Parkway Minerals NL (ASX: PWN) is an Australian exploration firm whose activities are targeted at the development of large greensand deposits, containing extensive potash and phosphate minerals, in Western Australiaâs Perth Basin. Parkway owns two fertiliser feedstock projects in WA, including Lake Seabrook and Dandaragan Trough Project (DTP). The company also owns 44.3 million shares of Davenport Resources (ASX: DAV) and 6.47 million shares of Lithium Australia (ASX: LIT). Strengthening its existing portfolio, Parkway has recently informed about the strategic acquisition of Australia-based Consolidated Potash Corporation Ltd (CPC).

For several years, Parkway has been assessing the potential feasibility of its DTP for potash, phosphate and other minerals. The company has also been involved in exploration of brine hosted potash resources within WA.

Market Opportunity

Parkway is the only company to successfully recover phosphate and potassium from greensand deposits. The company uses its proprietary KMax® technology to extract potassium from the greensand to generate SOP (sulphate of potash) of high purity.

SOP is a superior product with enormous demand, that enjoys significant margin over the usually traded potassium chloride. Potash is an essential nutrient used primarily in fertiliser production, having no other substitute. With a rising demand for fertilisers in agricultural production, the demand for potash is also increasing across the world. Even though potash ore reserves have been detected in twenty-one countries worldwide, the economic extraction of potash is currently practised in only twelve countries (primarily in Russia and Canada).

The demand for potash is driven by demand for fertilisers, which in turn depends on population growth. As stated by Parkway in its annual report, the global population is likely to increase by 30-50 per cent over the next 35 years, lowering the share of arable land per person by ~40 per cent. In addition, the production of more food will be required from smaller areas with an improvement in diets in the developing world. As per Parkway, the population growth, diminished arable land and dietary changes are likely to broaden the demand for food globally by 2050, thereby leading to an increased pressure on agriculture.

As fertilisers are one of the most cost-effective means of improvements in food production and the food supply chain for reducing malnutrition and maintaining quality of life worldwide, the fertiliser business is expected to grow along with an amplified demand for agricultural produce, resulting in a stronger requirement for potash products.

Progress in Potash Production

So far, Parkway has made substantial progress in its potash projects with an aim to become a major fertiliser supplier to the worldâs farming community. Let us discuss the progress in potash production at the companyâs major projects:

Lake Seabrook Potash Project

Wholly owned potash project of Parkway, Lake Seabrook consists of five exploration licences covering a salt lake close to the Koolyanobbing iron ore mining area, straddling the Perth to Kalgoorlie rail-line in WA. The Company has approximately 101 square kilometres of granted tenure over the lake surface.

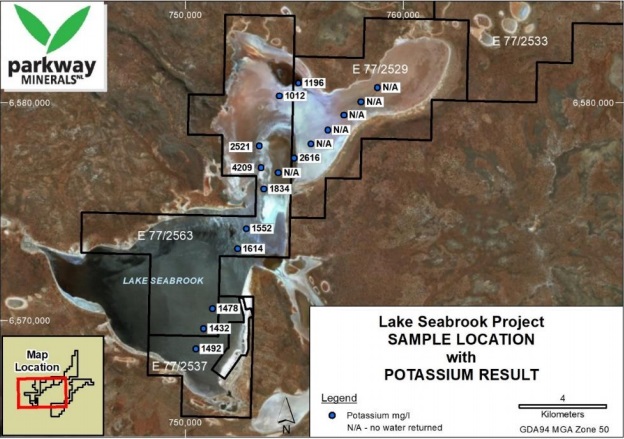

Lake Seabrook Sample Plan, Source: Companyâs report, 11th June 2019

Recently, the company completed an initial sampling program on its Lake Seabrook Project that confirmed the presence of potassium in solution in relatively high concentrations in the near surface brine. Three brine samples from the central part of the lake system returned encouraging potassium concentrations of 2,521 mg/L, 2,616mg/L and 4,209 mg/L.

The company notified that it has only completed sampling over approximately half of the project area and has not tested the primary target which is deeper alluvial channel sands within the lake. Parkway intends to finalise subsequent surface sampling on the remaining parts of the project area in addition to ground seismic surveys to outline paleochannels to drill test.

Dandaragan Trough Project

Parkwayâs 100% owned Dandaragan Trough project hosts one of the worldâs largest glauconite or greensands deposits, containing abundant phosphorus and potassium. The project has great infrastructure, with access to rail, roads, towns, power, gas and water supply. Within less than 200km of distance from the project, two major export ports and fertiliser plants are located at Geraldton and Kwinana.

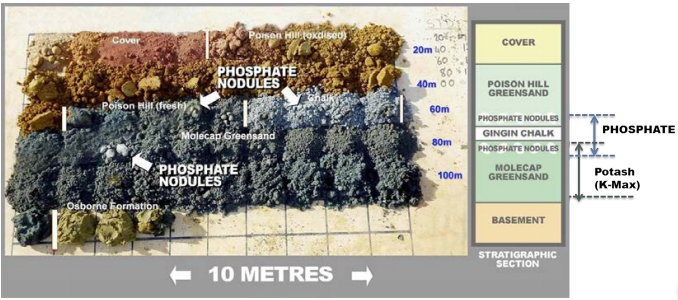

Dandaragan Trough Project, Source: Companyâs Presentation (5th August 2019)

Dandaragan Trough possesses Indicated and Inferred Potash Resource of 910 Mt @ 3.8% K2O, and Indicated and Inferred Phosphate Resource of 630 Mt @ 1.9% P2O5. Significant resource appraisal and flowsheet development studies have been performed to date at the project that confirmed its potentially attractive economics.

Parkway is exploring various pathways to introduce a strategic partner or joint venture to fund the next stage of feasibility studies, or potentially monetise the project interest.

Davenport Resources

In line with its focus on fertiliser feed, Parkway holds a significant share in Davenport Resources, which is a pure-play potash company with a globally significant potash resource inventory in an established potash mining district of Central Germany.

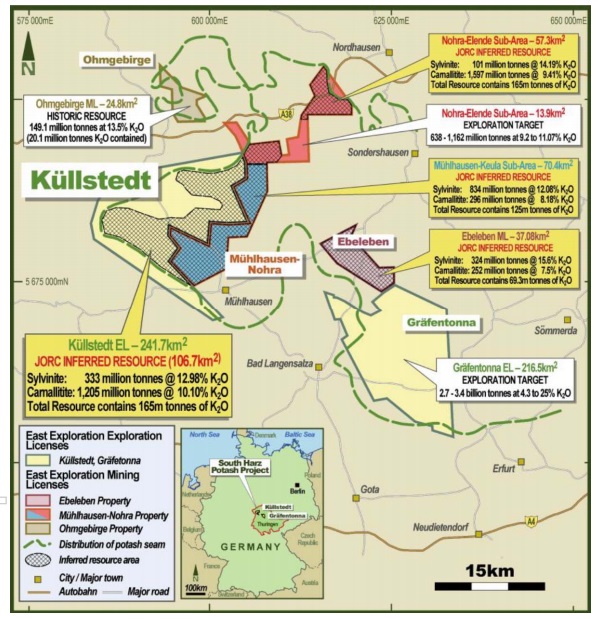

South Harz Project Location, Source: Companyâs Report (31st July 2019)

Davenport Resources owns the largest JORC compliant potash resource in Western Europe. Davenportâs portfolio of resources contains large potash (MOP) projects (three mining and two exploration licences) in South Harz area of Central Germany.

In February 2019, Davenport updated about a new JORC Inferred Resource of 1.5 Billion tonnes for the Küllstedt exploration licence, post which its total Inferred Resource at South Harz became 4.9 Billion tonnes @ 10.6% K2O. The company mentioned that preliminary engineering and economic evaluations are currently underway at Davenport Resources.

Acquisition of CPC

Recently, Parkway has also obtained direct ownership interests in Karinga Lakes Potash Project (KLPP) and New Mexico Lithium Project (NMLP) through the strategic acquisition of CPC. Consolidated Potash Corp. holds 15 per cent interest in KLPP and 100% interest in a highly prospective NMLP project in the US.

The KLPP is a well-defined sulphate of potash (SOP) project in central Australia that has undergone extensive appraisal and represents a highly prospective sulphate of potash (SOP) brine project. The acquisition of CPC has provided Parkway a direct ownership of CPCâs aMES⢠technology, apt for lithium and potash production as well as brine processing.

In a recent update on the ASX, Parkway informed about the successful completion of a heavily oversubscribed $450k capital raising related to CPC acquisition.

Source: Companyâs Presentation (5th August 2019)

Progressing extremely well with its project portfolio, Parkway remains focused on extracting essential fertilizer feedstocks including potash and phosphate from its projects. The anticipated rise in demand for fertilisers in the coming years offers a significant market opportunity for Parkway to continue with its growth strategies.

Stock Performance: PWN closed the trading session at AUD 0.006 on 28th August 2019 with ~4.4 million shares in rotation. The stock has delivered a massive return of 40 per cent on a YTD basis.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.