Highlights

- Vanadium Resources has concluded conditional Sale and Option Agreements for holding higher interest in the Steelpoortdrift Vanadium Project.

- VR8 acquires 12.54% project interest in return for ZAR 8,730 (A$707) in cash and 22,124,030 Share Options to acquire VR8 Shares.

- The deal will see VR8’s project increase from 73.95% to 86.49%.

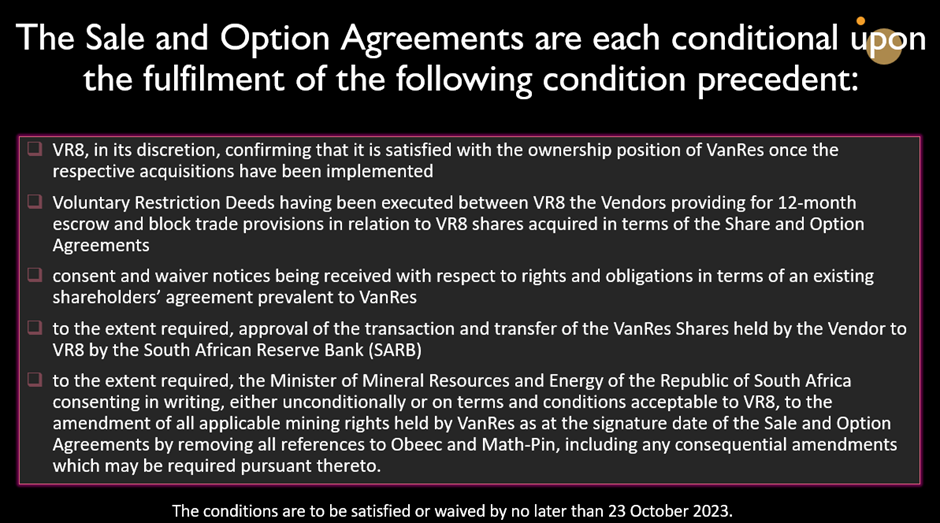

- The agreements are conditional on South African Reserve Bank approvals and sufficient guidance that the minimum ownership position of VanRes is satisfied, in regards to the South African Black Economic Empowerment policy.

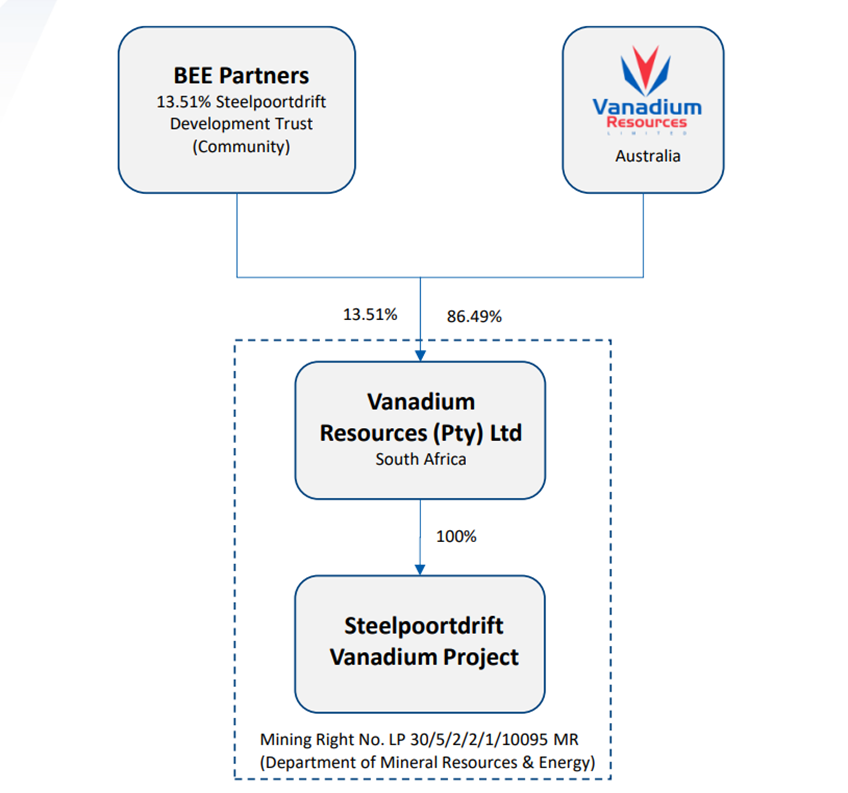

The developer of the Tier 1 Steelpoortdrift Vanadium Project in Limpopo, South Africa, Vanadium Resources Limited (ASX:VR8, FRA: TR3) has concluded conditional Sale and Option Agreements to secure an interest of up to 86.49% in Vanadium Resources (Pty) Ltd (VanRes).

The Company has signed two separate Sale and Option Agreements for acquisition of 100% of the interests held by Math-Pin Trust (Math-Pin) (the Parties and or Vendors) and Obeec (Pty) Ltd (Obeec) in the issued share capital of VanRes.

Data source: Company update

Stock price performance

The Company stock was spotted trading 17.4% higher at AU$0.088 midday on 03 May 2023. VR8 share price has jumped more than 43% on the year-to-date basis.

Terms of the Sale and Option Agreements

Vanadium Resources will be paying a cash consideration and an option to Obeec and Math-Pin for acquiring VR8 shares. “Black Economic Empowerment” (BEE) parties are the Vendors, helping VanRes to comply with minimum ownership needs of the present government of the Republic of South Africa.

Overall, a 12.54% interest is held by the Vendors in VanRes. With successful execution of the acquisition, the Company’s interest in VanRes will increase to 86.49% and the Steelpoortdrift Development Trust will have a 13.51% interest in VanRes.

The total consideration payable by VR8 in terms of the Sale and Option Agreements are ZAR 8,730 and 22,124,030 share options for acquiring VR8 shares, which options on exercise converts into 22,124,030 new fully paid-up VR8 ordinary shares.

A diagram of the updated (post Transaction) ownership structure