Highlights

- Second phase RC drilling has extended Garibaldi mineralisation and defined new targets at the Brandy and Old Camp prospects.

- Drilling at Garibaldi has returned a number of high-grade gold intersections.

- Garibaldi system is interpreted to extend over 200 metres in strike and open at depth.

- RC drilling results demonstrated that a major mineralised structure is present at the Brandy prospect.

Platina Resources Limited (ASX: PGM) has reported encouraging findings from the phase 2 reverse circulation (RC) drilling campaign conducted in September at the Brimstone Gold Project.

The campaign has validated extensions to the mineralisation at the Garibaldiprospect. Additionally, it has indicated that the Brandy and Old Camp prospects have the potential to host additional mineralisation. New targets have been defined at the Brandy and Old Camp prospects.

The drilling campaign comprised 18 holes for 3,300m at the Garibaldi, Old Camp and Brandy prospects, located near the major mining centre of Kalgoorlie.

Extension of Garibaldi mineralisation

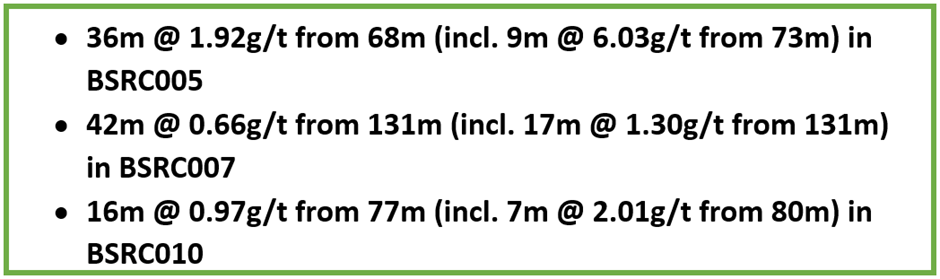

Drilling at the Garibaldi prospect has returned multiple gold intersections along strike and down plunge from existing mineralisation. Now, the system is interpreted to extend over 200 metres in strike and open at depth. Significant intersections reported from the prospect included-

Data Source: Company update

Major mineralised structure at the Brandy prospect

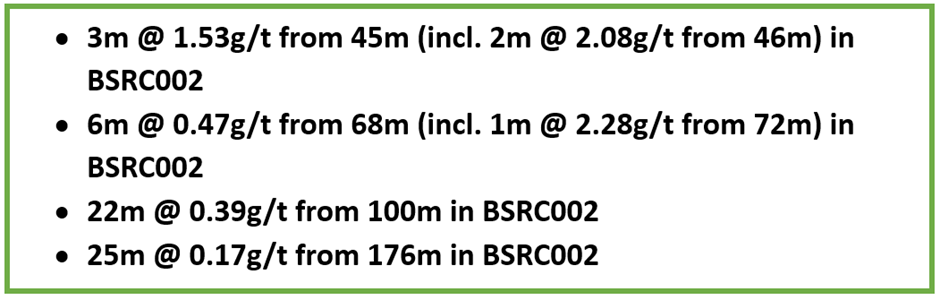

At the Brandy prospect, three out of four holes returned several vertically dipping zones of mineralisation across an 80 metres wide mineralised corridor under historical aircore drilling intercepts and along the Penny’s Find Shear Zone. The results highlighted the presence of an extensive mineralised structure at the prospect.

Significant results included-

Data Source: Company update

Shares up ~12%

PGM shares traded 11.99% higher to AU$0.028 apiece at the time of writing on 9 November 2023.

_06_16_2025_08_43_19_906343.jpg)