Highlights

- Australian Clinical Labs is an Australian pathology service provider with operations across the nation, except for Tasmania

- In FY23, ACL’s total revenue fell by nearly 30% YoY to AUD 697.1 million

- The company plans to focus on opening new collection centres and drive excellence in patient care

Australian Clinical Labs Limited (ASX:ACL) is a private provider of pathology services in Australia. The company offers a range of pathology tests through its NATA-accredited laboratories every year. The company caters to the needs of corporate clients, hospitals, patients, specialists and doctors.

ACL operates pathology collection centres and laboratories in all Australian territories and states except for Tasmania.

Financial year 2023 was a difficult year for the firm as it witnessed a fall in total profit and revenue. During the reported period, total revenue has declined by almost 30% YoY to AUD 697.1 million, while the non-COVID revenue has increased by 11.3% YoY to AUD 619.5 million. Medlab, which was acquired in 2021, significantly contributed to the yearly revenue of the company.

In FY23, net profit after tax fell by almost 80% YoY to AUD 35.9 million.

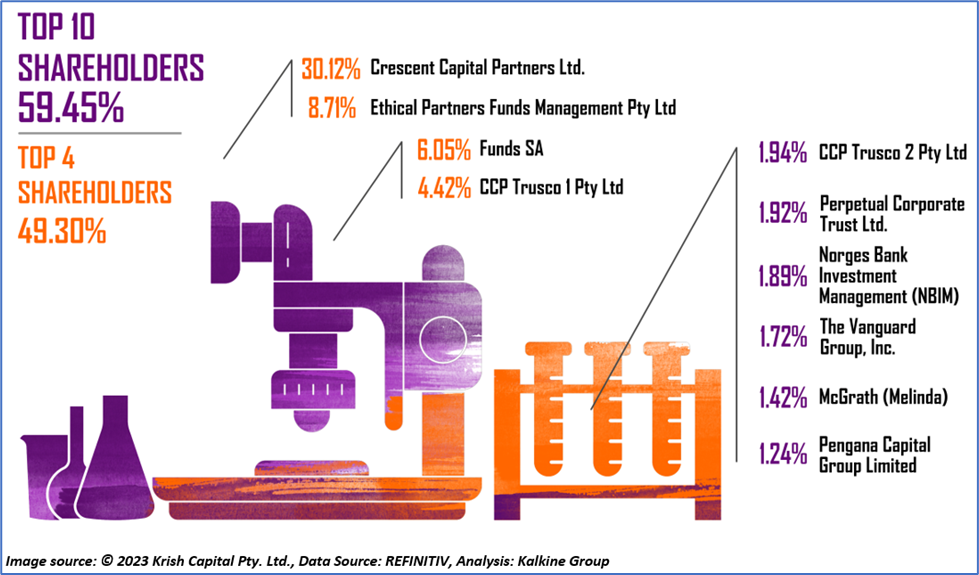

Top 10 shareholders of ACL

The top 10 shareholders of ACL have around 60% shareholding in the company, while the top four having 49.30% shareholding. Crescent Capital Partners Ltd. and Ethical Partners Funds Management Pty Ltd have the highest interest in the firm, with a shareholding of ~30.12% and ~8.71%, respectively.

Recent business update

Through an ASX update dated 22 September 2023, the company informed that in April 2023, it had proposed to buy all shares on issue in Healius Limited.

The ASX filing highlighted that further information required by the Australian Competition and Consumer Commission is pending, due to which the final decision on the proposal is expected to be delayed. The offer is open until 17 November 2023.

Outlook

In FY24, the company expects to register an EBIT of AUD 65-70 million. During FY24, the company says will focus on achieving above-market revenue growth and achieving operational efficiencies.

In FY24, the company intends to open new approved collection centres, drive excellence in patient care centres, undertake new initiatives and implement identified cost reduction and operational efficiencies.

Share performance of ACL

ACL shares closed 1.45% down at AUD 2.72 apiece on 11 October 2023. Including this, ACL’s share price has recorded a fall of 20.70% in the past 12 months and a decline of 23.81% in the past six months.

The 52-week high of ACL is AUD 3.87 apiece, recorded on 22 March 2023, and the 52-week low is AUD 2.68 apiece, recorded on 4 October 2023.

ACL Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 11 October 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.