Highlights

- Lifestyle Communities is an ASX-listed company which develops, owns and manages affordable independent living residential land lease communities

- In 1HFY24, LIC’s revenue increased by 16% YoY while operating profit after tax fell by 17.5% YoY

- AustralianSuper has the maximum stake in LIC with a shareholding of around 14.77%

Lifestyle Communities Limited (ASX:LIC) is a Victoria-based real estate company which develops, owns and manages affordable independent living residential land lease communities.

In the first half of the financial year 2024 (1HFY24), annuity revenue of LIC surged by 16% YoY, driven by higher rental revenue from increased number of homes under management and the inflation linked 6.6% rental increase YoY.

Operating profit after tax during the period stood at AUD 20.8 million, compared to AUD 25.2 million over pcp. Operating profit after tax fell in 1HFY24 due to fewer home settlements and an increase in pre-sales and marketing costs for upcoming projects yet to begin settlements.

Value of total assets in 1HFY24 increased by 32.9% YoY to AUD 1,440.7 million.

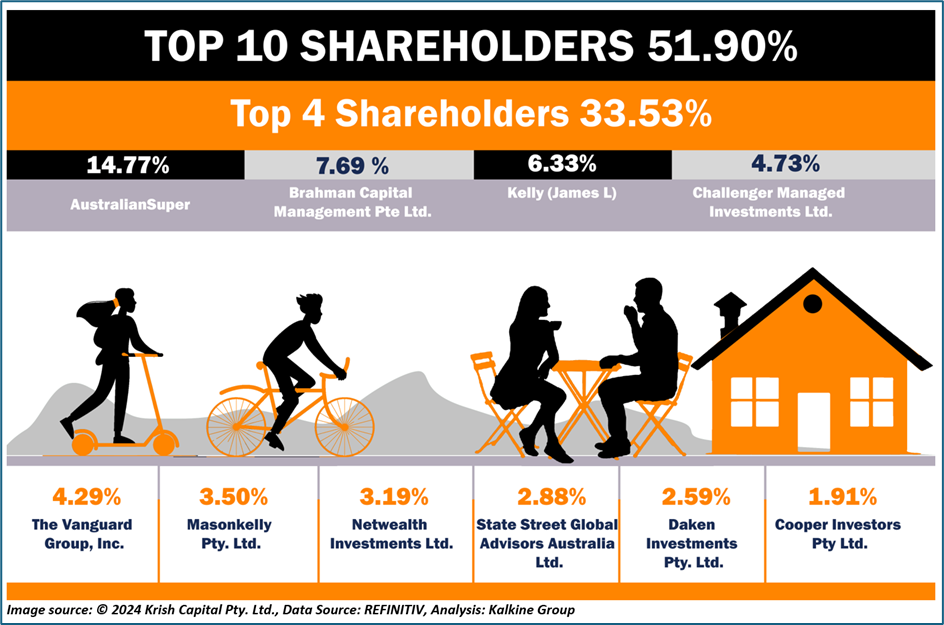

Top 10 shareholders of LIC

The top 10 shareholders of LIC have nearly 51.90% shareholding in the company. AustralianSuper and Brahman Capital Management Pte Ltd. have the maximum stake in the firm with a shareholding of around 14.77% and 7.69%, respectively.

Recent business update

Through an ASX-filing dated 18 July 2024, the company informed that it expects its operating profit after tax to fall in the range of AUD 52.4 - 53.4 million in FY24, compared to AUD 71.1 million recorded in FY23.

In FY24, new home settlements stood at 311, comparable to 356 in FY23.

The company withdrew all previously provided outlooks, citing challenges in evaluating the potential impact of recent media coverage uncertainty on future settlements and sales. Recent media focus on exit fees has overshadowed the company’s homes’ lower entry prices and additional benefits.

On 13 August 2024, the company is expected to release its FY24 results.

Outlook

Prime focus of LIC is on enhancing its annuity income stream by managing and expanding residential lease communities. The commitment is to develop new communities and expand the current communities to address the increasing demand.

An increased number of land buying opportunities is under assessment.

Through 1HFY24 results update, the company informed that it has ten projects in active development, the highest number in its history. Moreover, two additional projects are expected to be launched in 2004.

Share performance of LIC

LIC shares closed 0.63% lower at AUD 9.39 apiece on 29 July 2024. In the last one year, LIC’s share price has dropped by almost 45.78%, while in the last six months, it has declined by nearly 46.09%.

52-week high of LIC is AUD 19.070, recorded on 15 December 2024, and 52-week low is AUD 9.080, recorded on 19 July 2024.

LIC Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 29 July 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.