Highlights

- The ASX-listed company has announced the completion of AU$5.91 million equity placement

- Vanadium Resources' ASX shares traded at a higher price as compared to previous close after the announcement

- Over 53.7 million fully paid ordinary shares have been issued, and Matrix has received a 9.99% stake in VR8

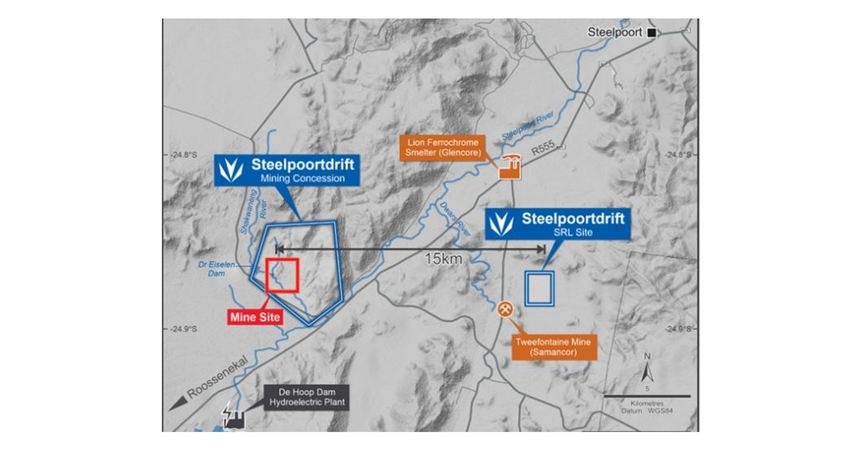

Vanadium Resources Limited (ASX: VR8) -- the ASX-listed company that is developing the Steelpoortdrift Vanadium Project in Limpopo, South Africa -- has informed about the successful completion of AU$5.91 million equity placement. The conditions precedent were satisfied by Vanadium Resources earlier this week, and now cleared funds have been received by VR8.

Notably, Vanadium Resources' ASX shares traded over 4.8% higher at AU$0.086 (market cap over AU$44 million) at the time of writing on 26 May 2023.

The development

VR8, which last year completed a DFS that confirmed Steelpoortdrift as a “world-class deposit with robust economics”, had earlier this month announced a binding Subscription Agreement with Matrix Resources (Zhejiang) Co., Ltd. The latter is a wholly owned subsidiary set up by Lygend Investment in September last year. Lygend is the largest shareholder of Hong Kong listed Lygend Resources, which is into nickel products.

Now, Vanadium Resources has informed that the AU$5.91 million equity placement to Matrix Resources has been completed, with cleared funds received by VR8. Over 53.7 million fully paid ordinary shares have been issued to Matrix Resources. The issue price of these shares is AU$0.11 per share. In return, Matrix has received a 9.99% stake in Vanadium Resources.

Source: Company update

Statement by Managing Director & CEO

Mr John Ciganek of Vanadium Resources has lauded the latest development and commented that the company is looking forward to working together to finalise a formal offtake agreement for VR8's vanadium products. Mr Ciganek also committed to continuing to progress the South Africa-based Steelpoortdrift Vanadium Project towards Final Investment Decision.