Highlights

- GPT owns, manages and develops office, logistics and retail properties in Australia

- Net profit dropped by 67% in FY22 due to negative investment property movement

- The group expects funds from operations to reach 31.3 cents in FY23, and distribution is expected at 25.0 cents

GPT Group (ASX:GPT) is a vertically integrated diversified property group that owns and manages office, retail assets and logistics across Australia. The company recorded a double-digit increase in funds from operations (FFO) in the financial year (FY22) as it reached AUD 620.6 million, while portfolio occupancy reached 97.5% at December 2022 end.

Net profit in FY22 dropped by 67% to AUD 469.3 million over the previous corresponding period due to negative investment property movements. During the reported period, the company focused on growing its funds under management, growing income from its diversified portfolio and maintaining a prudent approach to capital management.

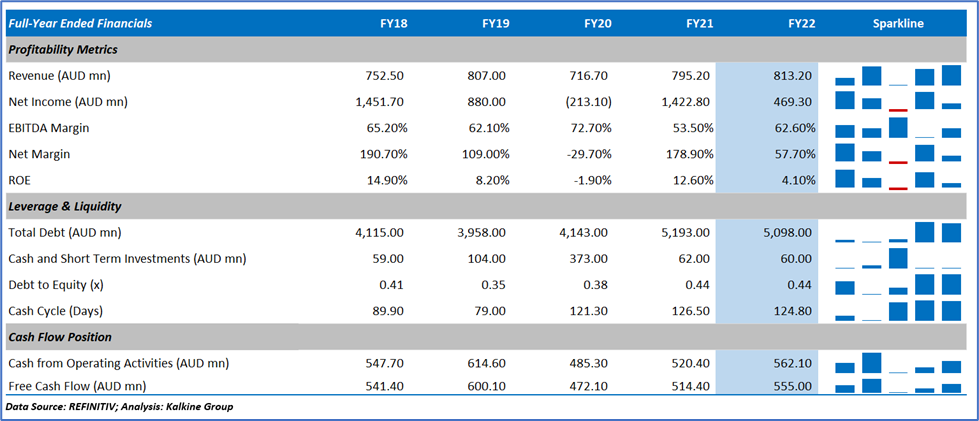

Here’s the historical financial trend of GPT:

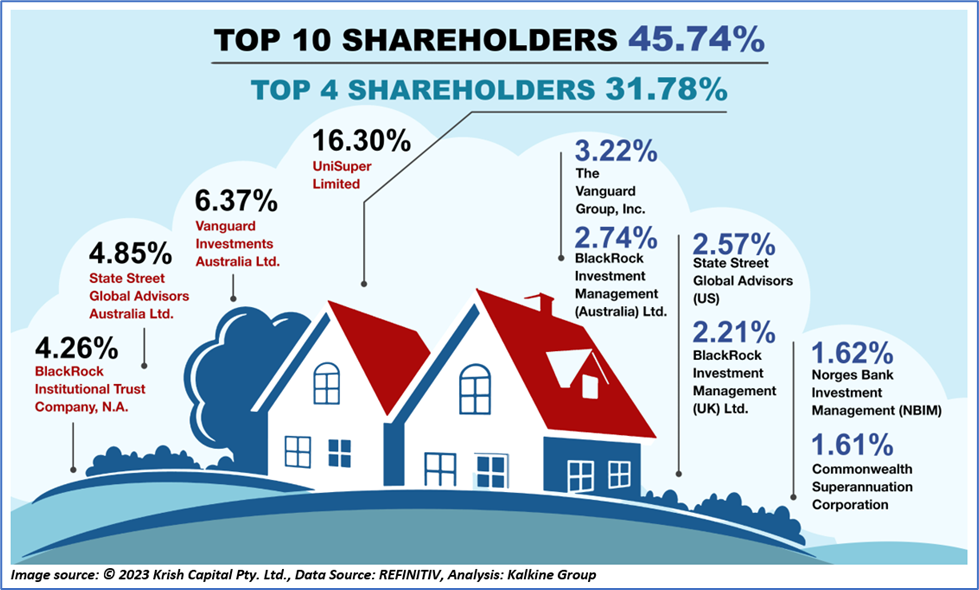

Top 10 shareholders of GPT

The top 10 shareholders of GPT form around 45.74% of the company’s total shareholding, while the top four shareholders have 31.78% stake in the company. The maximum stake is held by UniSuper Limited and Vanguard Investments Australia Ltd., with a shareholding of approximately 16.30% and 6.37%, respectively.

Recent business update

In the ASX update dated 16 June 2023, GPT announced a dividend of AUD 0.125 per ordinary stapled security with an ex-date of 29 June 2023 and a pay date of 31 August 2023. The dividend announced is 100% unfranked. In the same release, GPT informed that its interim results are due in mid-August 2023.

The company released its operational update for the March 2023 quarter—the group maintained occupancy at 97.6% across the diversified portfolio during the period. In March-end, the office portfolio occupancy was 88%, logistics portfolio occupancy was 99.5%, and retail portfolio occupancy was 99.4%.

Outlook

The property group said it is focused on taking advantage of opportunities arising from the demand for innovative workplace products, continuing leasing momentum, development pipeline in the logistics space, low vacancy and limited uncommitted supply.

In FY23, the company expects to record funds from operations of approximately 31.3 cents per security, and the expected distribution is 25.0 cents per security.

By the end of FY23, the group expects office portfolio occupancy to hit over 90%.

GPT share price performance

GPT shares closed 3.07% up at AUD 4.370 apiece on 27 July 2023 with a market capitalization of AUD 8.12 billion. In the last 12 months, the stock price has dropped by 2.02% and in six months, it has decreased by 4.79%.

The 52-week high of GPT is AUD 4.77, recorded on 3 February 2023, which is 8.29% higher than today’s stock price. The 52-week low is AUD 3.68, recorded on 28 September 2023, which is 18.75% lower than the current stock price.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 27 July 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.