Highlights

- IMDEX is an ASX-listed mining-tech firm that offers drilling optimization products

- IMDEX has acquired Devico and invested in Krux Analytics in the financial year 2023

- Recently, the company has announced a fully franked dividend of 21cps

IMDEX Limited (ASX:IMD) is a mining-tech company offering a broad range of drilling optimization products like real-time data, analytics, and rock knowledge sensors. IMD’s offerings are directed towards resource companies and drilling contractors.

During the financial year 2023 (FY23), the company acquired Devico and invested in Krux Analytics. Including Devico’s business (four months), IMD recorded a 20% YoY jump in total revenue to AUD 411.4 million, while excluding Devico, the revenue grew by 14% YoY.

During the reported period, net profit after tax dropped by 22% YoY to AUD 35 million, on account of one-off expenses on acquisitions and integration..

While sharing the full-year results for FY23, the company announced a final dividend of 2.1cps (cents per share), aligned with the 30% NPAT payout ratio on normalized earnings. The record date for the fully franked dividend is 28 September 2023, and the pay date is 12 October 2023.

Recent business update

Through a recent update dated 25 July 2023, the company announced that L1 Capital Pty Ltd has increased its interest in IMD to 14.43% as of 21 July 2023. Earlier, L1 Capital had 13.2% stake in IMD as on 1 June 023.

Outlook

The company informed that demand for its integrated product offering is steady, while the exploration activity is forecasted to contract by 20% in the calendar year 2023, and S&P expects the exploration budget to increase in the calendar year 2024.

IMD said that the long-term drivers for the industry are robust as drilling contractors and resource companies are continuously embracing innovation and new technologies to achieve greater productivity, enable remote working and enhance safety. Also, discoveries are expected to be undercover and at depth, leading to larger drilling programs. The company is well-positioned to leverage the robust industry fundamentals.

IMDEX is also pursuing new growth opportunities through its software offering and IMT business.

IMD share performance

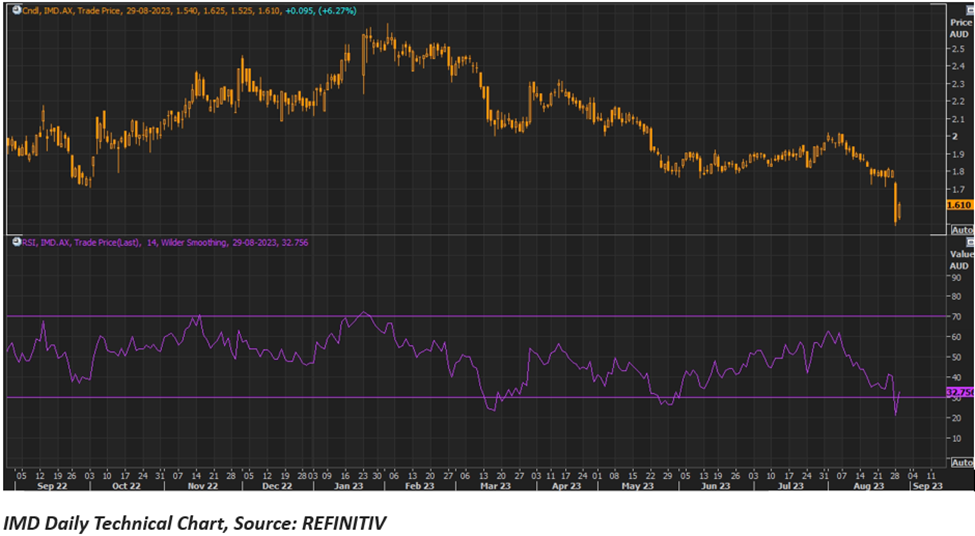

IMD shares closed 6.27% up at AUD 1.61 apiece on 29 August 2023. Including this gain, IMD shares recorded a fall of 15.04% in the past 12 months and recorded a drop of 24.63% in the past nine months.

The 52-week high of IMD is AUD 2.640 apiece, recorded on 2 February 2023 and the 52-week low is AUD 1.490 apiece, recorded on 28 August 2023. Worth mentioning here is that the existing share price is almost 40% lower than its 52-week high.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 29 August 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.