Highlights

- September quarter saw an action-packed period for Radiopharm.

- DUNP19 gained Orphan drug status and rare pediatric disease designation from the FDA.

- Radiopharm launched a joint venture company, Radiopharm Ventures, LLC, to develop novel pharmaceuticals.

- The company entered agreements with GenesisCare, SHINE Technologies, Lantheus and NanoMab.

- Radiopharm boosted its capital position with a fundraising program.

Radiopharm Theranostics (ASX:RAD) signed off its September quarter with power-packed activities and key achievements. The company entered some important deals and marked developments across its clinical pipeline.

Subsequent to the period, the company announced a capital raising program to accelerate its clinical development activities.

Radiopharm is leveraging the unique potential of radiopharmaceuticals to treat oncological diseases. The ASX-listed company is focused on developing products for both diagnostic and therapeutic uses in areas of high unmet medical needs.

Pivalate phase II data presented at EORTC/AACR/NCI symposium in Barcelona

The October month saw the presentation of interim data from the Pivalate phase 2a imaging trial in brain metastases, at the 34th EORTC/AACR/NCI symposium in Barcelona. The trial was conducted at Imperial College London and is expected to be published in a peer-reviewed journal.

The data demonstrated that F-18 Pivalate PET showed high uptake regardless of the origin of the primary tumour and can also be used to monitor cerebral metastases.

Joint venture with MD Anderson

Image source: Company update

Radiopharm launched a joint venture with The University of Texas MD Anderson Center (MD Anderson) in September.

The joint venture company named Radiopharm Ventures, LLC has been created to develop novel radiopharmaceutical therapeutic products for cancer. It aims to combine Radiopharm's expertise in developing radiopharmaceutical products and MD Anderson's pioneer and patented technologies in antigen discovery and molecular imaging.

The joint venture will initially focus on developing at least four therapeutic products based on MD Anderson's intellectual products.

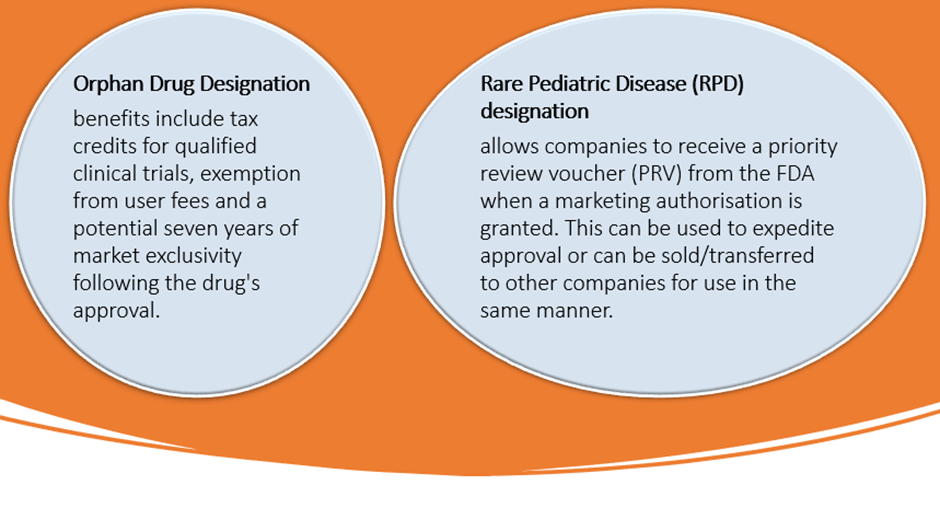

DUNP19 gains Orphan drug status and rare pediatric disease designation

DUNP19 is an LRRC15-Targeting Monoclonal Antibody being licenced by Radiopharm from the University of California Los Angeles (UCLA) Technology Development Group (UCLA-TDG).

During the quarter, DUNP19 secured two key designations from the US Food and Drug Administration (FDA) for the treatment of osteosarcoma, which is a kind of bone cancer.

Data and image source: Company update

Moreover, in October, the prestigious journal Nature published encouraging data on the role of DUNP19 receptors in cancer growth.

Major supply agreements

In July, Radiopharm extended its agreement with Genesiscare. The global oncology provider will support a second Radiopharm clinical trial that will leverage Radiopharm's PSA-targeting antibody to start a therapeutic Phase 1 in prostate cancer.

In August, Radiopharm entered strategic collaborations with Lantheus and NanoMab. The pact with Lantheus is for the mutually beneficial development of nanobody NM-01. Under the agreement with NanoMab, Radiopharm secured the imaging rights of NM-01 for China and global IP rights.

Late in the quarter, Radiopharm inked a deal with Shine Technologies. The next-generation fusion technology company will supply isotope non-carrier-added lutetium-177 (Lu-177) to Radiopharm for use in its clinical development pipeline.

AU$10 million capital raising program

Subsequent to the quarter end, Radiopharm completed institutional component of the entitlement offer and raised about AU$5.5 million. Additionally, the company intends to raise about AU$4.5 million from the retail component of the offer, amounting to a total of AU$10 million.

To know more read here

Radiopharm ended the quarter with AU$21.3 million in cash and equivalents.

RAD shares were trading at AU$0.110 midday on 11 November 2022.