An investor should focus on building a portfolio of investments in several stocks instead of solely investing in a single stock, which may expose investorsâ capital to unsystematic risk which is popularly known as âdiversifiable riskâ. As per Warren Buffetâs famous quote âNever Put your all Eggs in the same basketâ, which suggests investors to always diversify their investments.

When beginning to choose a stock, an investor must look for a familiar company or an industry, that will help put the results or reports of the company in context while analysing the stock performance. The next step would involve the analysis of a combination of financial parameters like Price/Earnings Ratio, revenue and profit position as depicted by quarterly or annual reports, trends in cost, debt position and dividends paid in the past.

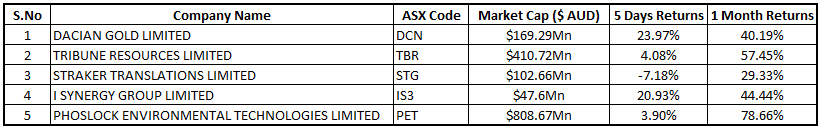

Let us now have a look at few stocks that have witnessed considerable movement in stocks in the past one week

Summary Table (Source: ASX)

Dacian Gold Limited

Dacian Gold Limited (ASX: DCN) engages in exploration and development of minerals.

The company recently made an announcement on the preliminary operating results for quarter ended 30 June 2019. During the quarter, the company recorded production of 36,658 ounces at an AISC of A$1,519/oz. Production & AISC for the period were in line with the guidance of 36,000 to 38,000 ounces and A$1,500 to A$1,600/oz, respectively.

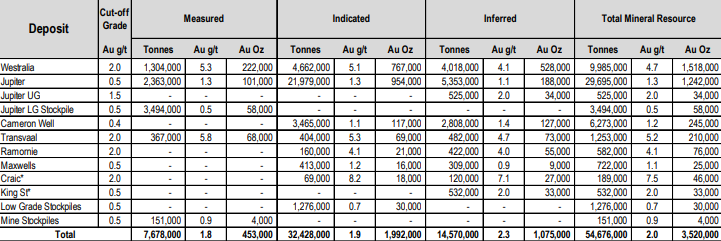

Life-of-Mine Plan: Dacian Gold also came up with the FY2020 guidance and the updated Life-of-Mine plan for its Mt Morgans Gold Operation. The company expects to achieve an average annual production of 170,000 ounces over the first 5 years of the 8-year life-of-mine plan. All-in-Sustaining-cost for the five-year period is expected to be between A$1,340 and A$1,440/oz. Over the 8-year period, total production from the mine is expected to be 1.1 million ounces and AIC is expected to be in the range of A$1,280 â A$1,380. Consolidated All-in-Cost for the period is expected to be in the range of A$1,330 â A$1,430/oz.

Mineral Resources (Source: Company Reports)

FY20 Guidance: Production during the year is expected to be between 150,000 and 170,000 ounces. MMGO AIC for the period is expected to be in the range of A$1,400 to A$1,500/oz. In addition, the company has provided consolidated AIC guidance in the range of A$1,450 to A$1,550/oz.

Stock Performance: The stock of the company is currently trading at a market price of $0.775, up 3.333% on 19th July 2019, with a market capitalisation of $169.29 million.

Tribune Resources Limited

Tribune Resources Limited (ASX: TBR) is engaged in exploration and development activities at its East Kundana Joint Venture tenements.

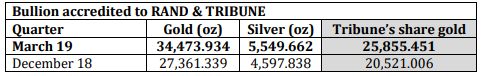

March Quarter Highlights: In the quarter ended 31 March 2019, the company processed 253,065 tonnes of EKJV ore at the Kanowna Plant. At the Greenfields Mill, the company processed 65,996 tonnes of R&T (Rand and Tribune) ore and 37,869 tonnes of EKJV. Rand and Tribune Bullion accounts saw credits of 34,473 ounces of gold and 5,549 ounces of silver during the period, 75% of which belong to Tribune Resources. The period also saw an investment of $11.05 million by Evolution Mining Limited, representing 19.9% shareholding in the company.

R&T Ore Production (Source: Company Reports)

Exploration Activity: The company conducted an in-mine exploration with underground drilling at EKJV. In addition, the company evaluation past exploration activity and target generation for the Seven Mile Hill project during the quarter. Review and operational planning for initiating exploration at the Diwalwal Gold Project in Philippines was also completed during the period. The company has scheduled the initial 3600m program of drilling in October 2019.

Currently, the stock of the company is trading at a market price of $7.650, up 3.378% on 19 July 2019, with a market capitalisation of $410.72 million.

Straker Translations Limited

Straker Translations Limited (ASX: STG) is engaged in provision of translation services. The company recently updated that Leonard Light ceased to be substantial shareholder of the company.

In the month of June, the company completed the acquisition of On-Global Language Marketing S.L for further expansion into U.S. The acquisition will add new strategic customers on the companyâs high-margin RAY technology platform. The deal has added new revenue to the 12 months to 31 March 2019. The acquisition was completed for a consideration of NZ$2.25 million, comprising NZ$1.73 in cash and NZ$520k in Straker shares.

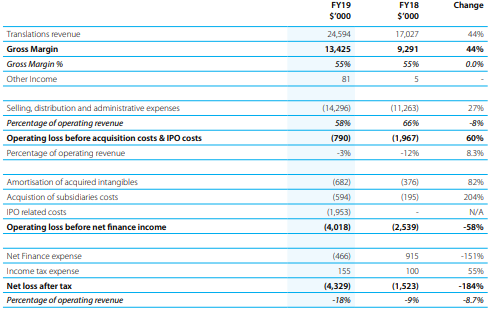

FY19 Performance: During the year ended 31 March 2019, the company generated revenue amounting to NZ$24.6 million, up 44% YoY. New customer revenue during the period witnessed a rise of 14.2% YoY and revenue from existing customer base reported an increase of 53.3%. Statutory Gross Margin for the period stood at NZ$13.4 million, up 44% YoY. Trading loss from operations improved by 60% year-on-year. As at 31 March 2019, the company has NZ$17.7 million cash at bank with no debt.

Statutory Results (Source: Company Reports)

Overall, the company performed strongly during the year with revenue and statutory gross margin exceeding its prospectus FY19 forecasts. Revenue during the period was up on prospectus forecast by 4.7%, owing to organic growth from enterprise customers in EMEA and APAC & earnings from acquisitions completed during the year.

Outlook: On the outlook front, the company is well set to continue its growth trajectory with future revenue and earnings to boost via additional merger & acquisition opportunities, MSS, Eule and COM translations, organic growth opportunities and a strong balance sheet.

The stock of the company is currently trading at a market price of $1.930, down 0.515% on 19 July 2019 and has a market capitalisation of $102.66 million.

I Synergy Group Limited

I Synergy Group Limited (ASX: IS3) is engaged in providing affiliate marketing solutions to advertisers and affiliates.

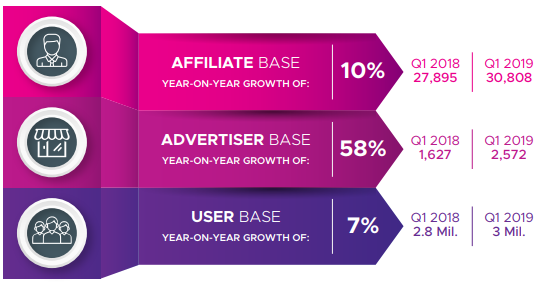

The company recently released the operational update for the quarter ended 30 June 2019. During the quarter, the company witnessed a y-o-y 10% rise in affiliate base. Affiliate programs in Q1 2019 were reported at 30,808 against 27,895 in Q1 2018. The companyâs advertiser base during the quarter grew by 58% y-o-y, from 1,627 in Q1 2018 to 2,572 in Q1 2019. User base reported a y-o-y growth of 7%. In Q1 2019, the company reported a total of 3 million users in comparison to 2.8 million users in prior corresponding period.

Q1 2019 Business Performance (Source: Company Reports)

Financial Highlights: During the year ended 31 December 2018, the company reported revenue amounting to A$9.6 million, down 9.9% on prior corresponding period. The company incurred a loss amounting to $784 million in the year. The decrease in revenue was due to lower income from software activation, training, license right and program fee owing to lesser affiliate sign-ups as compared to previous financial year.

The companyâs performance during the year should be looked in conjunction to the extensive investment made in the business expansion in Indonesian market. The companyâs financial performance remained strong with ample of liquidity and cash in hand with negligible debts. At the end of the period, the company reported cash and cash equivalents amounting to $9.95 million.

Currently, the stock of the company is trading at a market price of $0.260, reporting no change in the previously traded price. The stock has a market capitalisation of $47.6 million.

Phoslock Environmental Technologies Limited

Phoslock Environmental Technologies Limited (ASX: PET) is engaged in providing design, engineering and project implementation solutions for water related projects and water treatment products.

During the period ended 30 June 2019, the company reported record operating net cash flow of $10.7 million, comprising $6.0 million from the first quarter and $4.7 million from the second quarter. Customer receipts during the period amounted to $18.6 million. Receipts in the first quarter stood at $10.0 million. Second quarter receipts totalled to $8.6 million. At the end of the period, the company had cash at bank amounting to $18.0 million.

The company recently updated that it is in the process of increasing its production rate to 12,000 tons per annum of Phoslock, to cater to the current and upcoming demand. Presently, it is increasing its on-site wastewater processing and will be installing additional equipment. The company has estimated the cost of this additional wastewater equipment to be less than A$1 million, that will be funded from its cash flows.

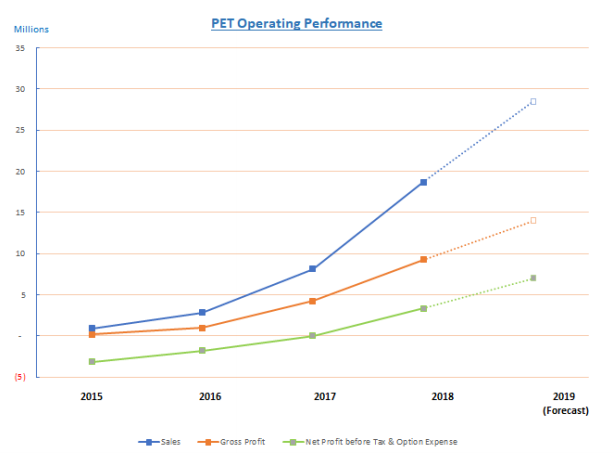

During the half year ended 31 December 2018, the company generated revenue amounting to $9.0 million, up 50% YoY. Net profit before tax and option expense amounted to $1.6 million, up 61% YoY.

2019 Forecast: Based on the performance in 2018, the company FY2019 revenue guidance in the range of $27 million to $30 million, reporting a approximate growth of 55% yoy. FY2019 is expected to be in the range of $6 million - $8 million, with yoy growth of around 100%.

Operating Performance (Source: Company Reports)

Currently, the stock of the company is trading at a market price of $1.400, down 4.437% on 19 July 2019. The stock is trading close to its 52 weeks high level of $1.540 and has a market capitalisation of $808.67 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.