At the close of the trading session on 15th July 2020, equity market of Australia ended in green. The benchmark index S&P/ASX200 witnessed a sharp rise of 111.8 points or 1.88% to 6052.9. Most of the sectors on ASX closed in green such as S&P/ASX 200 Consumer Staples (Sector), which moved up by 133.3 points to 13,116.8. S&P/ASX 200 Energy (Sector) settled at 7,440.4 with a rise of 67.9 points.

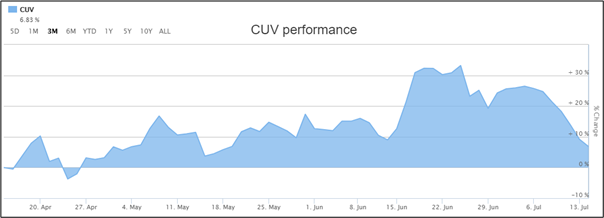

On ASX, the stock of CLINUVEL Pharmaceuticals Limited (ASX: CUV) went up by 6.803% to $23.550 per share. The share price of NRW Holdings Limited (ASX: NWH) stood at $1.700 per share, reflecting a rise of 6.25%.

Stock Performance (Source: ASX)

S&P/NZX50 stood at 11,611, indicating an increase of 1.01%. The share price of TRS Investments Ltd (NZX: TRS) rose by 50.00% to NZ$0.003 per share. Blackwell Global Holdings Limited’s stock (NZX: BGI) inched up by 21.88% and closed the trading session at NZ$0.039 per share. On the other hand, the stock of NZME Limited (NZX: NZM) plunged by 5.77% to NZ$0.245 per share.

Recently, we have written some crucial information on Empire Resources Limited (ASX:ERL), and the readers can view the information by clicking here.

CLINUVEL PHARMACEUTICALS LIMITED Rose by 6.803% on the Australian Securities Exchange.

CLINUVEL PHARMACEUTICALS LIMITED (ASX:CUV) recently revealed its second afamelanotide product in development, PRÉNUMBRA®. The company added that PRÉNUMBRA® is a liquid formulation of afamelanotide to be evaluated by CUV in clinical trials as a treatment for acute and systemic diseases. The second-generation product targets to provide prescribing physicians with dosing flexibility of the hormone analogue afamelanotide.

The company operates a profitable, cash flow positive pharmaceutical business with a clear objective to develop and deliver new products. CUV is planning to evolve into a diversified and integrated pharmaceutical business providing treatments to multiple patient groups. Moreover, the company’s financial performance has progressed through the Research & Development Phase into the Commercial Phase over time.

NRW Holdings Limited Ended in Green on 15th July 2020

NRW Holdings Limited (ASX:NWH) recently notified the market that Mitsubishi UFJ Financial Group, Inc. has ceased to become a substantial holder in the company on 24th June 2020. For the 10 months ended April 2020 (unaudited), the company reported record revenue amounting to $1.6 billion and EBITDA for the period stood at $177 million.

NWH added that the integration of BGC Contracting is progressing well, and all project teams are currently reporting through the NRW business structure. Considering the strong performance of the business, the company has paid an interim dividend of 2.5 cents per share on 9th June 2020. The company is on track to meet the revenue guidance of $2 billion for FY20.

_06_18_2025_01_37_48_131545.jpg)