Highlights

- Vertex Minerals (ASX:VTX) kicked off drilling at the Red Hill deposit in August 2022 and has drilled 750m to date.

- The technical team of VTX identified multiple gold targets that can possibly provide future feed.

- VTX looks to advance the Red Hill Project as it is believed to indicate substantial potential for exploration and resource growth.

Vertex Minerals Limited (ASX:VTX) has reported notable progress across the recent quarter that ended on 30 September 2022. During the period, VTX witnessed key developments, including the re-commencement of Red Hill drilling along with identifying several gold targets across the Hill End Gravity Gold plant.

The company has also renewed multiple exploration licences along with ESG reporting framework now in place. Let us look at the company’s progress during the September quarter of 2022.

Identifying multiple gold targets

During the quarter, the technical team of VTX uncovered multiple gold targets that are located around the Hill End Gravity Gold plant and can potentially deliver future feed.

Besides this, VTX also intersected visible gold from diamond drill-hole VRHD004, which was designed to intersect deeper mineralisation at approximately 110m downhole in the southern portion of the Red Hill mineralisation.

Visible gold in quartz vug (Source: VTX)

A non-targeted zone between 75m and 96m was also intersected in hole VRHD004, consisting of significant lode type quartz veins that lie from around 75.8 - 96 m down hole.

Presently, assay results from holes 1,2 and 4 are undergoing compilation and interpretation and are anticipated to be received shortly.

Maiden drill program at the Hill End Project

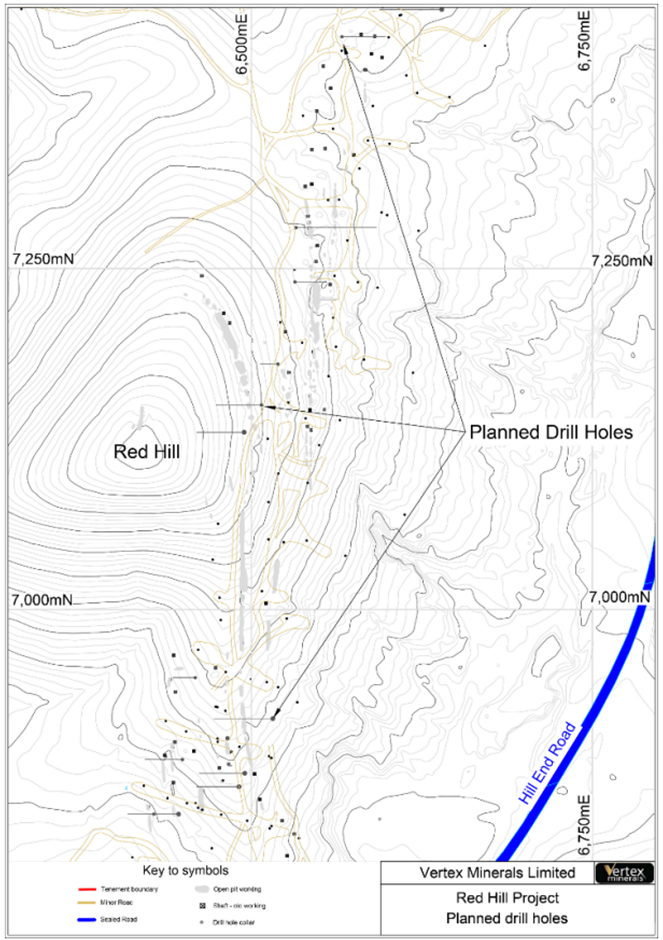

During the September quarter, VTX initiated resource diamond drilling at the Whites cross-course located at the southern end of the Red Hill deposit. The maiden drill program kicked off on 23 August 2022, and 750m has been drilled to date.

Four initial holes, including VRHD001 to VRHD004, have been designed and drilled to infill earlier exploration and later resource drilling programs undertaken by earlier explorers. Presently, initial assays for these holes are being compiled and interpreted.

Red Hill Drill Hole plan (Source: VTX)

VTX intends to advance the Red Hill Project and has started engaging with several departments within the NSW Government and Regional Councils for the mandatory consents and mining licence application.

VTX looks to target the stockwork and halo zones through resource drilling. These stockwork and halo zones have the highest possibility to deliver significant tonnage to the resource while enhancing amenability to bulk mining methods. The company will also examine the deeper targets during the program that were identified at the prospect, including the Frasers zone.

VTX believes that Red Hill suggests a substantial potential for exploration and resource growth in a neglected mining district of notable size, gold grade and distinct amenability to gravity processing methods.

Renewal of exploration licence

The Department of Regional NSW has proposed to renew Exploration Licence No 5868 and Exploration Licence No 6996 for the period of two years for the complete area of 16 units and six units, respectively, as applied for.

VTX begins ESG reporting

During the quarter, VTX also began ESG reporting by making disclosures against the framework of the World Economic Forum (WEF), which includes a set of shared metrics for sustainable value creation captured in 21 fundamental ESG disclosures.

The Board has decided to use this universal ESG framework to put in line the mainstream reporting on performance against ESG indicators.

VTX believes that the WEF Stakeholder Capitalism Metrics is the most suitable ESG disclosure framework to begin its ESG journey as it allows the company to report on a range of core ESG matters of governance.

Source: © Mauriceschuckart | Megapixl.com

VTX has engaged with Socialsuite, an impact monitoring technology platform, to streamline the disclosure and continuing ESG reporting process. VTX intends to establish commitment and progress on making ESG disclosures and aims to move forward on a range of core and expanded ESG metrics.

Cash position at quarter end

VTX held AU$2.896 million in cash as at 30 September 2022 and incurred exploration and evaluation expenses of AU$425,000 during the quarter.

VTX stock was noted trading at AU$0.105 on 15 November 2022.