Highlights

- Mount Burgess Mining (ASX:MTB) is aiming swift development of its 100%-owned polymetallic projects in Botswana.

- There has been growing support for the metals at the two polymetallic deposits, Nxuu and Kihabe.

- MTB is confident that Nxuu and Kihabe metals will remain strong as demand will continue to exceed supply over the coming years.

- The company plans to seek potential offtake agreements over coming quarters.

- MTB has outlined exciting exploration and development plans for the Nxuu and Kihabe deposits in 2023.

Australian mineral exploration company Mount Burgess Mining NL (ASX:MTB) is forging ahead eyeing swift development of its 100%-owned polymetallic projects in Botswana. Its two major Botswana projects are the Nxuu polymetallic deposit and the Kihabe polymetallic deposit.

The Nxuu polymetallic deposit has an initial inferred/indicated mineral resource estimate (MRE) of 6 million tonnes, containing zinc, lead, silver, vanadium pentoxide, germanium and gallium at a zinc equivalent grade of 1.8%, applying a zinc equivalent 0.5% low cut. A further MRE of 2.3 million tonnes of germanium @ 1.4g/t and gallium @ 11.3g/t surround the MRE of 6 million tonnes. The total MRE of 8.3 million tonnes are within an oxidised quartz wacke below Kalahari sand cover.

The company believes that the Kihabe polymetallic deposit holds significant value as seen in the MRE of 21 million tonnes containing 321,000 tonnes zinc, 154,000 tonnes lead, 5.4 million ounces silver and 10,000 tonnes vanadium pentoxide, at a zinc equivalent grade of 2.04% zinc, applying a 0.5% low cut.

MTB focusing on Nxuu deposit for initial development

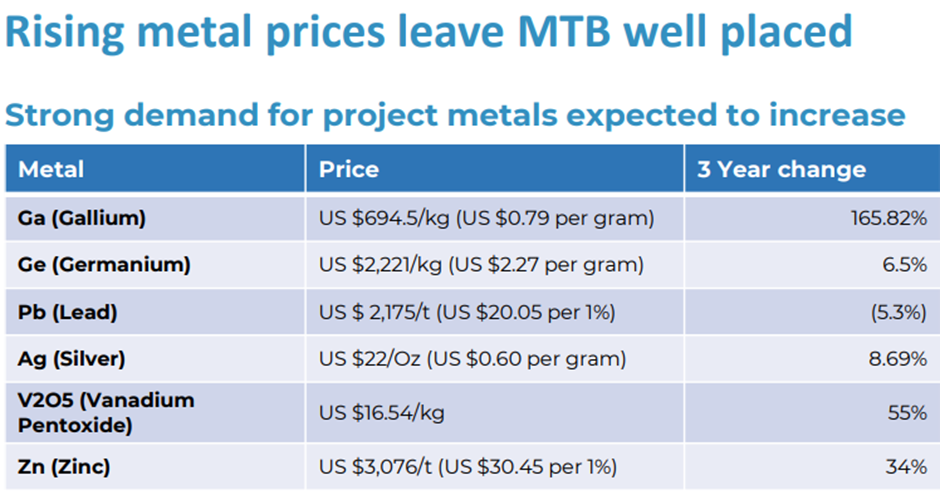

There has been growing demand for metals under the Nxuu and Kihabe deposits.

Image Source: MTB presentation, November 2022

Confident of substantial price increases in the future, MTB has defined a strategy for the development of its Nxuu and Kihabe deposits.

As part of the strategy, the company plans to continue to focus on the Nxuu deposit for initial development that is a low capital, low-risk project, with a fast way to production. The company believes that this highly oxidised deposit provides substantially less costly project development costs than sulphide deposits.

Initially, MTB intends to find the most suitable method to extract metals on site, without affecting recovery levels found after numerous recovery processes required for zinc, lead, silver, and vanadium pentoxide. It will need more metallurgical recovery test work.

Later, the company would seek potential offtake agreements for its project.

MTB outlines next steps for Kihabe and Nxuu deposits

In the first quarter of 2023, MTB plans to hold mineralogical test work on mica concentrates from the Kihabe deposit to identify host minerals for germanium and gallium. The company intends to begin metallurgical test work to find the order of several methods required to extract zinc, silver, vanadium pentoxide, germanium and gallium on site from the Kihabe Deposit Oxide zone. Further, MTB would import core samples from drilling conducted in 2021 on the Nxuu Deposit for mineralogical and metallurgical test work.

In the second quarter of 2023, the ASX-listed company is devising to hold mineralogical test on mica concentrates from the Nxuu deposit to identify host minerals for germanium and gallium. It may begin metallurgical test work to find out how multiple processes need to be ordered for extracting zinc, lead, silver, vanadium pentoxide, germanium and gallium from the Nxuu deposit. In Q2 2023, MTB also has plans to start drilling at the Nxuu deposit for upgrading the inferred/indicated MRE to an indicated/measured MRE.

In the third quarter of 2023, MTB wishes to wrap up follow up drilling at the Nxuu deposit. The company may import core samples from the deposit drilling for assaying during the quarter. It will initiate assaying samples from the deposit drilling. MTB will also upgrade the Nxuu deposit MRE to an indicated/measured MRE status.

In the fourth quarter of 2023, MTB plans to hold a pre-feasibility study on the Nxuu deposit. Also, the company would perform additional follow up metallurgical or exploration work, as needed, across both deposits.

MTB shares traded at AU$0.004 on 24 November 2022.