Highlights

- Platina Resources has kicked off maiden drilling at its recently acquired project, Brimstone, in Western Australia

- The company has already completed a cultural heritage clearance program for the project’s five northern prospecting licences

- The drilling program (aircore) is for 5,500 metres, and is expected to take 20 days to finish

- The company fully owns its gold projects located in the Yilgarn Craton and Ashburton Basin

Australia-based explorer Platina Resources Limited (ASX: PGM) has announced the commencement of maiden drilling at its Brimstone Gold Project. This development follows a successful cultural heritage clearance program pertaining to the site. PGM has stated that the Phase 1 program (5,500 metres of aircore drilling) would likely be finished over the next 20 days.

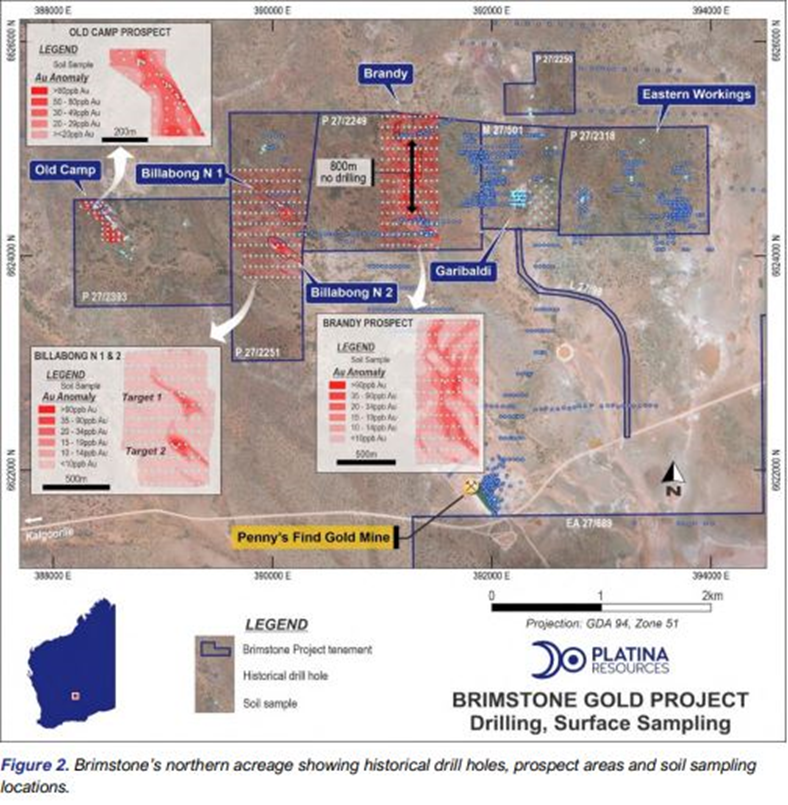

The Brimstone Gold Project is in mineral-rich Western Australian region, and it is nearly 40 km north-east of Kalgoorlie (Goldfields–Esperance region).

Shares gain over 5%

Notably, Platina's ASX-listed shares surged after this announcement, and at the time of writing traded at AU$0.021, up 5%.

Source: PGM ASX announcement dated 30 March 2023

The development

Platina Resources' Brimstone tenements lie inside of a proven gold district, with nearby Penny’s Find gold deposit. Also, the Kanowna Belle gold mine lies just 25 km from Brimstone. Now, after the cultural heritage clearance program, which spans the site's northern Prospecting Licences, Platina has reported the beginning of phase one of aircore drilling program. It is also reported that the program is for 5,500 metres, with completion likely within the next 20 days.

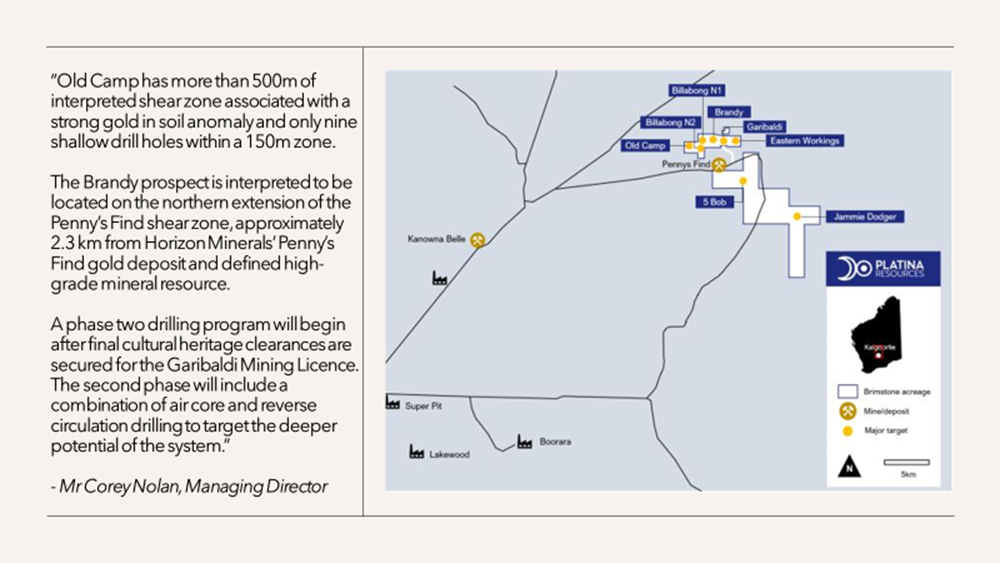

The company's Managing Director Mr Corey Nolan has commented that this first phase would be centred on Brandy, Old Camp, and Billabong North targets. He has also mentioned that the Old Camp prospect has over 500 metres of interpreted shear zone. This is linked to strong gold in soil anomaly. There are just nine drill holes (shallow) in the 150 metres zone.

Further, the Brandy target is near a defined high-grade mineral resource. It also has proximity (just over 2 km) to Horizon Minerals’ Penny’s Find gold deposit.

Mr Corey Nolan mentions that the second phase of the drilling program would target Garibaldi Mining Licence, and it would include both aircore and reverse circulation (RC). The focus of this Phase 2 would be on analysing the deeper potential of the system, and it will be conducted final cultural heritage clearances for the Licence.

Source: PGM ASX announcement dated 30 March 2023

About Platina Resources

The ASX-listed company focuses on taking early-stage metals projects toward the path of development by way of exploration, feasibility, and permitting. Platina Resources claims to create value by monetising its assets through varied means that include sale or partnerships (JVs) and development. Notably, PGM fully owns WA located Yilgarn Craton and Ashburton Basin (Au). Read more.

Alongside, the company also holds a Scandium Project in central NSW, Australia. The location is among the biggest and highest-grade scandium deposits globally.