On 29th June 2020, the equity market of Australia ended in red, and S&P/ASX200 moved down by 89.1 points to 5815. The benchmark index has lost 2.18% and 12.14% during the last five days and 52 weeks, respectively. S&P/ASX 200 Health Care (Sector) stood at 42,235.0, reflecting a decline of 315.5 points. S&P/ASX 200 Materials (Sector) witnessed a fall of 188.9 points to 13,089.7. All Ordinaries ended the session at 5915.6, indicating a fall of 1.60%.

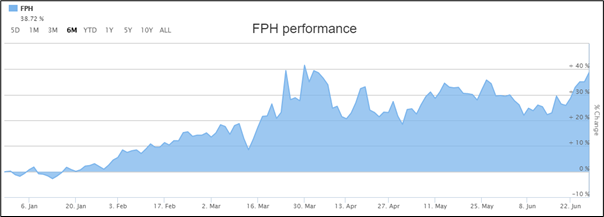

On ASX, the share price of Fisher & Paykel Healthcare Corporation Limited (ASX: FPH) rose by 6.885% to $31.670 per share. Also, on the same day, the stock price of Evolution Mining Limited (ASX: EVN) inched up by 4.112% on an intraday basis to $5.570 per share.

Stock Performance (Source: ASX)

At the end of the same session, S&P/NZX50 experienced a rise of 1.11% to 11,253. The stock of Abano Healthcare Group (NZX: ABA) went up by 17.19% to NZ$3.000 per share. The share price of New Talisman Gold Mines Limited (NZX: NTL) stood at NZ$0.008, indicating a rise of 14.29%. On the other hand, the stock of AFC Group Holdings (NZX: AFC) tumbled by 50.00% to NZ$0.001 per share.

Recently, we have written some crucial information on Ora Banda Mining Limited (ASX:OBM), and the readers can click here to view the article.

Fisher & Paykel Healthcare Corporation Limited Ended in Green on 29th June 2020

Fisher & Paykel Healthcare Corporation Limited (ASX:FPH) recently released its results for the full year ended 31 March 2020 and stated that the operating revenue for the period stood at $1.26 billion, reflecting a rise of 18% against last year. This was primarily due to growth in the use of its OptiflowTM nasal high flow therapy, demand for products to treat COVID-19 patients, as well as strong hospital hardware sales across the year. Net profit after tax amounted to $287.3 million with a rise of 37% over pcp. FPH has expanded its previous dividend policy into a broader capital management policy. The company declared a final dividend of 15.5 cents per share. This took the total dividend for FY20 to 27.5 cents per share. The stock of FPH is up due to the release of its FY20 results.

Evolution Mining Limited Rose 4.112% on Australian Securities Exchange.

Evolution Mining Limited (ASX:EVN) recently announced that Van Eck Associates Corporation and its associates have made a change to their substantial holdings in the company on 19th June 2020 with the current voting power of 10.54% as compared to the previous voting power of 11.59%.

In another update, the company released Mt Carlton update. As per the release, FY20 gold production at Mt Carlton is anticipated to be ~60,000 ounces. However, for FY21, the operation is anticipated to produce ~50,000 ounces.