Highlights

- Saunders (ASX:SND) has secured a contract from Park Fuels that is part of the government’s Boosting Australia’s Diesel Storage Program.

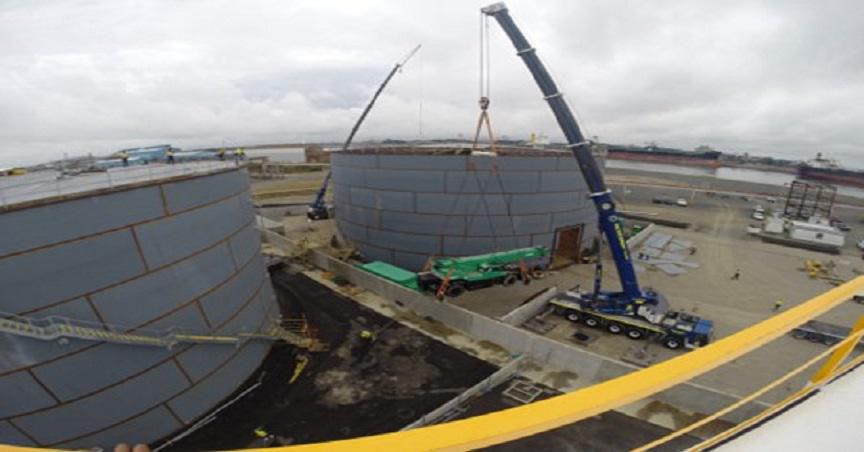

- The contract is for the design and construction of a new diesel storage tank at Park Fuels, Newcastle.

- There are a further five projects under the BADSP to be awarded.

Saunders International Limited (ASX:SND), an ASX-listed multi-disciplined engineering and construction company, has bagged a new design and construction contract, further boosting its orderbook.

The contract valued at AU$9 million is for a new 32 megalitre diesel storage tank at Park Fuels, Kooragang Island, Newcastle.

The contract awarded by Park Fuels Pty Ltd covers foundations and a stair tower used for roof access. The scope of work also includes all materials, labour, and equipment essential for the project.

The contract is part of the Government's 'Boosting Australia's Diesel Storage Program' (BADSP).

Saunders’ long-standing relationship with Park Fuels

Saunders previously catered to Park Fuels with its services for Kooragang Island Terminal. The company had constructed a smaller tank and refurbished two existing tanks at the terminal.

Saunders considers the latest development as an opportunity to provide its innovative solutions for bolstering its long-standing relationship with Park Fuels.

The company will deploy its local Newcastle teams and equipment to complete this tank construction project, as highlighted by Saunders Managing Director and Chief Executive Officer Mark Benson.

He added that this project is an important win for the company, as it positions Saunders ideally well for the remaining opportunities lying within the government program.

Design and construction contract: one more addition to Saunders’ record orderbook

The project win is an addition to the company’s already record orderbook, as highlighted in Saunders’ FY22 results released recently.

As per the company, the contract proceedings will strengthen the company's revenue stream by contributing to revenue and earnings through FY23 and into FY24.

Saunders has also highlighted that the pipeline valuation of live tenders and orders has increased to over AU$1.5 billion. The company has noted that it has got a substantial increase in tenders after the company's FY22 announcements.

BADSP program

The contract awarded is part of the government's BADSP grant to Park Fuels for 60 megalitres of diesel fuel storage: 32 million litres at Newcastle (awarded contract) and 28 million litres at Port Kembla (yet to be awarded).

These projects will increase the fuel storage capacity across two seaboard import terminals by ~50% from 122ML to 182ML.

Also, five projects are yet to be awarded under BADSP, and Saunders continues to assist the grant recipients in finalising their respective solutions.

SND share performance - Saunders’ shares traded at AU$1.06 on 2 November 2022. The shares have gained over 49% in the last one year.