Highlights

- Ansell produces personal protective equipment for industrial and healthcare units

- In FY23, ANN’s EBIT stood at AUD 206.3 million and sales stood at AUD 1,655.1 million

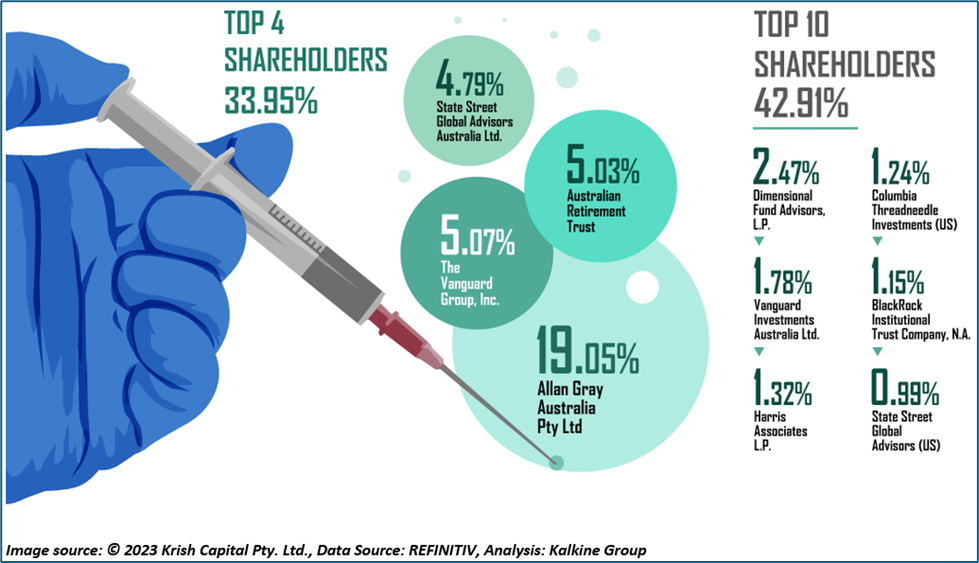

- Allan Gray Australia Pty Ltd has maximum stake in the company with a shareholding of around 19.05%

Ansell Limited (ASX:ANN), a leading provider of safety solutions, specializes in producing personal protective equipment for both healthcare and industrial settings. The company offers its diverse range of products under well-known brands like HyFlex, Ringers, MICROFLEX, TouchNTuff, GAMMEX, and AlphaTec. Ansell serves across more than 100 countries.

The AUD 3.06 billion-market cap firm witnessed a challenging period in the financial year 2023 (FY23). In FY23, sales decreased by 15.2% YoY to AUD 1,655.1 million, EBIT fell by 15.8% YoY to AUD 206.3 million and operating cash flow declined by 34.8% YoY to AUD 74.3 million.

During the reported period, the company witnessed growth in the industrial products segment, however, sales were weak in the healthcare sector because of destocking. Adverse currency movements and earnings loss due to exit from Russian business also impacted the performance.

Top 10 shareholders of ANN

The top 10 shareholders of ANN have around 42.91% shareholding in the company, while the top four have around 33.95% shareholding. The top two shareholders of ANN are Allan Gray Australia Pty Ltd and The Vanguard Group, Inc. with a shareholding of ~19.05% and ~5.07%, respectively.

Recent business update

Through an ASX update dated 15 January 2024, the company shared that it would release its first half results for FY24 on 20 February 2024.

Outlook

In FY24, the company expects to deliver adjusted EPS of US 92 cents – 112 cents. The expected range of statutory EPS including investment program costs is US 57 – 77 cents.

Accelerated Productivity Investment Campaign aims at simplifying and streamlining the organizational structure and improving manufacturing productivity. This campaign is expected to act as a catalyst for long-term earnings growth from FY25.

The focus is on enhancing presence in emerging markets, improving supply chain planning, product innovation, enhancing digital systems capabilities and undertaking investments in manufacturing capacity.

Share performance of ANN

ANN shares closed 1.35% lower at AUD 24.15 apiece on 31 January 2024. With this, in the last one year, the share price has decreased by 14.27% and in the last three months, it has increased by 12.07%.

The 52-week high of ANN is AUD28.75, recorded on 6 February 2023, while the 52-week low is AUD 21, recorded on 30 October 2023.

ANN Daily Technical Chart, Source: REFINITIV

Note 1: Past performance is neither an Indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, and currency, is 31 January 2024. The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

This article has been prepared by Kalkine Media, echoed on the website kalkinemedia.com/au and associated pages, based on the information obtained and collated from the subscription reports prepared by Kalkine Pty. Ltd. [ABN 34 154 808 312; AFSL no. 425376] on Kalkine.com.au (and associated pages). The principal purpose of the content is to provide factual information only for educational purposes. None of the content in this article, including any news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video is or is intended to be, advisory in nature. The content does not contain or imply any recommendation or opinion intended to influence your financial decisions, including but not limited to, in respect of any particular security, transaction, or investment strategy, and must not be relied upon by you as such. The content is provided without any express or implied warranties of any kind. Kalkine Media, and its related bodies corporate, agents, and employees (Kalkine Group) cannot and do not warrant the accuracy, completeness, timeliness, merchantability, or fitness for a particular purpose of the content or the website, and to the extent permitted by law, Kalkine Group hereby disclaims any and all such express or implied warranties. Kalkine Group shall NOT be held liable for any investment or trading losses you may incur by using the information shared on our website.