Highlights

- Australian Vintage is a wine making, marketing and vineyard management services company

- In FY23, the company focused on gaining market share and enhancing the company’s mix of higher margin business

- Allan Gray Australia Pty Ltd has the highest stake in the firm with a shareholding of ~21.76%

Australian Vintage Limited (ASX:AVG) is an ASX listed food and beverage company which is primarily engaged in wine making, wine marketing and vineyard management related activities. Headquartered in South Australia, the company manages a portfolio of global brands and owns and operates vineyards and wineries in multiple wine producing regions across Australia.

In the financial year 2023 (FY23), the company maintained its revenue in-line with the previous year and cash & cash equivalents increased by 176% YoY to AUD 6.9 million.

During the reported period, the focus was on capturing market share and enhancing the company’s mix of higher margin business.

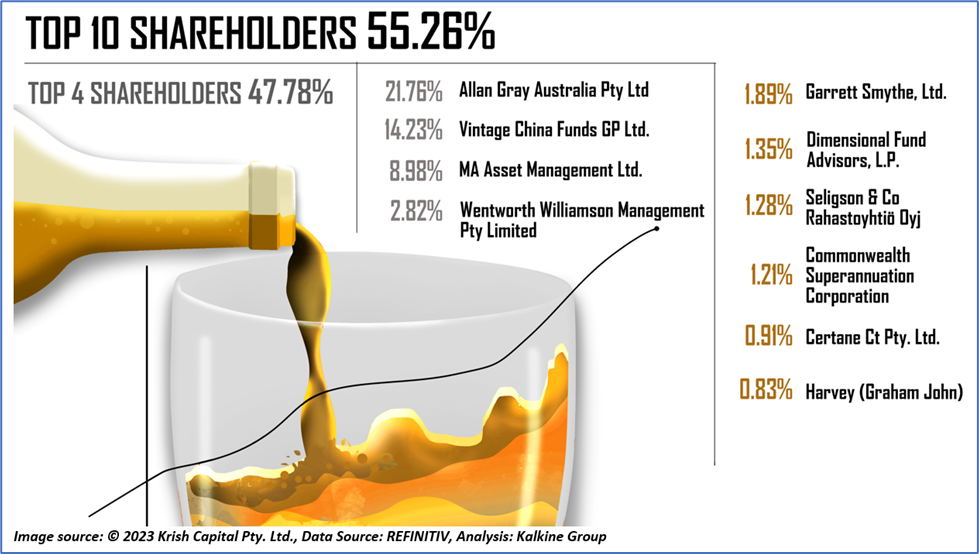

Top 10 shareholders of AVG

The top 10 shareholders of AVG have around 55.26% shareholding in the company, while the top four have nearly 47.78% stake in the firm. Allan Gray Australia Pty Ltd and Vintage China Funds GP Ltd. have the maximum stakes in the firm, with a shareholding of ~21.76% and ~14.23%, respectively.

Recent business update

On 20 October 2023, the company informed the market that its annual general meeting would take place on 22 November 2023.

Through an ASX filing dated 3 July 2023, the company shared an update about the commencement of a strategic review with an aim to unlock value with the consideration of available financial, business and strategic alternatives.

Outlook

In FY24, the company expects to see improvement in underlying EBITDAS and NPATS, in comparison to FY23.

In July 2023, the company registered a 16% YoY increase in sales, backed by improved performance in the UK and emerging markets along with focus on innovation.

AVG intends to explore alternatives to unlock further value through industry opportunities. Also, the company anticipates future upside from opportunities in China and rest of Asia.

Moreover, the company is focused onpremiumisation, marketing, innovation and people.

Share performance of AVG

AVG shares closed 2.41% down at AUD 0.405 apiece on 26 October 2023. With this, AVG shares lost 36.72% in the past 12 months and gained 6.58% in the last one month.

The 52-week high of AVG is AUD 0.695 apiece, recorded on 17 November 2022, and the 52-week low is AUD 0.345 apiece, recorded on 25 September 2023.

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 26 October 2023. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.