Highlights

- Regal Partners offers range of investment management services to private investors, charitable groups, family offices, and institutions

- In FY23, the company recorded 111% YoY rise in its funds under management to AUD 11.0 million

- New Highland Pty. Ltd. has highest stake in RPL with a shareholding of nearly 35.41%

Regal Partners Limited (ASX:RPL) is an investment management organization, specializing in alternative investments. The company manages a range of investment strategies including capital solutions, real and natural assets, private markets and hedge funds on behalf of private investors, charitable groups, family offices, and institutions.

In the financial year 2023 (FY23), funds under management of RPL grew by 111% YoY to AUD 11 million, backed by acquisition of 50% interest in Taurus Funds Management, acquisition of PM Capital and net client inflows of AUD 0.5 billion.

During the reported period, net income grew by 16.9% YoY to AUD 111.90 million and normalised NPAT jumped 31.9% to AUD 32.70 million. The yearly revenue growth in FY23 was underpinned by a 4% surge in funds management fees and other incomes. Worth mentioning here is that the revenue growth was partially offset by a 33.1% decrease in performance fees.

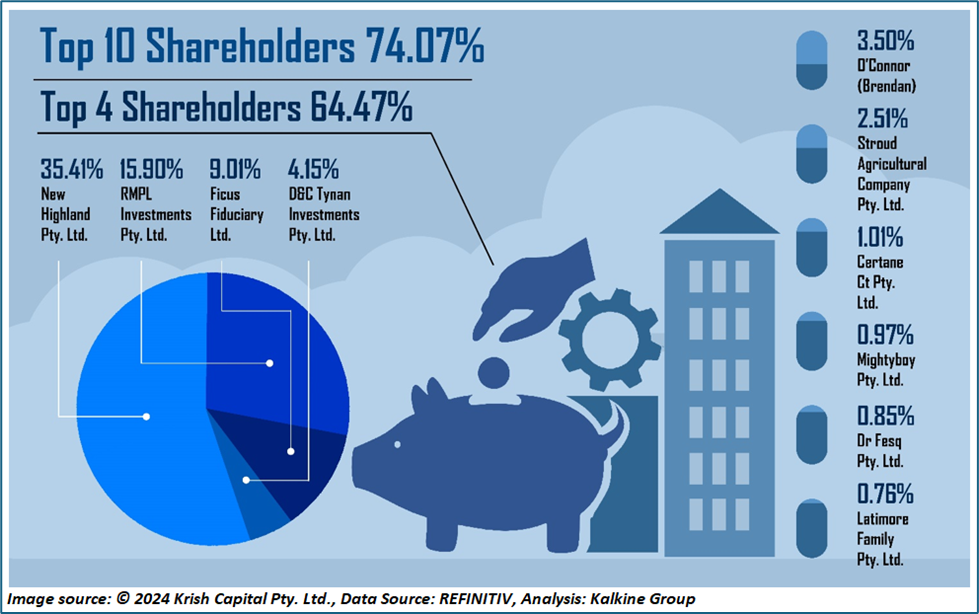

Top 10 shareholders of RPL

The top 10 shareholders of RPL have nearly 74.07% shareholding in the company, while the top four shareholders together have 64.47% shareholding. New Highland Pty. Ltd. and RMPL Investments Pty. Ltd. have the highest stakes in the company with a shareholding of ~35.41% and ~15.90%, respectively.

Recent business update

Through an ASX-filing dated 15 March 2024, the company shared that its annual general meeting (AGM) will take place on 30 May 2024. The agenda of the meeting comprises the election of directors. Director’s nominations will close on 22 March 2024.

On 5 March 2024, the company notified that New Highland Pty Ltd (as the trustee for King Family trust), New Highland Pty Limited (as the trustee for the Philip King Family Trust) and Philip King together have decreased their stake in the firm from 35.44% on 6 October 2022 to 35.41% on 1 March 2024.

Outlook

The company highlighted that funds’ performance is enhancing on the back of product innovation, which is expected to drive net inflows in earnings. The company is also seeking cost-saving opportunities.

In 2024, the company has received further fund commitments of AUD 0.4 billion.

A disciplined approach has been adopted by RPL to assess inorganic opportunities.

Share performance of RPL

RPL shares closed 3.81% higher at AUD 3.00 apiece on 19 March 2024. Including today’s gain, RPL’s share price has increased by 1.69% in the past one year and has increased by 31.58% in the last six months.

The 52-week high of RPL is AUD 3.36, recorded on 17 April 2024, while the 52-week low is AUD 1.7, recorded on 31 October 2023.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 19 March 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.