On 9th July 2020, the equity market of Australia closed in green, and S&P/ASX200 index stood at 5955.5 with a rise of 35.2 points. S&P/ASX 200 Materials (Sector) went up by 230.7 points to 13,723.5. S&P/ASX 200 Energy (Sector) ended at 7,475.3, reflecting a rise of 176.1 points. All Ordinaries experienced a rise of 40.6 points and ended the session at 6074.9.

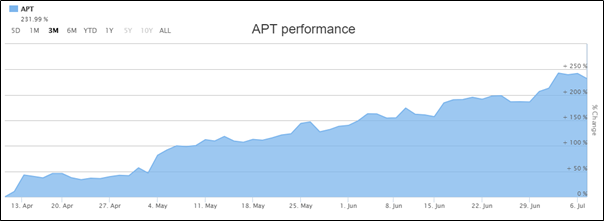

On ASX, the share price of Afterpay Limited (ASX: APT) soared by 11.364% to $73.500 per share. The stock of Netwealth Group Limited (ASX: NWL) inched up by 9.159% to $10.130 per share.

Stock Performance (Source: ASX)

On July 9, 2020, S&P/NZX50 witnessed a decline of 2.30% and settled at 11,441. The share price of AFC Group Holdings Limited (NZX: AFC) rose by 100.00% to NZ$0.002 per share. The stock of Blackwell Global Holdings Limited’s (NZX: BGI) moved up by 4.55% to NZ$0.023 per share. On the other hand, the stock of Contact Energy Limited (NZX: CEN) plunged by 13.95% and settled the day at NZ$5.800 per share.

Recently, we have written some crucial information on Greenland Minerals Ltd (ASX:GGG), and the readers can view the article by clicking here.

Afterpay Limited Ended the Session in Green

Afterpay Limited (ASX:APT) recently announced that it has successfully raised $650 million through a fully underwritten institutional placement. The Placement was priced at $66.00 per share, which reflects a discount of 2.9% to the close of trade on 6 July 2020. The company will also offer eligible shareholders the opportunity to purchase new shares in the company under a Share Purchase Plan, and the company is likely to raise $150 million. The company would utilise the proceeds to ramp up investment in growing underlying sales, and prioritising global expansion in the short term to maximise shareholder value in the longer term. During FY20, the company reported underlying sales amounting to $11.1 billion, which was supported by strong performance in the business. This indicates that APT is well placed to surpass its underlying sales target of $20 billion by the end of FY22.

Netwealth Group Limited Soared by 9.159% due to the Release of Quarterly Business Update

Netwealth Group Limited (ASX:NWL) recently announced that Hyperion Asset Management Limited has ceased to become a substantial holder in the company on 7th July 2020. In another update, the company reported funds under administration of $31.5 billion as at 30th June 2020, reflecting a rise of $8.2 billion. For FY20, the company reported record FUA net inflows amounting to $9.1 billion. The company would continue to increase its investment in FY21 to ensure continued market leadership in technology, service and functionality and to capitalise on the significant growth opportunity for long-term.