Summary

- Ora Banda Mining has announced maiden underground Mineral Resource from recent drilling that targeted the Callion Main Lode.

- OBM’s total Mineral Resource now stands at 23.7 Mt @ 2.8 g/t Au for 2.13M ounces.

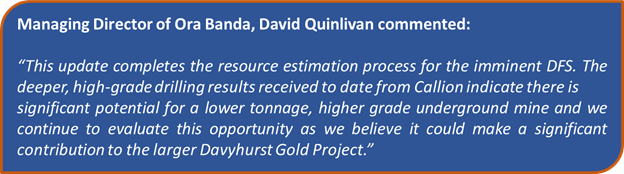

- OBM continues to evaluate this opportunity believes that it can make a significant contribution to the larger Davyhurst Gold Project.

A distinctively positioned gold exploration and development company, Ora Banda Mining Limited (ASX:OBM) is focused on unlocking significant value from the company’s strategic and highly prospective landholdings by targeting resource development activities at five advanced projects, namely,

- Davyhurst Project (Waihi, Callion and Golden Eagle)

- Riverina Project

- Siberia Project

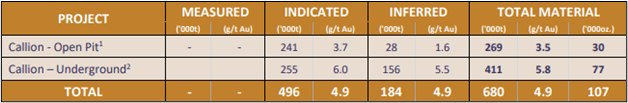

Recently, OBM has reported a maiden underground Mineral Resource of 411Kt @ 5.8 g/t Au for 77,000 Au ounces at Callion growing the total resource at this historic high-grade mining centre by 72% to 680Kt @ 4.9 g/t Au for 107,000 Au ounces.

Previous Update: Ora Banda Reports 46% Increase In The Underground Mineral Resource At Riverina Project

Mineral Resource Statement for Callion (Source: Company's Report)

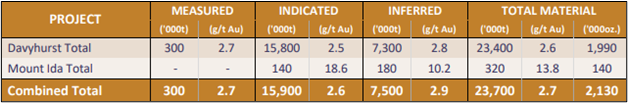

Following this update, OBM’s total Mineral Resource stands at 23.7 Mt @ 2.8 g/t Au for 2.13M ounces.

OBM Mineral Resource Statement (Source: Company's Report)

Previously, the Callion Main Lode has been the focus of underground mining, with access initially by way of shafts, followed by decline development in the late 1980s. Moreover, there are pieces of evidence of ore development and production stopping over six levels and stretch to a maximum vertical depth of 250 metres beyond the surface. In addition to this, gold mineralisation at Callion has been defined by drilling to depths of approximately 450 metres beneath the surface and dives moderately to the south.

Related: Tracing the Progress of Ora Banda at Waihi Project in 2020

Ora Banda’s recent drilling has focused on defining additional underground resources proximal to and above the base of existing workings. Moreover, a considerable amount of potential remains to expand the solid results from deeper drilling indicating the resource below the existing mine workings.

Importantly, total recorded historical production for the open pit stands at 135Kt @ 4.1g/t Au for 17.6Koz, with the underground mine producing 146Kt @ 15.8g/t for 74 Koz for a total production of 280Kt @ 10.2g/t Au for 92Koz of contained gold.

Related: Ora Banda Mining reports 60% upgrade in Davyhurst Gold project Ore Reserve; stock mounts 8.51%

A Look at the Callion Deposit

Callion is a vital part of the Company’s Davyhurst Gold Project located 13 km south-west of the Company’s Davyhurst processing plant. Moreover, recent drilling that targeted the Callion Main Lode below the A$2,400/oz optimised open pit Resource shell resulted in the new underground Resource at Callion.

Overview Plan Showing Callion’s Proximity to Davyhurst Mill (Source: Company's Report)

Callion Deposit, being one of the five priority mining targets identified by Ora Banda is a key part of the Company’s plans to underpin the viable restart of production operations at its Davyhurst Gold Project. . Moreover, the current Callion open pit is approximately 650m long and 40m deep, with underground workings extending off the southern end of the pit to a vertical depth of 250 m.

The new underground Resource at Callion incorporates all recent resource definition drilling, both extensional and infill, by Ora Banda. The drilling undertaken has significantly increased the geological understanding of the area and provided additional drill support for a robust model.

Moreover, with a major shear plane evident through the central section of the existing Callion pit leading to a broad zone of structural disruption, the dominant structural trend at Callion is oriented NW(Northwest)-SE(Southeast). Mapping of additional small NW-trending cross faults has been done in the southern section of the pit with minor metre-scale sinistral movement.

Related: Ora Banda records encouraging results from ongoing RC and DD programs; Stock spikes 12.5%

In addition to this, Callion’s mineralisation is characterised by a series of steep east-dipping to sub-vertical stacked quartz lodes, striking approximately 3500 over a strike length of about 1200 metre.

OBM stock was noted at $0.305 with a market capitalisation of 193.82 million on 29 June 2020.