Highlights

- JB Hi-Fi Limited (ASX:JBH) operates through three divisions--JB Hi-Fi Australia, JB Hi-Fi New Zealand, and The Good Guys

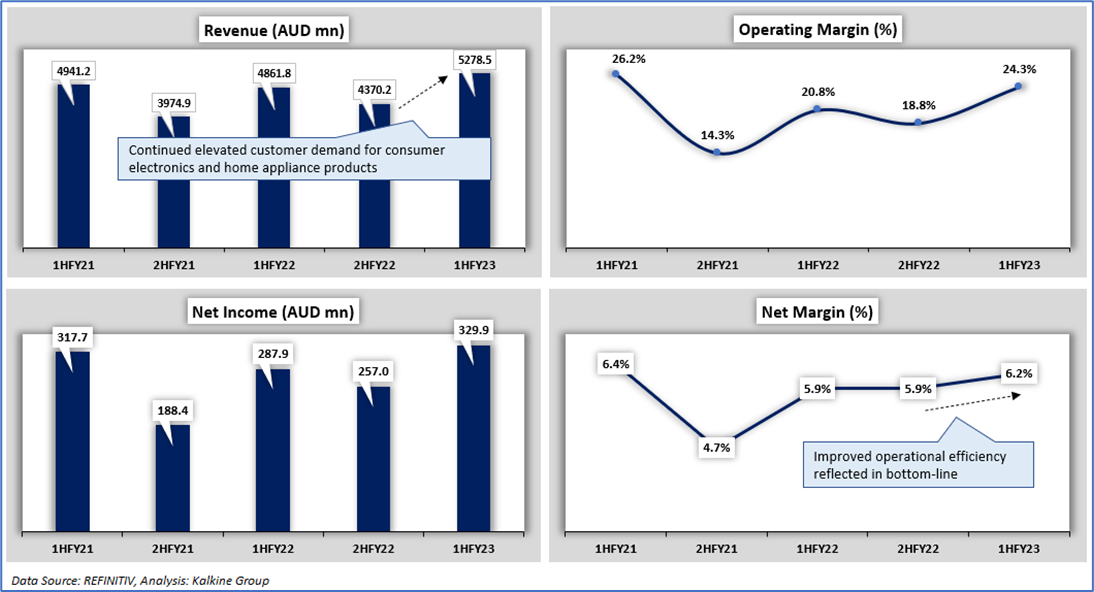

- For the first half of FY23, JBH's total revenue grew by 8.6% annually to AUD 5,278.5 million, while its net profit surged by 14.6% to AUD 329.9 million

- JBH shares closed 0.143% lower at AUD 41.680 apiece on Friday (23 June 2023)

Australia-based specialty retailer JB Hi-Fi Limited (ASX:JBH) operates through three divisions--JB Hi-Fi Australia, JB Hi-Fi New Zealand, and The Good Guys. For the three months through 31 March 2023, JB Hi-Fi Australia sales declined by 0.1% year-on-year (yoy), JB Hi-Fi New Zealand sales went up 10.8%, while The Good Guys reported a 3.8% decline in sales.

However, on a year-to-date (YTD) basis, JB Hi-Fi Australia sales surged by 5.8%, JB Hi-Fi New Zealand sales went up by 14.5%, and The Good Guys sales climbed by 3.8%. Compared to FY19, FY23 YTD sales for JB Hi-Fi Australia were up 38.6%; for JB Hi-Fi New Zealand, it was higher by 24.2%, and for The Good Guys, it was higher by 32.1%. These figures indicate sales have jumped significantly compared to the pre-COVID level.

However, the ASX-listed retailer that provides technology solutions, consumer electronics, and home appliances said growth has moderated from the peak levels witnessed in 1HFY23.

JBH has achieved sales momentum despite a significant interest rate jump over the last year. However, it could be difficult for the speciality retailer to maintain this revenue growth, given that rising interest rates have impacted the discretionary spending and purchasing power of an average Australian.

For the first half of FY23, JBH's total revenue grew 8.6% annually to AUD 5,278.5 million, while its net profit surged 14.6% to AUD 329.9 million. However, one should not forget that the first half of the year was marked by elevated customer demand, and promotional offers from retailers during Black Friday and Boxing Day also helped boost sales. Here is how JBH's sales, net profit and margins have fared since 1HFY21:

JBH Share Price Performance

JBH shares closed 0.143% lower at AUD 41.680 apiece on Friday (23 June 2023). With today's loss, the stock has corrected nearly 5.53% in a month, but it is almost flat on a year-to-date basis. The stock hit a 52-week high of AUD 49.720 on 17 January 2023 and a 52-week low of AUD 37.520 on 3 October 2022.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 23 June 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.