Highlights

- Victory Bore PFS has been finalised on time and budget with outstanding financial outcomes.

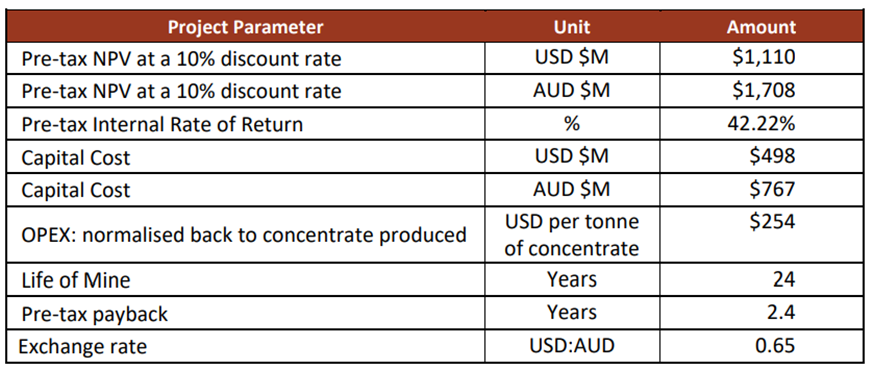

- The study suggests a pre-tax net present value (NPV10%) of AU$1.708 billion, with an internal rate of return of 42.22% and a life of mine (LoM) of 24 years.

- The pre-tax payback period is 2.4 years at a capital cost of AU$767 million.

- The results indicate that offshore processing is the right choice to take the project into development and production stage.

- The company has updated mineral resource estimate.

- Discussions are underway with KSA companies for the project.

Surefire Resources NL (ASX: SRN) has announced outstanding financial results from the pre-feasibility study (PFS) for its flagship Victory Bore Project, Western Australia.

The PFS has been completed on-budget and on time by METS Engineers, Snowden-Optiro and other key specialists. The PFS, finalised with an accuracy of +/- 25% to 35%, provided reliable cost estimates using conservative commodity pricing.

PFS results

The PFS was based on the production of around 1.25 million tpa of vanadium-titanium magnetite concentrate at the Victory Bore mine site. Furthermore, it focused on the production of up to six products from that concentrate in the Kingdom of Saudi Arabia (KSA).

The table below provides the summary of project economics estimate.

Image source: Company update

The company stated that its approach to this landmark and maiden study of Victory Bore is to employ industry standard processing for various products to increase the value, allowing for a demonstrable and reliable low-risk business concept.

The results indicate that offshore processing is the right approach, considering the increasing operating and capital costs globally.

SRN’s engagement with KSA

In August, the company entered into a Memorandum of Understanding (MoU) with the Ministry of Investment Saudi Arabia (MISA) for critical mineral and vanadium processing in KSA. The low power and fuel cost jurisdiction provides significant advantages to the project such as reduction in operating costs and production of final products for the nearby markets. KSA’s steel sector generates significant demand for vanadium products.

SRN has initiated talks with Saudi companies which are interested in partnering for the KSA processing operation. Also, the ASX-listed company is engaged in organising meetings at the upcoming Future Minerals Forum (FMF), which is due in January 2024 in Riyahd, KSA.

Updated mineral resource estimate (MRE)

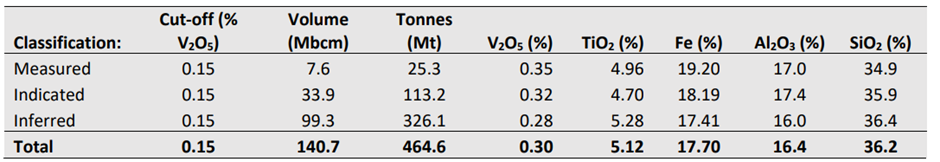

MRE for the Victory Bore Project has been updated. The resource model remains the same but there is a change in reporting to include lower cut-off grade (V2O5) of 0.15%, which was earlier 0.26%, based on marginal cut-off grades ascertained during the PFS. Moreover, TiO2, AI2O3, Fe and SiO2 grades have been incorporated in the reporting.

Detailed MRE for Victory Bore as of December 2023 –

Image source: Company update

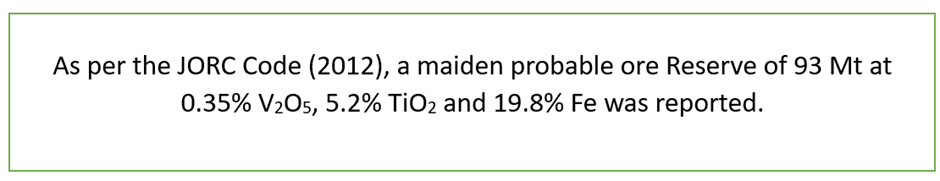

Maiden Ore reserve

The MRE was converted into an ore reserve by economic evaluation employing open pit optimisation to generate an economic mining shell followed by pit design and life of mine scheduling.

Data source: company update

Mine schedule estimate

The mining schedule offers the beneficiation plant with 4 Mt/a ore to generate around 1.25 Mt/a of magnetite concentrate. This concentrate will undergo processing to create six end products. The overall mining rate would ramp up to 12 Mt/a within the nine months of commencement of mine, including waste, informed SRN.

SRN shares traded at AU$0.010 apiece at the time of writing on 5 December 2023, up more than 5% from the last close.