Highlights

- Tempest Minerals recently released its quarterly report for the three-month period ended 31 March 2023.

- During the quarter, Tempest posted its continued journey of actively investigating and evaluating new growth opportunities in numerous jurisdictions and commodities.

- TEM expanded its landholdings in the Yalgoo region by 195km2, taking Tempest’s total footprint to over 1,000km2 in the Yalgoo region, WA.

- The company announced results from a regional surface geochemistry sampling project, identifying the ‘Remorse’ Target.

- During the March quarter, possible future field activities based on new geological data to the south at Meleya were assessed.

Australian based mineral exploration company Tempest Minerals Limited (ASX: TEM)

boasts a rich project portfolio in Western Australia which is considered highly prospective for precious, base and energy metals.

Tempest has been forging ahead, utilising team’s commercial and technical expertise, to achieve its mission to boost shareholder value by data-driven exploration and development of its assets. The company has been using data-driven processes to detect poorly or unexplored areas of highly prospective geology that comprises several instances of proven mineralisation.

In the recently released quarterly report as well, Tempest has posted its continued journey of actively investigating and evaluating new growth opportunities in numerous jurisdictions and commodities. Below are the key updates from the detailed report, have a read!

Yalgoo Region

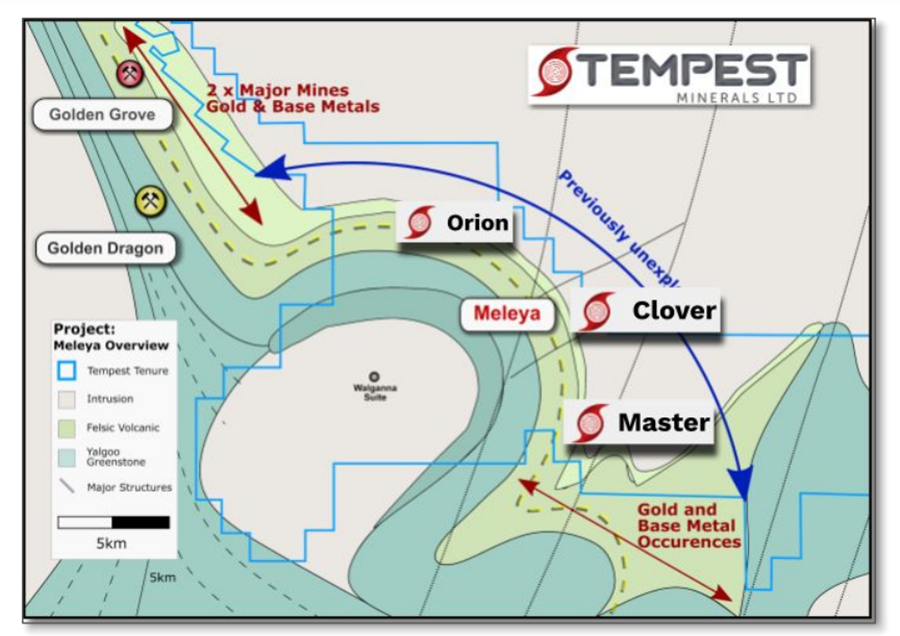

In March 2023 quarter, the firm expanded its landholdings in the Yalgoo region by 195km2 (5 tenements - 4 applications and 1 granted), making Tempest’s total footprint to over 1,000km2 in the Yalgoo region of Western Australia. Its projects are based within the rich Yalgoo Greenstone Belt that is home to several world-class mines.

Now, Tempest is the dominant regional explorer by land area.

The Meleya Project

Image source: Company presentation

Image source: Company presentation

A part of TEM’s flagship Yalgoo portfolio, Meleya target zones are considered by TEM as one of the interesting greenfields base and precious metal upside exploration opportunities in the market.

During the quarter, the company announced results from a regional surface geochemistry sampling project that was held at the Ktulu area in Dec 2022 quarter. The results identified a multi-kilometer, highly coherent copper zinc anomaly or the ‘Remorse’ Target.

Also, the percussion drillholes completed at the Clover target revealed widespread mineralisation, including shallow intercepts of critical minerals.

Remorse Target

The company announced results from surface geochemistry during the quarter. The assays delivered extremely anomalous Cu, Zn and other elements. The sampling included individual soil samples with values as high as 182 ppm zinc, 635 ppm copper, and 24ppm lead, and

forms a coherent core zone of Cu-Zn anomalism.

Notably, the copper and zinc anomalism appears as ‘layered’ with a predominance of copper to the NorthEast and increased and a more dispersed zinc halo to the SouthWest. This type of zonation is typically seen within VMS deposits and is related to the preferential crystallisation of mineralisation relative to the proximity of a local heat source and the metal concentration source.

The Euro Project

A part of 100% TEM owned tenements in the Southern Yalgoo Greenstone Belt, Euro contains thick gold intercepts in legacy drilling. During the March quarter, the company focused on planning of future field work at the project along with advancement of regulatory requirements.

The Messenger Project

With five granted tenements based next to the EMR Golden Grove base and precious metal mine, Messenger is a popular historic mining centre with multiple high-grade mines and a state battery. During the March quarter, possible future field activities based on new geological data to the south at Meleya were assessed.

Warriedar West

During the March quarter, geological targets at the project were assessed. This involved geophysical understandings from further east at Meleya.

Mount Magnet Region

A prolific multi-million ounce gold mining centre, Mt Magnet currently hosts many large scale, long life open pit and underground mines in operation.

During the quarter, exploration targets and geology were interpreted following the mapping data that was gathered earlier.

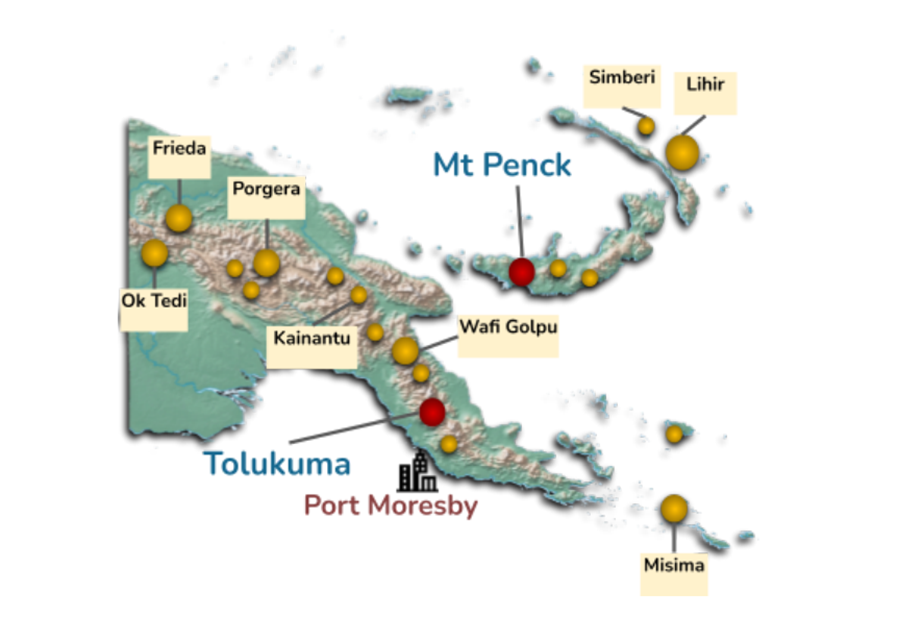

Tolu Investment (PNG)

Tolu Minerals is advancing to issue an Initial Public Offering (IPO) on the Australian Securities Exchange (ASX). It is targeting a capital raise of about AU$10 to AU$15 million at an issue price of AU$0.50.

Overview of Lole Mining Projects

Overview of Lole Mining Projects

The Rocky Hill Project

Rocky Hill is 100% TEM owned tenure (29km2 granted tenure, 250km2 pending) located approximately 100km from Perth within the exciting new exploration front known as the South West Terrane and includes neighbours such as Newmont Corporation. TEM focussed on progressing pending tenement applications.

International Lithium Exposure

Tempest has been building its position in the global lithium market since 2017 and has been able to maintain a strong de-risked foothold in the sector. The company holds a portfolio of Western Australian exploration projects as well as abroad through holdings or interests in projects in Africa and the USA. Also, it has strong de-risked interests and exposure to international Li, such as hard rock lithium exploration targets in Africa and lithium brine in the USA.

Africa: Through a divestment deal in 2020, Tempest retains a sizable holding (25 million shares) in London listed Premier African Minerals (AIM:PREM). PREM has significant market upside through development of portfolio. During the quarter, TEM sold 15 million PREM shares for gross proceeds of ~$214,000.

USA: Argosy (ASX:AGY) is progressing their headline Tonopah Lithium Project (TLP) located in a world class mining jurisdiction of Nevada, United States of America. Tempest retains an interest in the project through a A$250,000 milestone based cash payment entitlement.

TEM shares were trading at AU$0.016 on 19 May 2023.