Highlights

- Pact Group provides packaging solutions in Australia catering to both industrial and consumer sectors

- Despite tightened economic conditions and softer demand, the company delivered revenue growth in FY23

- Geminder (Raphael) has nearly 49.76% shareholding in the company

Pact Group Holdings Limited (ASX:PGH) provides packaging solutions in Australia, catering to both industrial and consumer sectors. The company specializes in supplying and manufacturing metal packaging and rigid plastic. The company also offers materials handling solutions.

In the financial year 2023 (FY23), the company saw softer demand from Asia, tightened economic conditions and weather conditions across New Zealand and Australia. Despite this, the company delivered 6.04% YoY growth in revenue to AUD 1,949 million, driven by the recovery of costs and volume growth.

However, the underlying EBIT fell by 7.05% to AUD 145 million, and the underlying NPAT fell by 35.71% to AUD 45 million during the reported period due to increased costs like labour, and domestic supply chain.

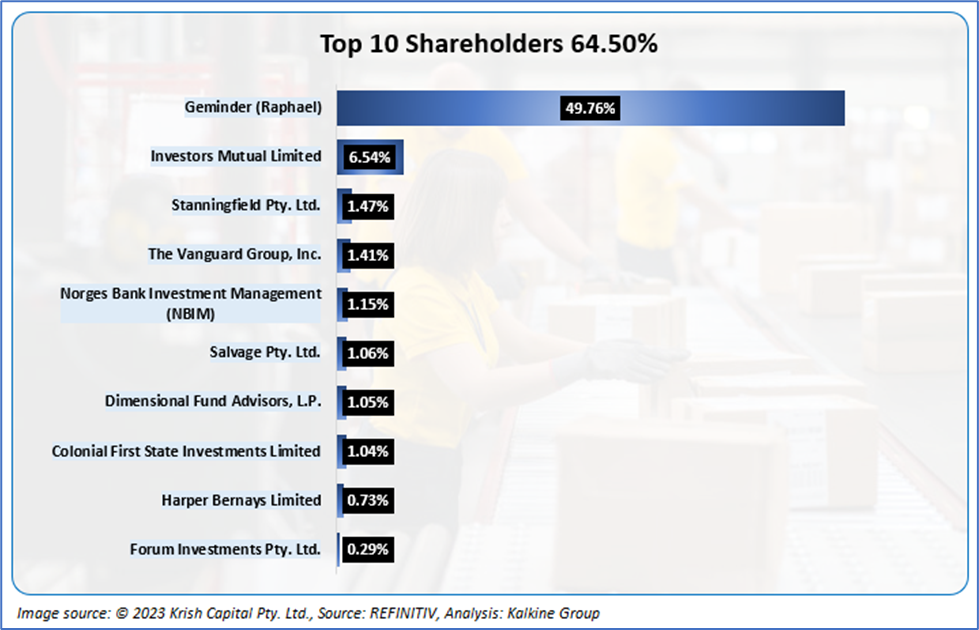

Top 10 shareholders of PGH

The top 10 shareholders of PGH together have around 64.50% shareholding in the company. The maximum stake is held by Geminder (Raphael), with a shareholding of approximately 49.76%.

Recent business update

Through an ASX filing dated 18 August 2023, the company informed that 497,967 unvested performance rights allotted to Sanjay Dayal (company’s director) in FY21 lapsed on 15 August 2023 because vesting conditions were not fulfilled.

On the same date, the company shared that 995,482 performance rights ceased on 15 August 2023 as exercising conditions were unmet.

Outlook

The company said it focuses on reducing costs because input costs remain elevated.

PGH informed that it is upgrading its packaging platforms with the intent to produce high-quality packaging that contains recycled content at an increased scale as desired by its customers like Aldi Australia and Woolworths Group.

The company is directing its investment towards new joint venture recycled manufacturing facilities in Laverton and Altona to ensure the availability of recycled resin. This is expected to add additional capacity.

Share performance of PGH

Shares of PGH closed 1.30% down at AUD 0.76 apiece on 22 August 2023 with a market capitalization of AUD 265.1 million. With this, in the past one year, the stock has recorded a fall of 54.35%, and in the last six months, it has fallen by 35.86%.

The 52-week high of PGH is AUD 1.800 apiece, recorded on 22 August 2022, and the 52-week low is AUD 0.545 apiece, recorded on 26 June 2023.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 22 August 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.