Highlights

- VR8 has increased its project interest by 7.95% to 81.90% in the Steelpoordrift Vanadium Project.

- The consideration comprises ZAR 5,800 in cash and 14,031,220 share options for acquiring VR8 shares (Shares are subject to 12 month voluntary escrow and a block trade arrangement for any sale of future shares can be managed by VR8).

- Transfer of a further 4.59% of VanRes Shares held by Mathpin to VR8 (increasing VR8 project interest to 86.49%) awaits approval from the South African Reserve Bank and the fulfillment of other conditions precedent.

- The company is focused on raising the required construction financing and achieving the critical pathways to develop the project.

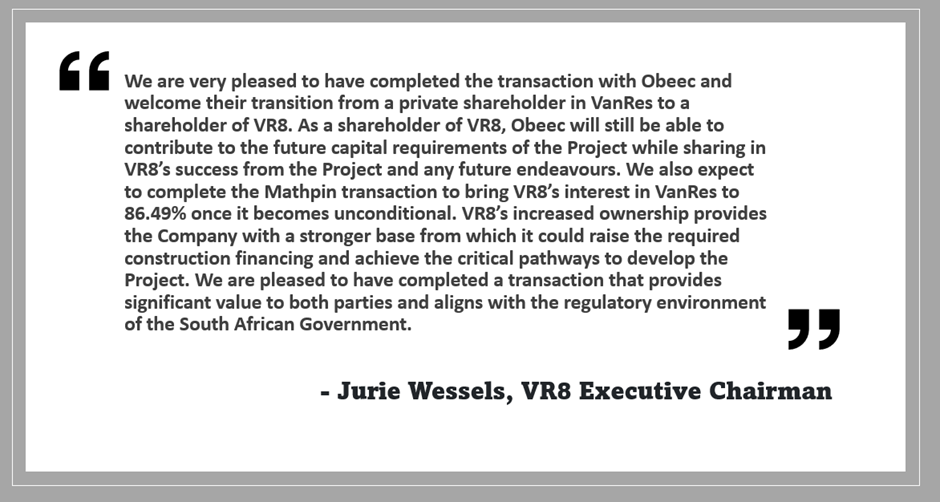

Vanadium Resources Ltd (ASX: VR8, DAX: TR3) has increased its interest in the flagship Steelpoortdrift project to 81.90% from 73.95% after the completion of the sale and option agreement with Obeec (Pty) Ltd.

Following the satisfaction of all conditions precedent to the agreement, Obeec has sold its interest in Vanadium Resources (Pty) Ltd (VanRes) to VR8.

Data source: Company update

The parties had entered into the agreement in May 2023, under which VR8 had agreed to buy Obeec’s 7.95% interest in VanRes for a consideration of ZAR 5,800 in cash and approximately 14 million share options to buy VR8 shares, representing 2.54% of VR8’s share capital.

To know details of the agreement, click here.

VR8 shares to be issued after the exercise of share options are subject to a voluntary escrow of 12 months under a voluntary restriction deed signed between VR8 and Obeec. Also, the shares are subject to a block trade arrangement.

More

Steelpoortdrift is one of the largest and highest grade undeveloped vanadium deposits globally, with a mineral resource of 680Mt @ an average in situ grade of 0.70% V2O5. The proved and probable reserve stands at 77Mt @ an average in situ grade of 0.72% V2O5, and the mineral resource has a life of over 180 years, as per the current throughput rates.

Read encouraging Steelpoortdrift DFS outcomes here.

With the latest development, VR8 holds an 81.90% interest in VanRes, Math-pin Trust has a 4.59% interest, and Steelpoortdrift Development Trust has an interest 13.51%.

The interest held by Math-Pin is expected to be acquired by VR8 under a separate sale and option agreement executed between the parties. The completion of the agreement awaits South African Reserve Bank (SARB) approval and satisfaction of certain conditions precedent.

VR8 shares traded at AU$0.047 apiece at the time of writing on 19 October 2023.