Highlights

- Radiopharm has unveiled an equity raising program for up to AU$10.0 million via an entitlement offer.

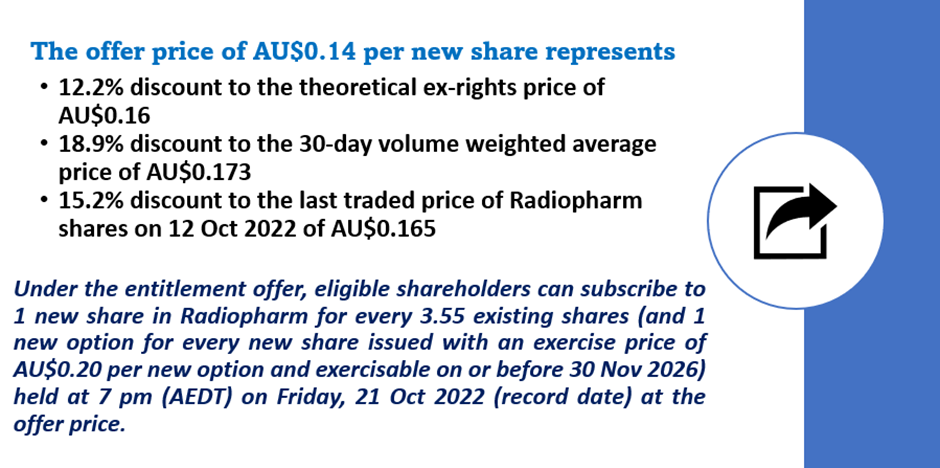

- Under the offer, the new shares will be issued at AU$0.14.

- RAD Chairman Paul Hopper and CEO Riccardo Canevari are participating for entitlements under the offer.

- The company has highlighted that this fundraising program will provide a runway until at least the end of 2023, including three new assets acquired since IPO.

Radiopharm Theranostics Limited (ASX:RAD) is all set to boost its financial footing with a new capital raising program. The company has announced an accelerated 1 for 3.55 non-renounceable entitlement offer of new fully paid ordinary shares to raise up to AU$10 million (before costs).

According to Radiopharm, proceeds from the entitlement offer provides runway to the company until at least the end of 2023 and costs of the entitlement offer. The company expects to have five fully funded Phase 1 clinical trials underway by the beginning of 2023, whilst progressing Pivalate into late-stage trials in the US.

Radiopharm has also announced positive outcomes from the Phase 2 trial in brain metastases in just 11 months since its IPO. Brain metastases have a significant unmet clinical need.

Radiopharm Chairman and CEO to participate in the offer

Radiopharm Executive Chairman Paul Hopper intends to participate for AU$500,000 in entitlements. Similarly, CEO Riccardo Canevari plans to take up his entitlements amounting to nearly AU$170,000.

Data source: RAD update, Image source: © 2022 Kalkine Media®

The entitlement offer entailing the issue of up to 72 million new ordinary shares in RAD has two components:

- Institutional entitlement offer

- Retail entitlement offer

RAD raises AU$5.5 million via institutional entitlement offer

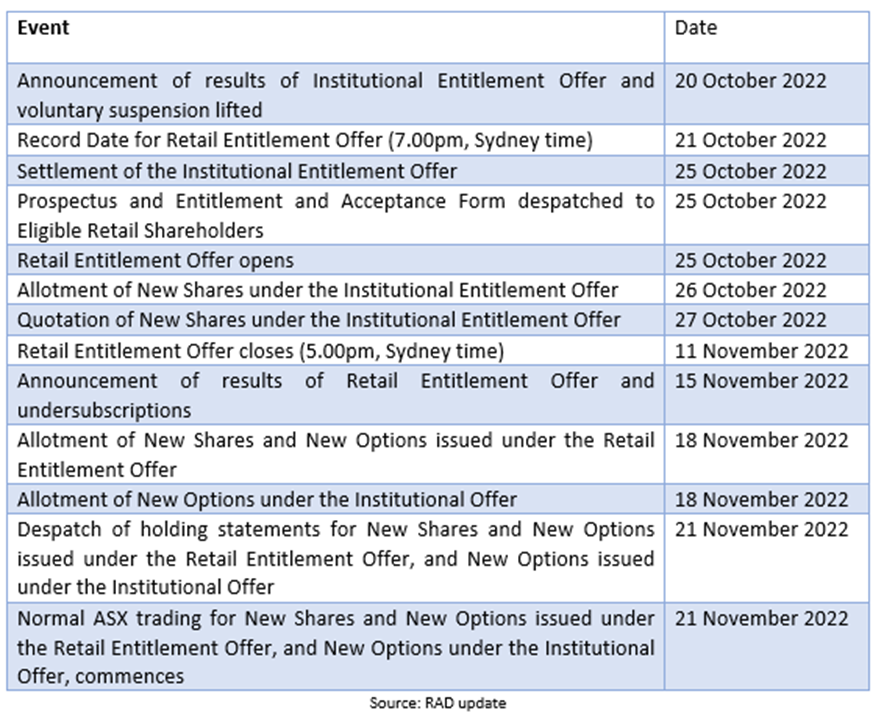

The institutional entitlement offer, conducted on 19 October 2022, was strongly supported by existing shareholders and new professional and sophisticated investors.

The company completed the institutional entitlement offer, raising approximately AU$5.5 million.

Embed video: https://www.youtube.com/watch?v=sbYkMhfXx0g

RAD secures commitments for retail entitlement offer

Bell Potter Securities Limited has committed to fully underwrite the retail entitlement offer of approximately AU$4.5 million.

RAD states that this commitment provides certainty that approximately AU$10.0 million will be raised under the offer.

The retail entitlement offer will open on Tuesday, 25 October 2022 and close on Friday, 11 November 2022, 5:00pm AEST. The offer is for eligible shareholders in Australia and New Zealand (record date, 7.00pm AEST on 21 October 2022). The offer price and ratio for this scheme are the same as the institutional entitlement offer.

Below is a table depicting an indicative timeline of the offer:

RAD shares were trading at AU$0.130 in the early hours of 20 October 2022.