Highlights

- Mount Burgess Mining (ASX:MTB) carried forward development activities at its 100%-owned Kihabe-Nxuu project during September quarter.

- The Kihabe deposit mineral resource estimate, compliant with the 2012 JORC Code, has been updated.

- During the quarter, AGR got assay results from the last eight holes that were drilled into the Nxuu deposit NW and NE areas.

- Post quarter, MTB released initial mineral resource estimate for the Nxuu deposit.

Australian mineral exploration company Mount Burgess Mining NL (ASX:MTB) recently delivered its report for the quarter ended 30th September 2022. The company made progress in activities at its 100%-owned polymetallic Zn/Pb/Ag/Cu/V/Ga/Ge Kihabe-Nxuu Project during the quarter. It also announced an updated Kihabe Deposit Mineral Resource Estimate, compliant with the 2012 JORC Code.

To know more about the significant developments through the quarter, keep reading!

Assays from diamond core drill holes at Nxuu deposit

The quarter saw MTB receiving assay results from the last eight holes which were drilled into the NW and NE areas of the Nxuu deposit during October/November/December 2021. The holes assayed for the quarter totalled 376.2m to the base of mineralisation (BOM) contained:

- 43m of Kalahari sand cover, being 19.7% of total m to BOM

- 04m of mineralised Quartz Wacke, being 65.4% of total m to BOM

- 69m of sub-grade Quartz Wacke, being 14.9% of total m to BOM

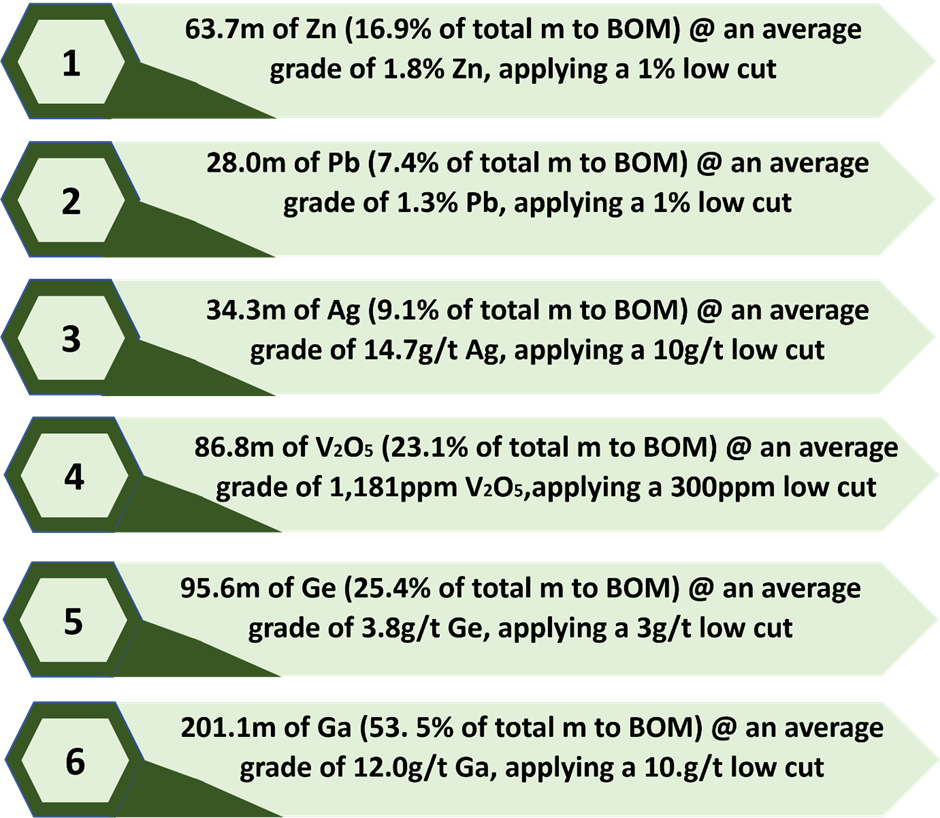

The 8 holes, assayed for Zn/Pb/Ag/V/Ge/Ga include the following intersections:

Data source: MTB update

To date, MTB has drilled 47 holes in the NW & NE Areas of the Nxuu Deposit, totalling 2,008.6m to BOM.

Kihabe Mineral Resource Estimate

During the quarter, the company released the Kihabe Deposit Mineral Resource Estimate (MRE) compliant with the 2012 JORC Code. The Indicated/Inferred Mineral Resource for the deposit was estimated at 21 million tonnes with a 2.0% Zn equivalent grade. It includes 321,000 tonnes of Zn, 10,000 tonnes of V2O5, 154,000 tonnes of Pb and 5,400,000 ounces of Ag.

Initial Mineral Resource Estimate for Nxuu deposit

Subsequent to the quarter, the company announced initial indicated/inferred mineral resource estimate, compliant with the 2012 JORC Code, for the Nxuu deposit.

It has been estimated at 6 million tonnes containing Zn/Pb/Ag/V2O5/Ge/Ga. To read further, click here.

Rising global demand for metals of Kihabe–Nxuu project

There are potentially significant amounts of zinc, lead and silver, along with gallium, germanium and vanadium pentoxide at the Mount Burgess’ deposit, says MTB.

Most of these metals have seen a good upsurge in their demand across the globe. Considered to be metals of the future, these metals have found multiple applications across industries. Keep reading to know more!

- Gallium: As per the Fraunhofer Institute System and Innovation Research, it is expected that the global demand for gallium will grow six times by 2030, as compared to the present production rate of around 720 tonnes/year.

- Germanium: It was classified as a strategic metal by the US government of late. The metal is used in making high brightness LEDs, fibre optics, semi-conductors, and infra-red optics.

- Vanadium Pentoxide (V2O5): It is considered to be the main element for a clean energy future and future energy storage requirements. Vanadium redox flow (VRF) batteries designed to incorporate V2O5, have the ability to store ample amount of power, produced using wind and solar, for longer durations.

- Zinc: Researchers from the University College of London published a paper in September 2021 on new zinc-based batteries which get charged directly by light.

- Lead: Lead has found applications in radiation protection, roofing, solders, lead-acid car batteries, ammunition, and weights. For the power produced using solar/wind energy or diesel, large-format lead-acid batteries are employed for storage.

- Silver: It is currently used as a key material for alternative energy generation in the manufacture of photovoltaic panels as well as for making jewellery and domestic utensils.

On 10 November 2022, MTB traded at AU$0.004 on the ASX.