Highlights

- Cromwell Property Group (ASX:CMW), a real estate investor and fund manager having operations spread across three continents

- The company has three primary segments: Funds and asset management, Co-investments, and Investment portfolio

- On 3 July 2023, the company announced it entered into a binding agreement to create a joint venture with Hong Kong-based asset manager Value Partners Group

Cromwell Property Group (ASX:CMW), a real estate investor and fund manager, having operations spread across three continents, has been selling its non-core assets as a strategic move to turn capital-light. The company believes the move will help it reduce its leverage in a scenario where interest rates are rising. The company has three primary segments: Funds and asset management, Co-investments, and Investment portfolio. The Funds management segment represents activities concerning establishing and managing external funds for institutional and retail investors.

On 3 July 2023, the company announced it entered into a binding agreement to create a joint venture with Hong Kong-based asset manager Value Partners Group, exchanging on the sale of a 50% stake in the Cromwell Italy Urban Logistics Fund assets. The fund consists of seven properties, which are 100% leased to DHL and are situated in seven prime logistics submarkets in Italy.

The transaction happened on a portfolio asset value of €55.8mn (at 100%), 9.4% higher than the initial purchase price of Cromwell. Settlement of this transaction is expected in late July 2023, with Cromwell’s European operations team set to continue to manage the portfolio. The company said this transaction will reposition it as a capital-light fund manager. The Italian assets were identified as non-core to Cromwell’s business in 2022 and, as a result, CMW actively marketed the assets for sale or co-investment.

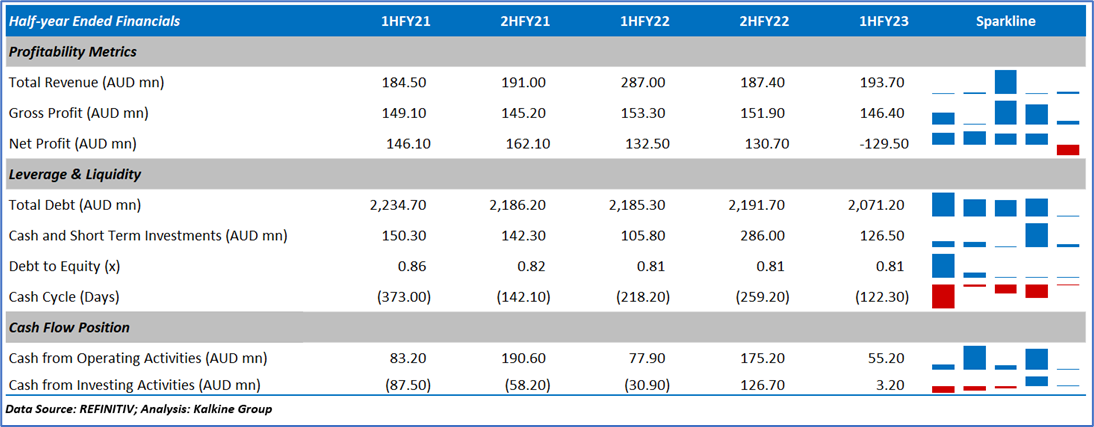

For the first half ending 31 December 2022, CMW reported a 32.51% year-on-year decline in its revenue at AUD 193.70 million. This decline in revenue was primarily because of the fall in income from the company's investment portfolio as the company continues to dispose of its non-core assets.

In its FY23 outlook, the company said it would continue its non-core asset sale programme and use the proceeds to repay debts to reduce risks in a rising interest rate scenario. Meanwhile, the company may also look for suitable opportunities to take the Australian asset portfolio off the balance sheet and reallocate capital for appropriate growth opportunities, which continues to underpin CMW's strategy of moving to a capital-light fund manager. The company aims to reduce its gearing to a 30-40% target range.

Top 10 Shareholders

The top 10 shareholders of the company together hold around 53.13% stake in the company. ARA Real Estate Investors XXI Pte. Ltd. and Tang (Gordon) hold maximum stakes in the company at 23.57% and 7.18%, respectively. Here are other large shareholders in the company.

CMW Share Price Performance

CMW shares closed 1.77% lower at AUD 0.555 on Thursday (6 July 2023). The stock has witnessed a decline of around 18.38% in the last six months, and over the last 12 months, it has declined by nearly 29.75%. The stock has a 52-week low and 52-week high of AUD 0.500 and AUD 0.850, respectively and is currently trading below the 52-week high-low average.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 06 July 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.