Highlights

- Ramsay offers acute and primary healthcare services across the UK, Europe, Asia and Australia

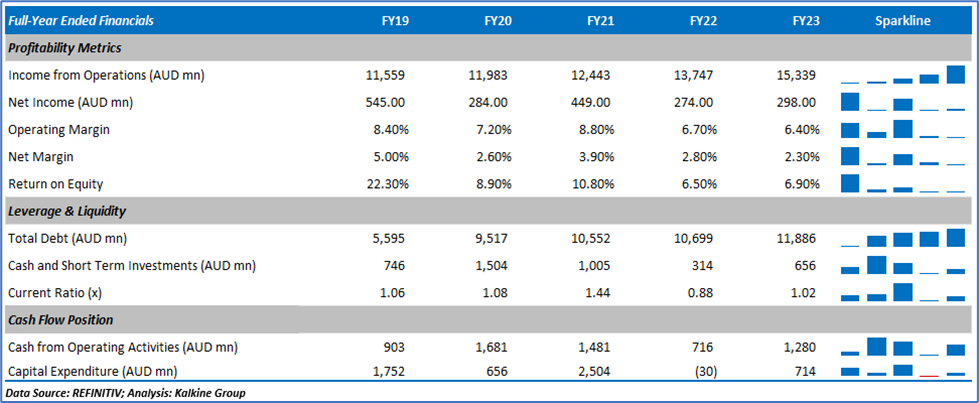

- In FY23, the company reported performance improvement across all its sectors, resulting in 11.58% growth in yearly revenue

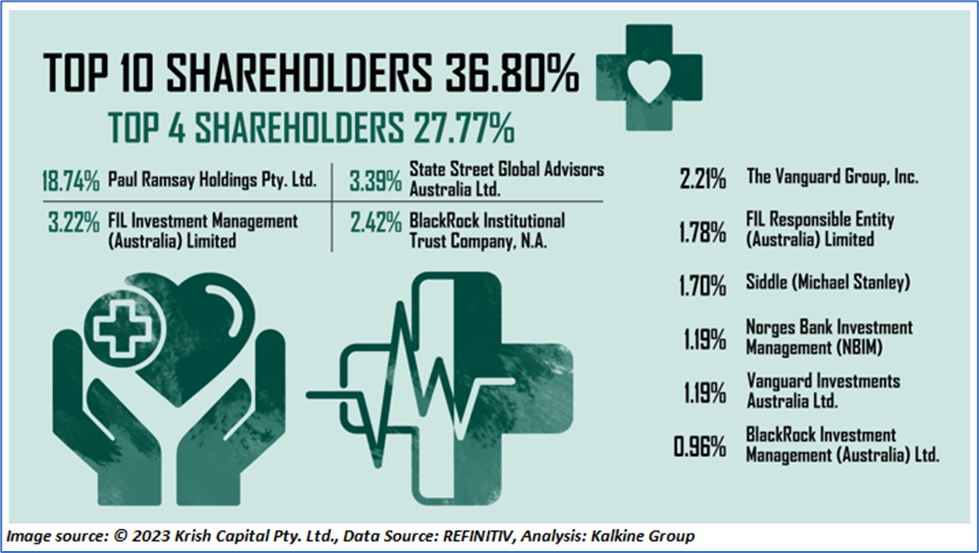

- Paul Ramsay Holdings Pty. Ltd. Has the highest stake in the firm, with a shareholding of almost 18.74%

Ramsay Health Care Limited (ASX:RHC) is an ASX-listed healthcare company which offers a variety of acute and primary healthcare services through its imaging centres, day surgery facilities, primary care clinics, private hospitals and pharmacies in Australia, the UK and many other countries.

In the financial year 2023 (FY23), the company witnessed recovery from the COVID-led disruptions of the past years, and its impact has been seen across all the regions of RHC. The period saw 14.6% YoY growth in earnings before interest and tax to AUD 1 billion.

Total revenue for the period stood at AUD 15,339.10 million, 11.58% higher than the previous corresponding period; the EBITDA stood at AUD 2,022.10 million, 10.49% higher than the previous year, and NPAT reached AUD 298.10 million, 8.80% higher than FY22.

Improvement across regions and the acquisition of GHP, smaller Nordics and Elysium underpinned the revenue growth.

Top 10 shareholders of RHC

The top 10 shareholders of RHC have nearly 36.80% shareholding in the company, while the top four have 27.77% shareholding in the firm. Paul Ramsay Holdings Pty. Ltd. and State Street Global Advisors Australia Ltd. Have the highest stake in the firm with a shareholding of ~18.74% and ~3.39%, respectively.

Recent business update

Through a recent update dated 10 October 2023, the company informed that its annual general meeting would happen on 28 November 2023 at the Sofitel Sydney Wentworth Hotel, Sydney, New South Wales, Australia.

In an ASX release dated 29 September 2023, the company shared that 262,844 shares issued under the dividend plan on 29 September 2023 would be quoted for trading.

Outlook

In FY24, the company expects to report volume and earnings growth in its Australian and UK business. The performance of Elysiuim is also anticipated to improve in FY24.

The company is directing its investment towards digital and data platforms to improve productivity and support future growth.

Share performance of RHC

RHC shares closed 1.48% up at AUD 51.51 apiece on 10 October 2023. Including today’s gain, RHC’s shares have lost 9.10% in the last 12 months and gained 4.60% in the last one month.

The 52-week high of RHC is AUD 69.66 apiece, recorded on 12 April 2023, and the 52-week low is AUD 46.76 apiece, recorded on 25 August 2023. Worth mentioning here is that RHC’s today’s closing price is 26.20% lower than its 52-week high.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 10 October 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.