Highlights

- Praemium provides financial planning tools, investment platforms and portfolio administration services

- The company witnessed 17% YOY growth in total revenue in the financial year 2023

- On Tuesday (17 October 2023), PPS shares closed 0.88% down at AUD 0.565 apiece

Praemium Limited (ASX:PPS) is an ASX-listed portfolio management company which offers financial planning tools, investment platforms and portfolio administration services, mainly to private wealth firms, some largest financial institutions and intermediaries. The company provides financial planning software licences and virtual managed accounts and administers the Australian managed account platform.

In the financial year 2023, the company registered a revenue growth of 17% YoY to AUD 74.3 million, backed by net inflows of AUD 1.4 billion, increased cash administration fee contribution and positive equity market valuations. The revenue growth comprises a 20.26% YOY rise in platform revenue and an 8.52% YOY surge in portfolio services revenue.

EBITDA during the period increased by 23% YoY to AUD 23.4 million, and statutory NPAT surged by almost 307% to AUD 15.2 million.

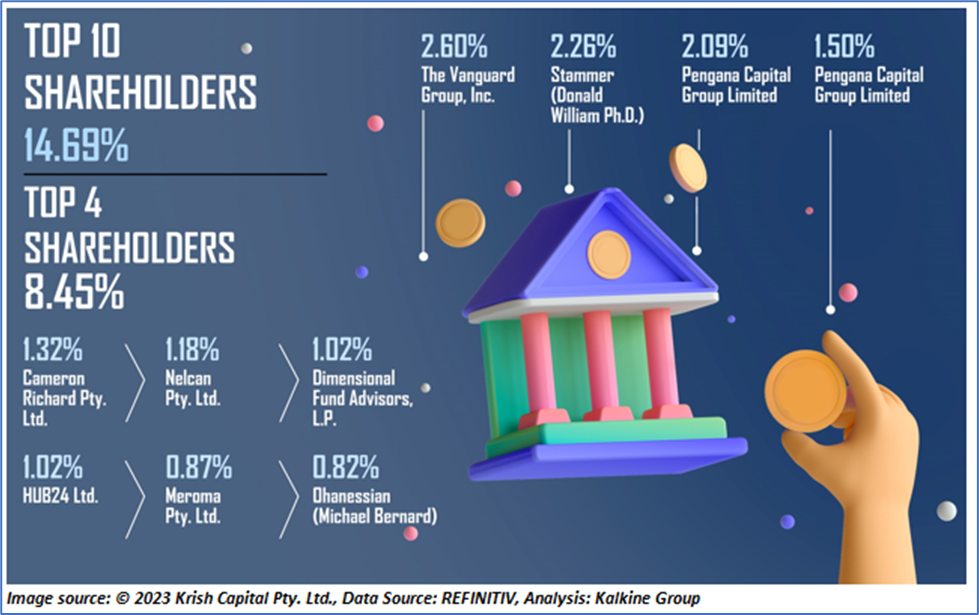

Top 10 shareholders of PPS

The top 10 shareholders of PPS have around 14.69% shareholding in the company, and the top four have nearly 8.45% shareholding. The Vanguard Group Inc. and Stammer (Donald William Ph.D.) have the highest stake in the firm, with a shareholding of ~2.60% and ~2.26%, respectively.

Recent business update

Through an ASX release dated 11 October 2023, the company announced the appointment of Rachel Axton as a company secretary, effective 11 October 2023.

An ASX filing dated 26 September 2023 informed that PPS had inked a new administration services agreement with Mercer Investments (Australia) Limited to use its Virtual managed account solution and administration services (VMAAS). Under this agreement, around 400 client portfolios would be administered by Praemium.

Outlook

Over the medium term, the company intends to grow its FUA by 10-15% annually.

Presently, the company is committed to taking advantage of current market opportunities like growth in demand for fixed-income assets, personalized services and diverse investment options to boost revenue growth.

Certain strategic initiatives are in progress, such as operational transformation, group-wide service enhancements, superannuation advances and acquisition opportunities.

Share performance of PPS

PPS shares closed 0.88% down at AUD 0.565 apiece on 17 October 2023. With this, PPS’ share price has witnessed a fall of 28.03% in the past nine months and a fall of 16.91% in the last one month.

The 52-week high of PPS is AUD 0.92, recorded on 11 November 2022, and the 52-week low is AUD 0.54 , recorded on 9 June 2023.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 17 October 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.