Highlights

- Mount Burgess Mining continued advancing its 100% owned Kihabe-Nxuu polymetallic project in the first half of FY23.

- The project contains multiple metals that have been witnessing strong demand.

- Many of these metals have been listed on the 2022 critical metals list of the US government.

- The company has secured a two-year renewal of PL43/2016 that covers the project.

Mount Burgess Mining NL (ASX:MTB) continued exploration endeavours across its Kihabe-Nxuu polymetallic project in Botswana in the first half of FY23 ended 31 December 2022. The project is situated within a Neo-proterozoic belt.

So far, the company has developed Indicated and Inferred Mineral Resource Estimates compliant with the 2012 JORC Code at the Kihabe and Nxuu deposits.

In early January 2023, the company secured a two-year renewal of PL 43/2016 to 2024 end. MTB says that this development puts the company in a favourable position to raise funds for the ongoing project development activities.

Kihabe and Nxuu MRE

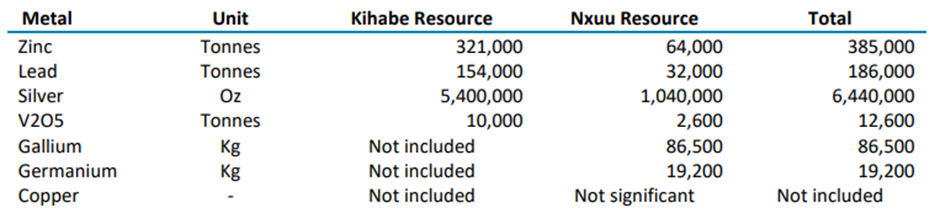

The combined in-ground metal content of the Kihabe and Nxuu Mineral Resource Estimate (MRE), which sit at 29.5 million tonnes at various grades of Zn/Pb/Ag/V2O5/Ge/Ga, is as follows:

Image source: MTB update

Kihabe Deposit – The company believes that this deposit holds the potential to be an open-cut mining operation.

For this deposit, the MRE sits at 21 million tonnes, applying a 0.5 percent zinc equivalent low cut. This estimate covers zinc, lead, silver and vanadium pentoxide. To include copper, gallium and germanium in the mineral resource estimate (MRE), further drilling and assaying are required.

Nxuu Deposit - The Nxuu deposit has the potential to be an open-cut mining operation. Applying a 0.5 percent zinc equivalent low cut, the deposit has an MRE of 6 million tonnes at 1.8 percent zinc equivalent grade. This MRE contains zinc, lead, silver, gallium, germanium, and vanadium pentoxide.

Subsequent to the period, the company also announced appointment of Mining Engineer Jacob Thamage and Geologist Ian Barclay McGeorge as non-executive directors to its Board.

In essence, MTB continued developments aimed at assessing the potential to exploit additional known metal credits at its flagship project. The company believes that its strong, stable and experienced board has the capacity to develop these two deposits, backed by in-depth knowledge of the region and the metals.

MTB shares were trading at AU$0.003 midday on 9 March 2023.