Highlights

- Through a placement and a rights issue, SRN has raised approximately AU$3.4 million (before costs).

- The Board and management took their complete rights issue entitlements, highlighting their confidence in SRN’s projects.

- The company is focused on advancing Victory Bore towards a definitive feasibility study (DFS) and establishing a downstream vanadium processing plant in the KSA.

Surefire Resources NL (ASX: SRN) has secured approximately AU$3.4 million through a capital raising program comprising a placement and a non-renounceable rights issue.

Through the placement, SRN raised AU$2 million (before costs), while from the rights issue, the company secured AU$1.4 million (before costs).

The board of directors and management took their full entitlements in the rights issue, highlighting the confidence and commitment they have in the company’s projects and its future.

Details of the capital raise

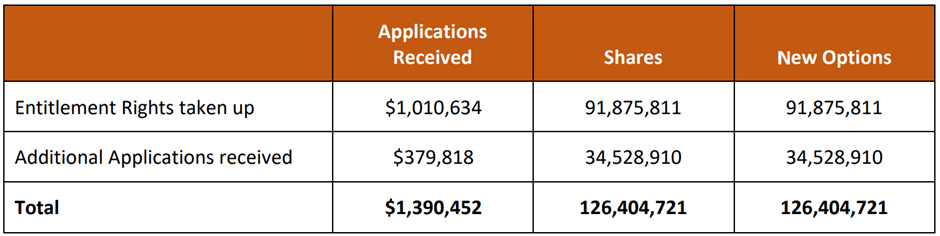

The table below highlights the final allocations from the right issue-

Image source: company update

In addition to the entitlement issue, 181,818,186 options have been issued to those investors who participated in the placement while 20,000,000 options have been issued to the joint lead managers of the placement. The options issued have an exercise price of AU$0.019 and will expire on 30 November 2026.

Considering the issue of new shares and options, now the company’s securities on issue includes-

- 1,963,157,813 fully paid ordinary shares;

- 258,785,323 partly paid ordinary shares;

- 328,222,907 options to acquire fully paid ordinary shares

The funds raised will be directed towards advancing the Victory Bore vanadium critical and battery minerals project.

What’s the plan ahead?

The capital raising program follows the pre-feasibility study results for the company’s Victory Bore Vanadium Project that demonstrated robust project economics. Read more about the results.

Furthermore, the company released a maiden probable ore reserve of 93 Mt @ 0.35% V2O5, 5.2% TiO2 and 19.8% Fe. The results have been reported in accordance with the JORC Code (2012). They give a significant basis as one of the largest Australian underdeveloped vanadium projects, says SRN.

With the completion of capital raise and encouraging PFS results, SRN would now advance a definitive feasibility study on the project. Moreover, the company would focus on establishing the downstream vanadium processing plant in the Kingdom of Saudi Arabia (KSA).

SRN MD Paul Burton and Chairman Vladimir Nikolaenko will participate in the Future Minerals Forum (FMF), which will be held in Riyahd, KSA, in January 2024.

SRN shares traded at AU$0.010 on 14 December 2023.