 – 2,050 per ounce.

SLR plans to direct an AUD 24.8 million investment in exploration focused on grade control of new production areas. In addition to this, the company intends to make further investments to extend the mine life of Mount Monger and invest in drill data acquisition at Sugar Zone.

The company also seeks mergers and acquisition opportunities to register larger, longer life and lower cost business.

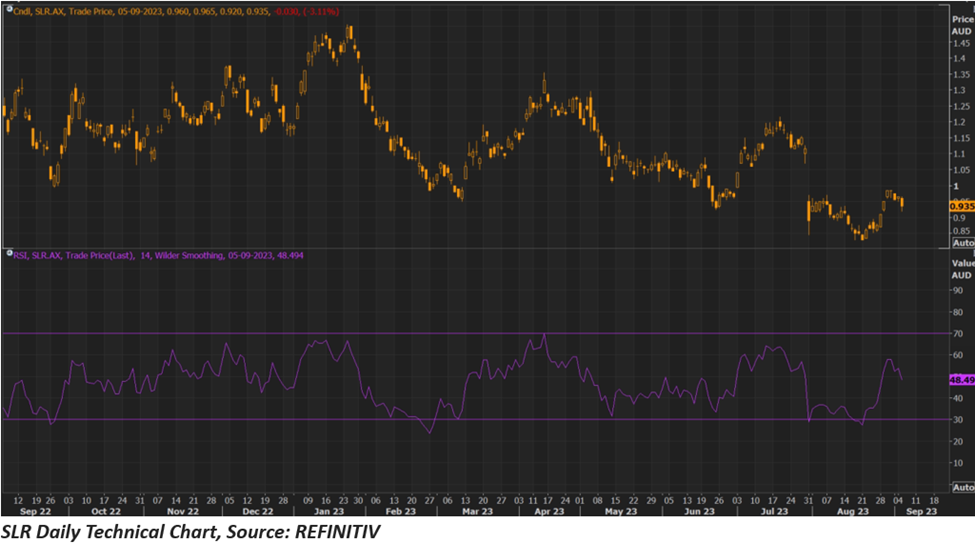

Share performance of SLR

SLR shares closed 1.58% lower at AUD 0.935 apiece on 5 September. SLR's share price has witnessed a fall of 28.35% in the past nine months and a drop of 10.52% in the last three months.

The 52-week high of SLR is AUD 1.505 apiece, recorded on 24 January 2023, and the 52-week low is AUD 0.83 apiece, recorded on 21 August 2023. Worth mentioning here is that the existing share price of SLR is 37.87% lower than its 52-week high.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 05 September 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.