Highlights

- Coles is an Australian retailer that manages over 2,500 retail outlets nationally

- In FY23, the company opened its first automated distribution centre and divested its Coles Express business

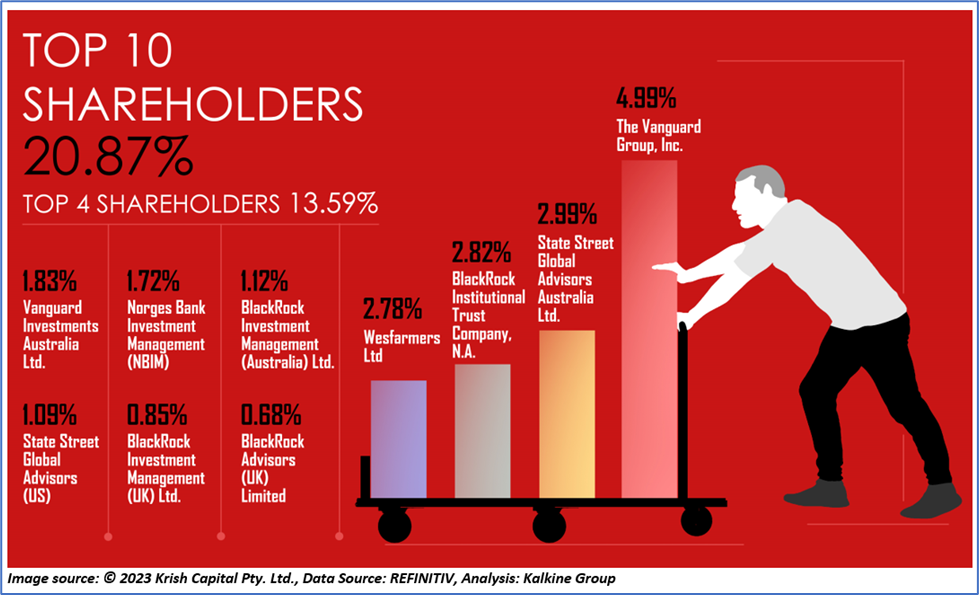

- The Vanguard Group, Inc. has the highest stake in the firm with a shareholding of nearly 4.99%

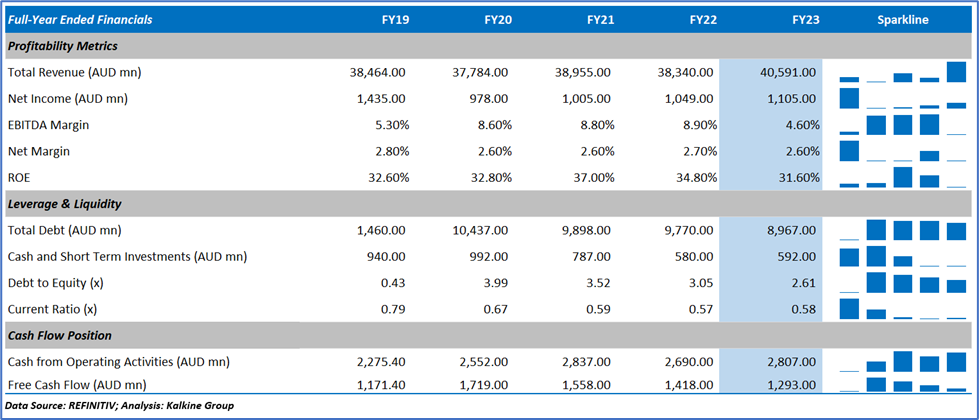

Coles Group Limited (ASX:COL) is a retailing company operating around 1,800 supermarkets and liquor stores. The company primarily deals in fresh food, groceries, general merchandise, liquor, and financial services. The Australian retailer reported a 6% YoY jump in the group sales revenue to AUD 40,483 million during the financial year 2023 (FY23). The period saw a 3.8% YoY increase in EBITDA to AUD 3,382 million, and the supermarket sales revenue increased by 6.1% YoY to AUD 36,746 million.

During FY23, the company opened its first automated distribution centre and also refreshed or opened over 300 stores and divested its Coles Express business.

The smarter selling program led to the achievement of AUD 1 billion in benefits in FY23.

Here’s the historical financial performance of COL:

Top 10 shareholders of COL

The top 10 shareholders of COL together have around 20.87% shareholding in the company, while the top four shareholders have approximately 13.59% shareholding. The Vanguard Group, Inc. and State Street Global Advisors Australia Ltd. have the highest stake in the company with shareholdings of ~4.99% and ~2.99%, respectively.

Recent business update

On 18 August 2023, the company shared a CFC (customer fulfilment centre) project update through an ASX announcement. The company informed about the notification received from Ocado Group plc regarding the delay in timing for the hand over the Victorian CFC.

The incremental ramp-up of the Victorian CFC is anticipated to commence in mid-FY25, which was earlier planned for mid-FY24.

Outlook

Coles is focused on bringing innovation across the breadth of its brand portfolio to meet customer demands. The plan is to continuously invest in its digital and physical footprint.

The company aims to open around 15 new stores, renew 50 stores and close six stores under the supermarkets segment. While under the liquor segment, the company intends to open nearly 20 new stores, restoring over 100 stores and closing six stores.

The focus remains on improving productivity, launching new automated CFCs and delivering a consistent customer experience.

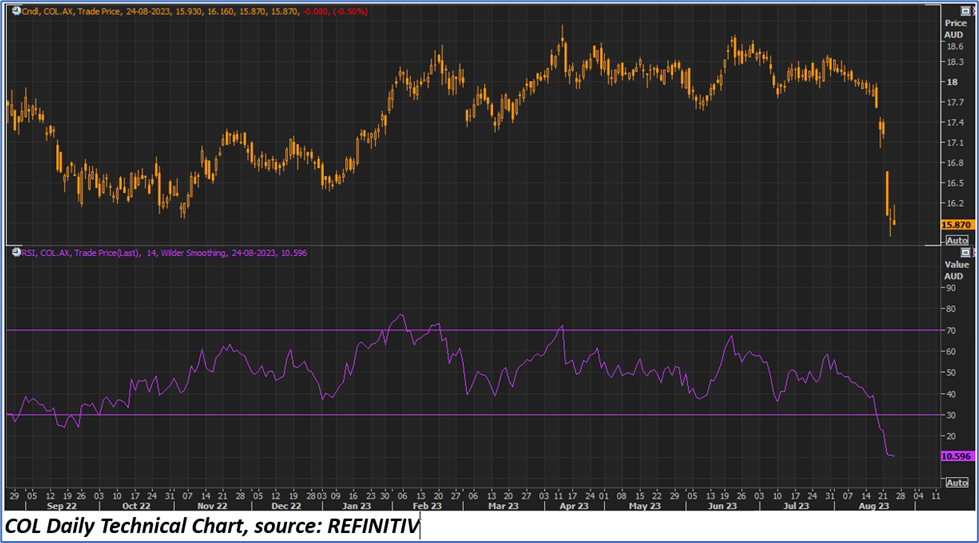

Share performance of COL

Coles shares closed 0.50% down at AUD 15.87 apiece on 24 August 2023 with a market capitalisation of AUD 21.34 billion. With this, in the past one year, the share price has dropped by almost 11.04% and on a year-to-date basis, the share price has declined by 5.08%.

The 52-week high of Coles is AUD 19.395 apiece, recorded on 22 August 2022, while the 52-week low is AUD 15.7 apiece, recorded on 23 August 2023. The existing share price is 1.08% higher than its 52-week low.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, is 24 August 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.