Highlights

- The High Court of Justice in the United Kingdom approved the proposed takeover of Tulla Resources Plc (ASX:TUL) on 23 June 2023

- PNR is a gold producer having operations in Western Australia

- For the half-year ending 31 December 2022, the company reported a net loss of AUD 44.97 million compared to a net profit of AUD 477,500 in the year-ago period

Pantoro Limited (ASX:PNR) on Monday (26 June 2023) announced that the High Court of Justice in the United Kingdom approved the proposed takeover of Tulla Resources Plc (ASX:TUL) on 23 June 2023.

As part of the scheme, Tulla share and CDI holders will receive 4.9578 ordinary shares of PNR for every Tulla CDI and Tulla share held by them. New Pantoro shares commenced trading on ASX on 26 June 2023. Worth mentioning here is that the takeover scheme will be implemented on 30 June 2023, with new Pantoro Shares being quoted on ASX and commencing normal settlement trading at 10:00 am AEST on 3 July 2023.

PNR is a gold producer having operations in Western Australia. The company operates its fully-owned Halls Creek Gold Project and 50%-owned Norseman Gold Project in the region. PNR also owns the only commercial-scale gold processing facility in the Kimberley region of Western Australia.

For the half-year ending 31 December 2022, the company reported a net loss of AUD 44.97 million compared to a net profit of AUD 477,500 in the year-ago period. Meanwhile, its revenue increased by 9% annually to AUD 45.4 million in 1HFY23.

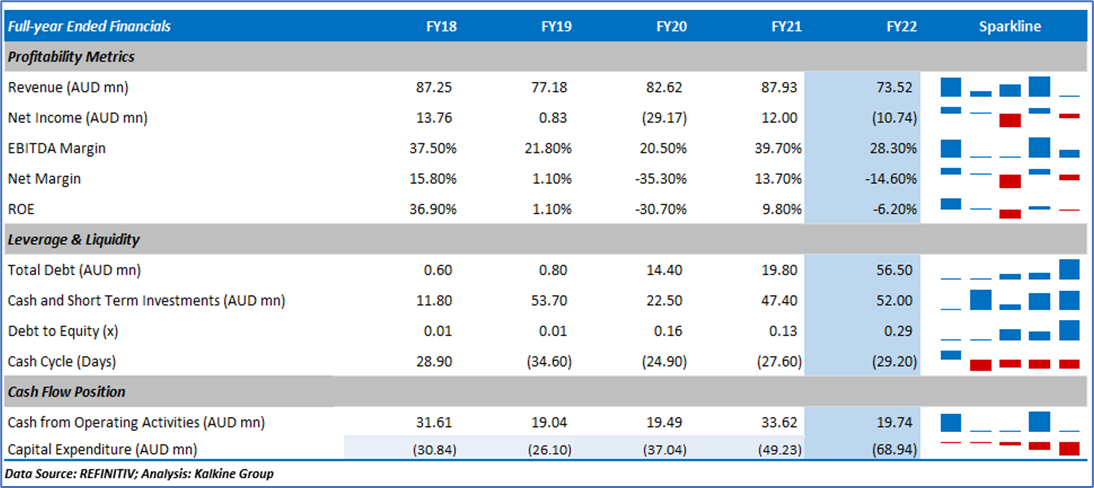

During 1HFY23, its new gold plant, with an annual capacity of 1 million tonnes, commenced production. Meanwhile, production from the Norseman Gold Project stood at 7,543 ounces, while production from the Halls Creek Project reached 14,180 ounces. Here is a look at its historical financial metrics:

PNR Outlook

The company is focused on completing the proposed acquisition of Tulla Resources Plc to create a significant gold producer in the Western Australian region. PNR targets to achieve an annual production capacity of 110,000 ounces in FY24.

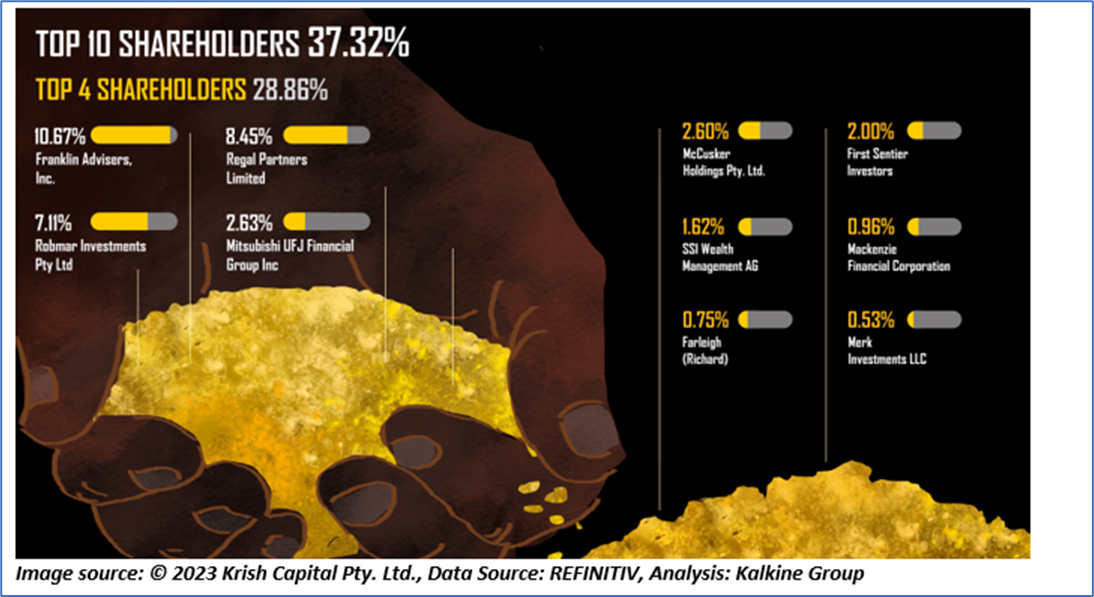

Top 10 Shareholders

The top 10 shareholders of PNR together hold around 37.32% stake in the company. Franklin Advisers, Inc. and Regal Partners Limited hold maximum stakes in the company at 10.67% and ~8.45%, respectively. Here are the other large shareholders in the company:

PNR Share Price Performance

The stock price has gone down by around 22.22% in the last six months, and over the last one year, stock prices went down by nearly 65%. The stock has a 52-week low and 52-week high of AUD 0.048 and AUD 0.230, respectively, and is currently trading below the mid-range of the 52-week-high-low levels.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 27 June 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.