Highlights

- Champion Iron’s majority of the project lies within the southern Labrador Trough, Canada’s largest source of iron ore

- Champion Iron’s net profit dropped by 62% in FY23 over the previous corresponding year

- O’Keeffe (William Michael) has the highest stake in the company, with a shareholding of nearly 8.71%

Champion Iron Limited (ASX:CIA) is a dual-listed company listed on both ASX and TSX. Champion Iron can also be traded on the OTCQX under the ticker “CIAFF”. Champion Iron is an iron ore exploration and development firm with most of the project located in the southern Labrador Trough, which is known as the largest source of iron ore in Canada.

The company’s flagship projects are Bloom Lake, Consolidated Fire Lake North iron ore, and Kamistiatusset.

Champion Iron registered a net profit attributable to members of CAD 200.7 million in FY23 (ended 31 March 2023), 62% lower than the previous year. During the stated period, revenue from ordinary activities fell by 4% to CAD 1395 million, and EBITDA dropped by 47% to CAD 493.2 million.

Despite the fall in the yearly net profit, the company announced a semi-annual dividend of CAD 0.100 apiece with ex-date 13 June 2023 and pay date 5 July 2023.

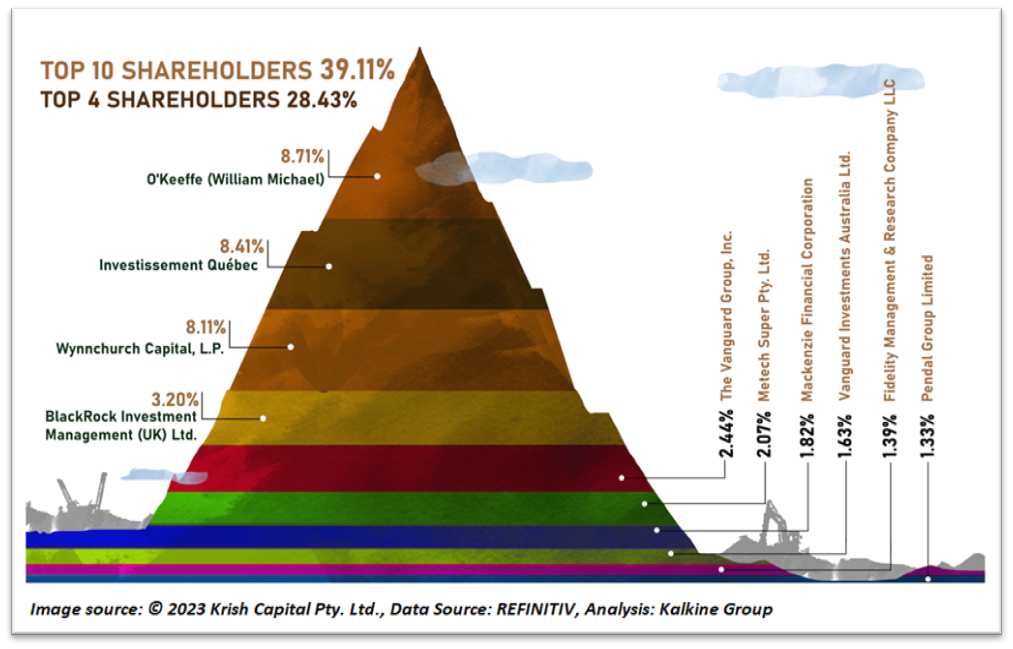

Top 10 shareholders of CIA

The top 10 shareholders of CIA in total have around 39.11% stake in the company, while the top four shareholders have around 28.43% stake. O’Keeffe (William Michael) and Investissement Québec have the maximum stake in the firm with a shareholding of nearly 8.71% and 8.41%, respectively.

Recent business update

The largest publicly listed pure-play high-grade iron ore producer, Champion Iron, registered 3.4 million wet metric tonnes (wmt) of iron ore production, a 49% YoY jump during the first quarter of the financial year 2024 (1QFY24). The company generated revenue of CAD 297 million during the latest quarter.

The quarter witnessed lower iron prices because of decelerating economic growth in China and weakness in steel mill profitability.

Notwithstanding, the sales of inventories of approximately 1.3wmt is expected to improve liquidity positions in the coming quarters.

Outlook

The CIA’s project proposes to generate DRPF (direct reduction pellet feed) with a quality of up to 69% Fe. The company informed that the global demand for DR (direct reduction) iron ore is anticipated to be at a deficit of over 100Mtpa by 2031.

CIA expects gradual improvement in its liquidity position following the sales of inventories as rollingstock capacity surges in the upcoming quarters. With this development, the company expects to have sufficient liquidity to pursue a growth trajectory.

The company is continuously assessing the organic growth opportunities, which includes a feasibility study of the Kamistiatusset and a feasibility study examining the re-commissioning of the Ponte-Noire Iron ore Pelletizing facility and evaluate its ability to generate DR (Direct Reduction) grade pellets. Both feasibility studies are expected to be concluded by the second half of 2023.

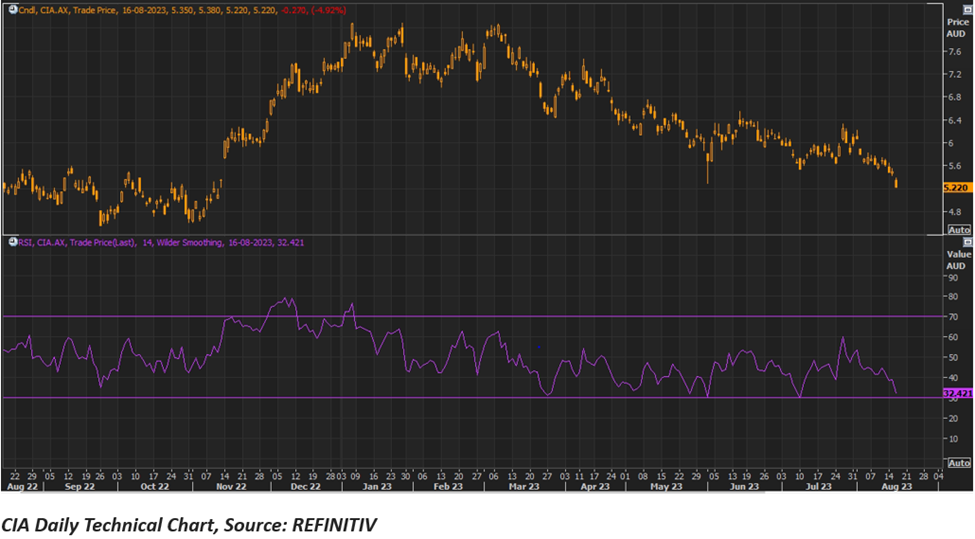

Share performance of CIA

CIA shares closed 4.92% lower at AUD 5.220 apiece on 16 August 2023 with a market capitalization of AUD 2.83 billion. Including today’s share price movement, CIA shares recorded a rise of 0.58% in the last one year and a fall of 28.59% in the last six months.

The 52-week high of CIA is AUD 8.08 apiece, recorded on 27 January 2023, and the 52-week low is AUD 4.55 apiece, recorded on 26 September 2022.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 16 August 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.