Highlights

- Vanadium Resources is progressing its Steelpoortdrift Vanadium Project in South Africa at full pace towards FID.

- As per the encouraging economics and technical viability results from the DFS, the project can produce around 484,000t of vanadium pentoxide (V2O5) flake over a period of 25 years.

- VR8 inked an option agreement with Kadoma Investments Proprietary Limited for acquiring a 135-hectare industrial site for the proposed Salt Roast Leach (SRL) plant.

- Strategic investment of A$5.91m and 40% offtake deal with Matrix Resources.

One of the emerging vanadium producers, Vanadium Resources Limited (ASX:VR8, FRA: TR3) has been focusing on progressing its Steelpoortdrift Vanadium Project in South Africa at full pace. The activities got a major boost in October 2022 with the definitive feasibility study confirming the project’s robust economics and technical viability. As per the DFS results, the project can return around 484,000t of vanadium pentoxide (V2O5) flake over a period of 25 years.

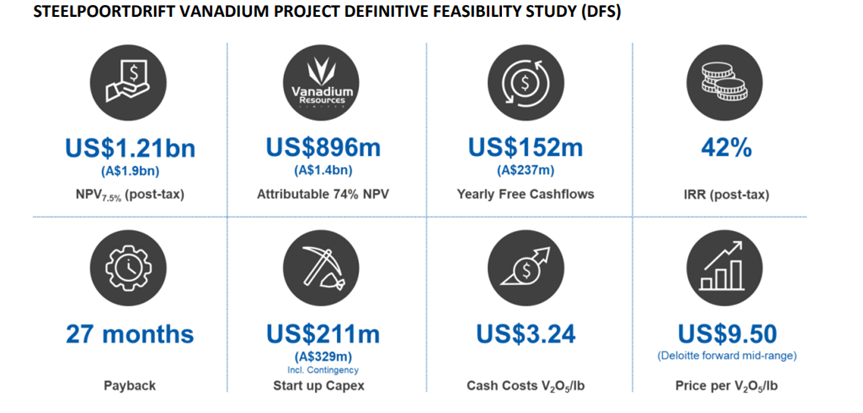

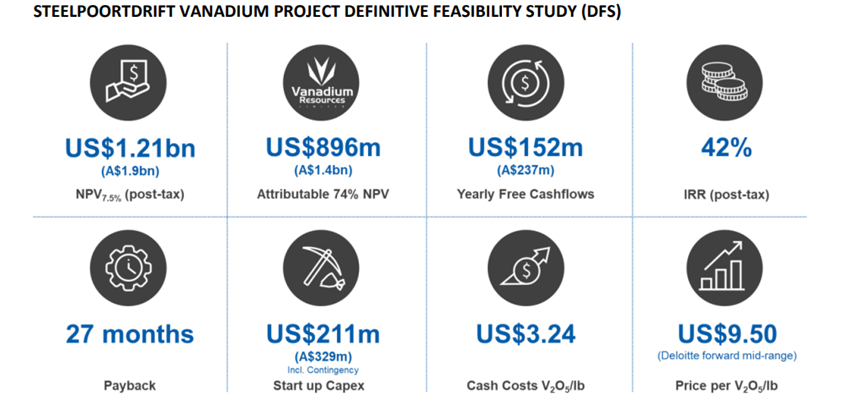

With the potential to emerge as a large-scale low-cost vanadium producer with competitive operating expense and capital expense metrics, the Steelpoortdrift Vanadium Project can deliver a post-tax NPV7.5% of US$1.21 billion with an IRR post tax of 42%, suggests the study.

Owing to the low capital expense of US$211 million and high-grade nature of the mineralisation, an annual free cashflow of US$152 million is expected with a payback period of nearly 27 months.

Image source: company update

The DFS results brought to light multiple opportunities that would elevate the potential Mineral Resources, Ore Reserves and the associated LOM plan, lower costs and lesser environmental impacts and level up earnings potential.

Data source: company update

Besides the significant DFS results, there were numerous other developments that highlight the progression made by Vanadium Resources during the financial year 2023 from 1 July 2022 to 30 June 2023. Here are some key updates from its recently released annual report. Have a read!

VR8 scales up interest in Steelpoortdrift

Vanadium Resources moved ahead towards an 86.49% interest in the project with successful execution of two conditional sale and option agreements. Under the agreements, VR8 would get 100% acquisition of the interests held by Math-Pin Trust and Obeec (Pty) Ltd in the issued share capital of Vanadium Resources (Pty) Ltd, subject to certain conditions.

Acquisition of Property for Salt Roast Facility

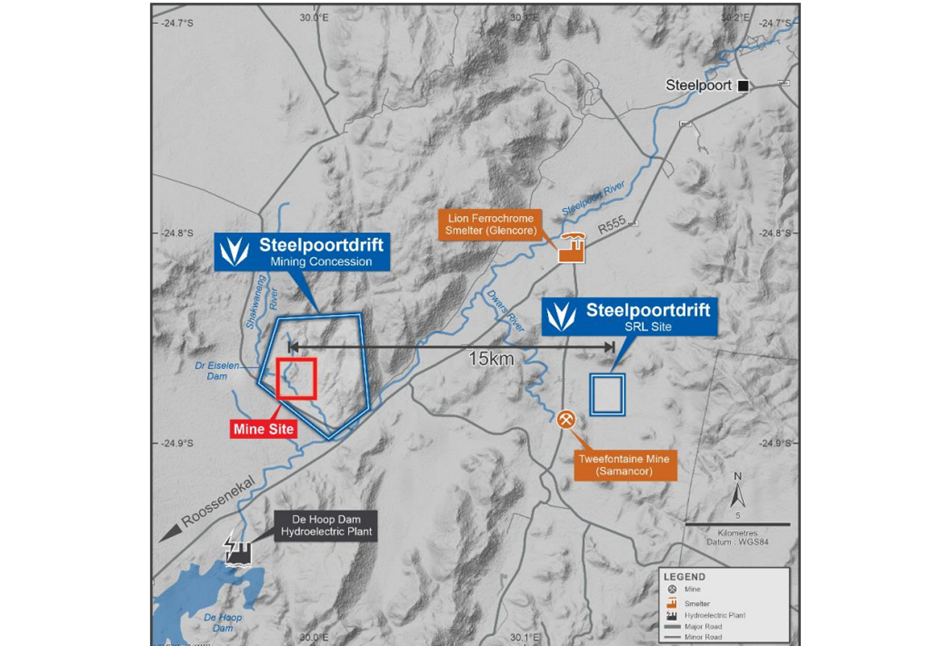

VR8 inked an option agreement with Kadoma Investments Proprietary Limited for acquiring a 135-hectare industrial site for the proposed SRL plant, for a consideration of AU$2.74 million. It is located near the Steelpoortdrift Mine Site as well as the mining hub of Steelpoort.

Image source: company update

Strategic investment and offtake deal with Matrix Resources

In FY23, VR8 completed a AU$5.91 million strategic equity placement to Matrix Resources (Zhejiang) Co., Ltd (Matrix). Vanadium Resources gave a period of exclusivity to Matrix till 03 September 2023 to negotiate and ink offtake rights agreement for the supply of up to 40% of vanadium products produced for a period of 10 years from Phase 1 of the Project. The talks are still underway, even after the expiry of the exclusivity right to Matrix, for an offtake agreement over the project.

Vanadium Resources is targeting a final investment decision to develop the Steelpoortdrift Vanadium Project in 2H24 with first production in 1H26.

VR8 shares traded at AU$0.052 on 16 October 2023.